bitcoin-usd/”>BITCOIN BEAR MARKET IMMINENT? 🚨

According to Timothy Peterson, author of Metcalfe’s Law as a Model for Bitcoin Value, the crypto industry is careening towards another bear market, and we’re all just along for the ride.

This analysis comes as the Federal Reserve (Fed) maintains its cautious stance on interest rates, because who needs excitement, anyway?

Analyst Explains How a Bear Market Could Unfold (and Why We Should All Be Terrified)

In his recent analysis, shared on X (Twitter), Peterson warned that the market is currently overvalued, which is just a fancy way of saying “we’re all about to get rich…or poor, depending on your perspective”. While such a decline needs a trigger, he suggests that the Fed’s decision to keep interest rates steady could be enough to set it off, because who needs a reason to panic, really?

“It’s time to talk about the next bear market. There’s no reason to think it couldn’t happen now. The valuation justifies it. What it needs is a trigger. I think that trigger may be as simple as the Fed not cutting rates at all this year,” wrote Peterson, because who needs a reason to be bearish, anyway?

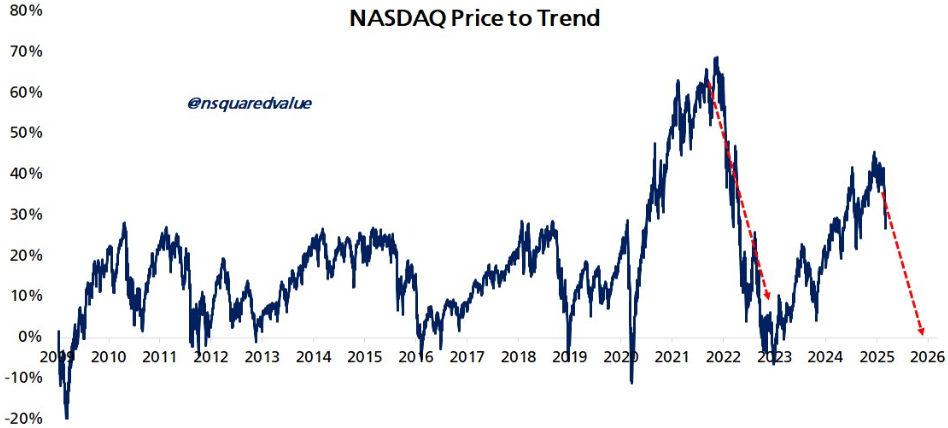

Peterson’s analysis draws parallels between past market downturns and current conditions, because history has a way of repeating itself, and we’re all just pawns in the game of high finance. Using the NASDAQ as a reference point, he estimates that a bear market could last anywhere from 7 to 14 months, which is just enough time to watch your entire portfolio disappear.

Given that the NASDAQ is currently 28% overvalued, he anticipates a decline of about 17%, bringing the index down to 15,000, because who needs a healthy market, anyway?

Applying these projections to Bitcoin, Peterson expects a roughly 33% drop, pushing Bitcoin’s price down to around $57,000, because who needs a Bitcoin at $100,000, anyway?

“Multiply by 1.9. 17% drop in NASDAQ = 33% drop in BTC -> $57k,” Peterson added, because math is hard, but bear markets are easier.

However, he notes that opportunistic investors could step in early, because someone has to save the day, and potentially prevent the Bitcoin price from falling that low, finding support around $71,000, because who needs a bear market, anyway?

This aligns with a recent analysis from Arthur Hayes, because who doesn’t love a good bear market, am I right?

Analysts also highlighted Bitcoin’s air gap below $93,198, with little to no significant support until around the $70,000 range, because who needs support, anyway?

Fed’s Role in the Market Downturn (and Why We Should All Be Worried)

Meanwhile, about a month ago, Fed Chair Jerome Powell said that the central bank is in no rush to cut interest rates, because who needs excitement, anyway? He reiterated these remarks during his speech last week, speaking at a policy forum in New York, Powell emphasized the need for patience, because who needs a quick fix, anyway?

“We do not need to be in a hurry, and are well positioned to wait for greater clarity,” Powell stated, because who needs clarity, anyway?

Powell’s remarks come amid economic uncertainty fueled by President Donald Trump’s policy changes in trade, immigration, fiscal policy, and regulation, because who needs stability, anyway?

Despite market expectations for rate cuts this year, Powell has made it clear that the Fed will wait and see before adjusting monetary policy, because who needs a clear plan, anyway?

Adding to concerns about an impending Fed-inspired downturn, Bitcoin recently dropped following the Fed’s warning of a possible recession, because who needs a strong economy, anyway? The Fed projected a 2.8% decline in GDP for the first quarter (Q1) of 2025, triggering fears of economic instability, because who needs stability, anyway?

Despite these warnings, Peterson remains unconvinced that a full-fledged bear market is imminent, because who needs a bear market, anyway? He argues that current market conditions are not as euphoric as those of previous bubbles, because who needs a bubble, anyway?

BeInCrypto data shows Bitcoin was trading for $86,026 as of this writing, down 0.1% since Sunday’s session opened, because who needs a strong Bitcoin, anyway?

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-03-09 09:27