Pi Network (PI) has been in a bit of a pickle lately, my dear chap. After reaching new heights in late February, it seems the little blighter has hit a spot of bother. The DMI chart suggests that sellers are attempting to maintain control, as the +DI has dropped while the -DI is rising, signaling increasing bearish momentum.

Meanwhile, the RSI remains neutral, fluctuating between 45 and 55, indicating a lack of strong directional movement. If a strong uptrend emerges, PI could break above $2 and potentially test $3, but downside risks remain, especially with the upcoming unlock of 18 million tokens this month.

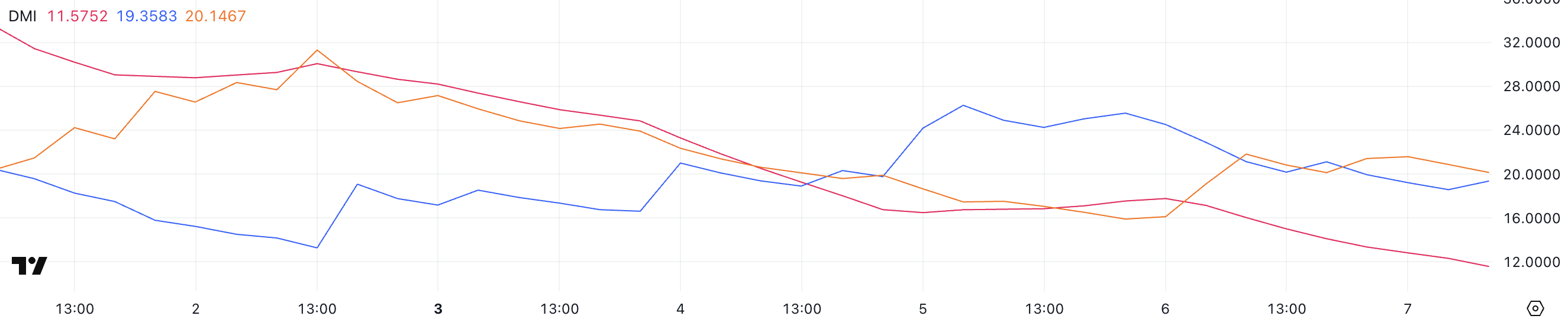

Pi Network’s DMI Shows Sellers Are Trying To Keep Control

Pi Network’s DMI chart shows that its ADX has dropped to 11.5, down from 17.7 the previous day.

The Average Directional Index (ADX) measures trend strength on a scale from 0 to 100, with values below 20 indicating a weak trend and readings above 25 suggesting a strong trend.

A declining ADX suggests that the current trend, whether bullish or bearish, is losing momentum and is less likely to continue in the short term.

At the same time, PI +DI has fallen to 19.3 from 24.5, while -DI has risen to 20.1 from 16.1. This shift indicates that bearish momentum is increasing as selling pressure overtakes buying pressure.

If this trend continues, PI could struggle to gain upside momentum and may face further price weakness.

For a bullish reversal, +DI would need to reclaim dominance over -DI alongside an ADX increase, confirming a stronger trend direction.

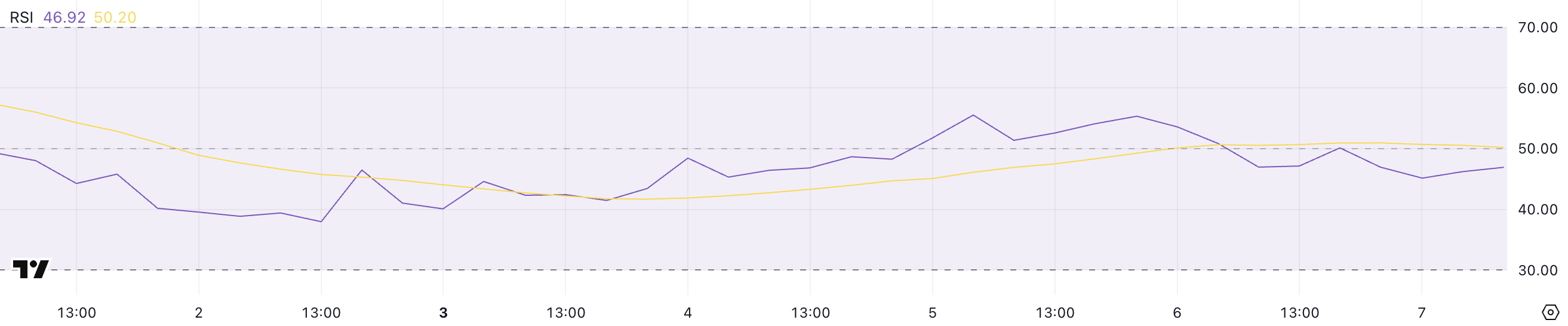

PI RSI Has Been Neutral For 8 Days

Pi Network’s RSI is currently at 46.9, maintaining a neutral stance since February 27 and fluctuating between 45 and 55 for the past three days.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of price movements on a scale from 0 to 100.

Readings above 70 indicate overbought conditions, suggesting a potential pullback, while readings below 30 signal oversold conditions, hinting at a possible rebound. A neutral RSI between 45 and 55 typically reflects a lack of strong momentum in either direction.

With PI RSI sitting at 46.9, the market appears indecisive, lacking clear bullish or bearish momentum. This suggests that Pi Network’s price may remain range-bound unless a significant shift in buying or selling pressure occurs.

For a stronger bullish outlook, the RSI would need to break above 55, signaling increasing buying interest, while a drop below 45 could indicate growing bearish momentum, potentially leading to further price declines.

The coin recently surpassed 4 million followers on X, however, Binance listing remains elusive, which could contribute to more selling pressure.

Pi Network Could Rise Above $3 If A Strong Uptrend Emerges

Pi Network has been in a consolidation phase over the past few days after reaching new highs at the end of February.

Consolidation periods often indicate a temporary pause in price movement as traders assess the next direction, with the potential for either a continuation of the previous trend or a reversal.

If buying pressure returns and Pi Network resumes its uptrend, it could first test resistance around $2. A breakout above this level, combined with strong momentum, could push Pi toward $3 and even higher, marking new all-time highs.

However, if the uptrend fails to materialize and selling pressure increases, PI price could enter a corrective phase. In this scenario, the price could decline toward $1.51. Its next price movements could be driven by its 188 million token unlock, which will take place this month.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DODO PREDICTION. DODO cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

- Happy Birthday Jason Momoa: Revisiting His Top 10 Movies As Actor Turns 45

2025-03-08 01:57