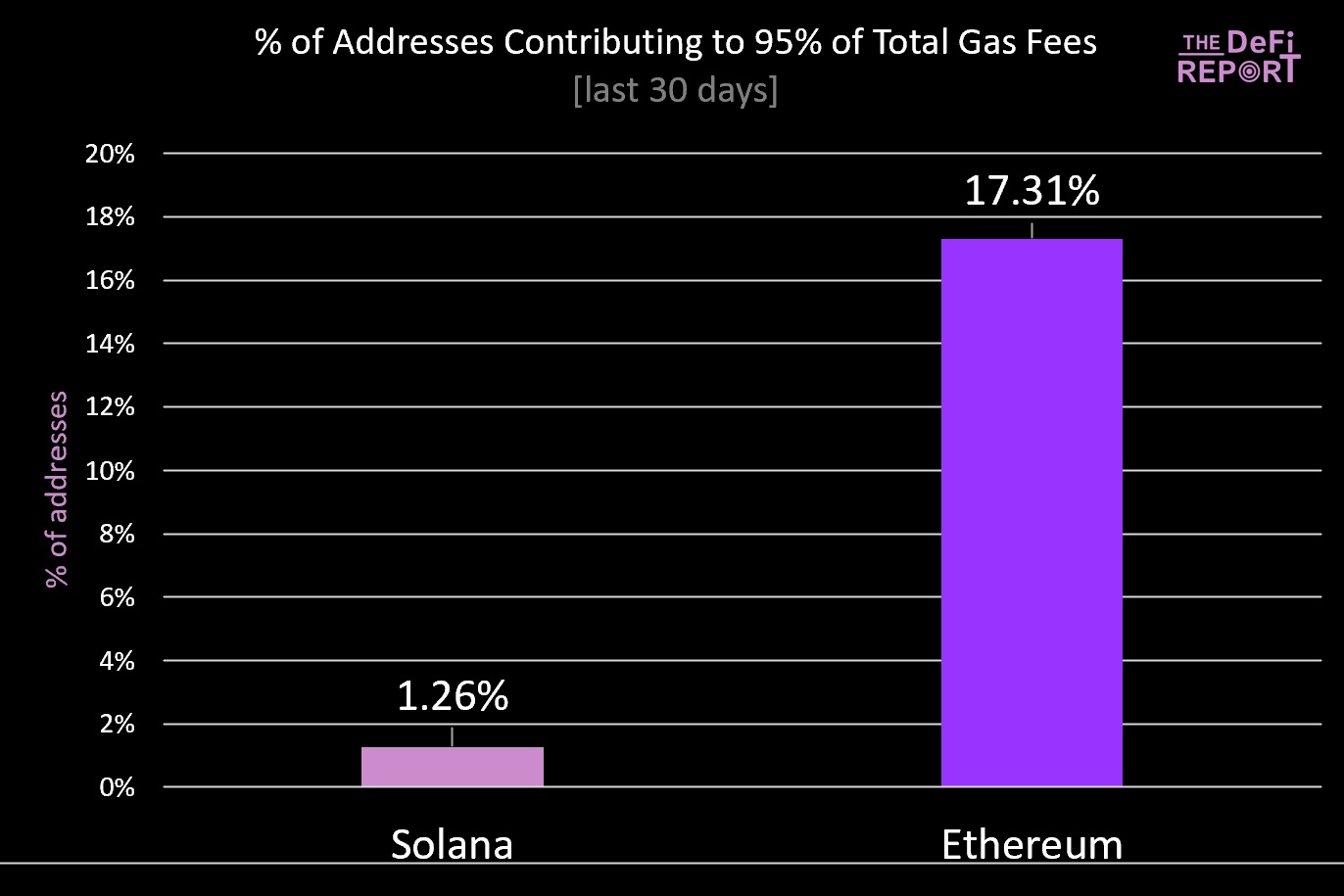

Oh, the irony! 😂 In the land of supposedly decentralized finance, Solana’s fee structure is sparking more drama than a Bridget Jones’s Diary sequel. Turns out, a mere 1.26% of wallets are the big spenders, generating a whopping 95% of the fees. Talk about the 1% having all the fun! 🥂

Solana’s Fee Structure: A Critic’s Delight 🎯

Fees, fees, glorious fees! Solana’s raking them in, with a staggering 89.73 million in fees last February. But wait, it’s not all sunshine and rainbows. Michael Nadeau, the Sherlock Holmes of The DeFi Report, is here to burst the bubble. He’s hinting that Solana’s fee party might just be a glorified game of Monopoly. 🎲

Sure, Solana’s growth is impressive, but according to Nadeau, it’s about as organic as a hot dog. 🌭

“But if you look under the hood, it looks like a house of cards,” he wrote. And we all know how well that worked out for Kevin McCallister in Home Alone. 🏠

Ethereum, the seasoned blockchain, has a broader fanbase, with 17.31% of addresses contributing to its fees. But Solana? Just 1.26%! That’s like having a party where only one person brings the booze. 🍷

And who’s the life of this Solana party? None other than Wintermute, the market-making firm that’s shaking things up. The rest? Just a bunch of bots having a rave. 🤖

These wallets are living it up with sandwich attacks and meme coin pumps, leaving retail investors feeling like they’ve just been ghosted. 👻

Imagine a world where your dance moves on the trading floor are copied by someone faster, leaving you in a cloud of dust. That’s a sandwich attack for you. 💃

Nadeau warns that if the little guys catch wind of this bot bonanza, they might just take their toys and go home, leaving Solana’s revenue dreams in tatters. 🧸

“Nothing against Solana. Massive comeback story. But my sense tells me another period of “chewing glass” is yet to come,” he concluded. And we all know glass isn’t the tastiest of snacks. 🍷

Solana’s got speed, it’s got style, but its fee concentration is raising more eyebrows than a Botox convention. 💉

“When 95% of fees come from 1.26% of users, it’s less “decentralized finance” and more “exclusive finance,” Superchargd co-founder wrote on X. It’s like trying to crash a VIP party with a fake ID. 🎟️

Some say Solana’s future is as bright as a disco ball. Others say it’s as doomed as a soufflé in a microwave. 🕺🍳

“Solana doesn’t have a future; it’s a Ponzi scheme designed for grifting,” one user said, probably while wearing a tin foil hat. 👽

And let’s not forget the drama around SOL‘s inclusion in President Trump’s US crypto strategic reserve. It’s like finding out your ex is now dating a celebrity. 🌟

“Solana is a complete house of cards built on wash trading bots and centralized control,” another user remarked, clearly not in the mood for a card game. 🃏

Despite the naysayers, Franklin Templeton is betting on Solana like it’s the last horse in the race. They’re talking about scalability, low fees, and user activity like it’s the recipe for a perfect dating profile. 🏇❤️

So, here’s Solana, at a crossroads, with its technological prowess and cost-efficiency on one side, and its centralized fee shenanigans on the other. Will it soar like an eagle or crash like a lead balloon? Stay tuned, folks! 🚀🎈

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Elder Scrolls Oblivion: Best Bow Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-03-07 13:43