In a most curious turn of events, the esteemed Arbitrum has proclaimed a most strategic buyback plan, aimed at acquiring ARB tokens amidst a rather prolonged and disheartening price decline. The illustrious Offchain Labs, the company behind this venture, has made a significant move to reinforce its commitment to the ecosystem, as if to say, “Fear not, dear investors!”

Alas, this buyback arrives as ARB finds itself languishing over 85% below its once lofty heights, a fate most unfortunate indeed.

Arbitrum’s Grand Announcement of the Buyback Program

In a rather audacious post on X (Twitter), Offchain Labs has emphasized that this initiative reflects the ongoing growth of Arbitrum’s ecosystem. They assert that technical advancements and strategic DAO initiatives are the primary drivers for the Arbitrum network, as if we were all waiting with bated breath for such news.

“We’re reinforcing our commitment to the ecosystem and strengthening our alignment by adding ARB to our treasury through a strategic purchase plan,” the company stated, with all the confidence of a Regency gentleman.

The firm has also assured the community that purchases would follow predetermined parameters to ensure sustainability, as if we were all children needing guidance in a candy store.

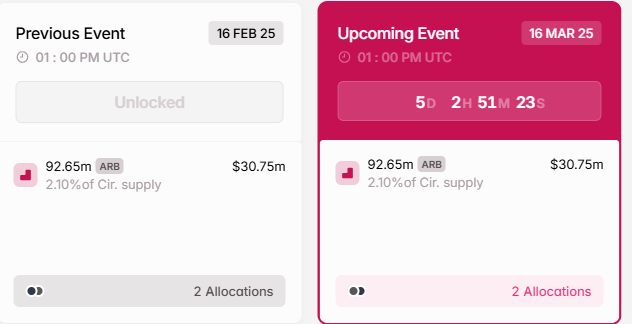

Meanwhile, this announcement comes just days before Arbitrum’s token unlock event, which, according to the ever-reliable Tokenomist, will unlock a staggering 92.65 million ARB tokens worth $30.75 million at current rates. These tokens constitute a mere 2.1% of the ARB circulating supply, a drop in the ocean, one might say.

Thus, Offchain Labs’ buyback announcement aligns with this token unlock event, as if they were dancing a delicate waltz to absorb the expected supply shock. A recent report has indicated that 90% of token unlocks drive prices down, a statistic that surely brings a tear to the eye.

However, not all are convinced that buybacks alone are the panacea for this predicament. Yogi, a well-known wallet maxi, has criticized the move, arguing that such a strategy lacks long-term vision. He likens it to traditional equity markets, where excessive buybacks often signal a slowdown in innovation, much like a once-vibrant ball that has lost its luster.

“Pure buybacks alone feel unimaginative and short-sighted—they create scarcity without driving long-term growth or strategic value,” Yogi wrote, with a hint of sarcasm that would make even the most stoic smile.

He proposed a more diversified approach, suggesting that 30% of the treasury should be allocated to strategic buybacks and OTC (Over-the-Counter) deals. Further, 30% is directed toward liquidity provision to attract institutional players, and 20% is reserved for a yield-generating treasury for stable dividends. How very sensible!

Yogi also suggested 15% for ecosystem investments and 5% for a protocol insurance fund, as if he were crafting a recipe for success. In his opinion, this diversified strategy would better align incentives and enhance the protocol’s long-term sustainability, a notion that surely deserves a round of applause.

Criticism Over Buybacks as ARB Price Struggles

Patryk, a researcher at Messari Crypto, echoed similar sentiments, noting that while such structured plans are beneficial, they can be as difficult to outline as a proper Regency novel at the start of a buyback initiative. He suggested that Arbitrum remain flexible and deploy funds into strategic areas over time rather than committing to a rigid framework, much like a lady adjusting her bonnet to suit the weather.

“I think projects will do this eventually. It’s just difficult to announce a concrete plan for the funds at the beginning of buybacks, like those that Arbitrum just announced. Remain flexible,” the researcher suggested, with the wisdom of a sage.

Despite the ongoing debate, the buyback announcement and token unlocks come as Arbitrum is experiencing renewed market attention. The ARB token recently received a listing on the Robinhood platform, a move that surely sent ripples through the community.

While this move temporarily boosted the ARB price, it failed to sustain a lasting

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2025-03-11 15:10