Oh, dear! It appears that Bitcoin has taken a rather dismal turn, with its weekend gains evaporating faster than a magician’s rabbit. The brief flicker of hope, courtesy of Trump’s Crypto Reserve announcement, has been snuffed out like a candle in a windstorm, leaving the underlying macroeconomic woes to loom ominously.

As if that weren’t enough, Trump’s tariffs against his closest trading partners are still on the docket, and the Federal Reserve is predicting a decline in US GDP that could rival the worst of the pandemic. A broader recession, it seems, is poised to give the crypto industry a good kicking.

Bitcoin Takes a Nosedive of 10% as Recession Looms

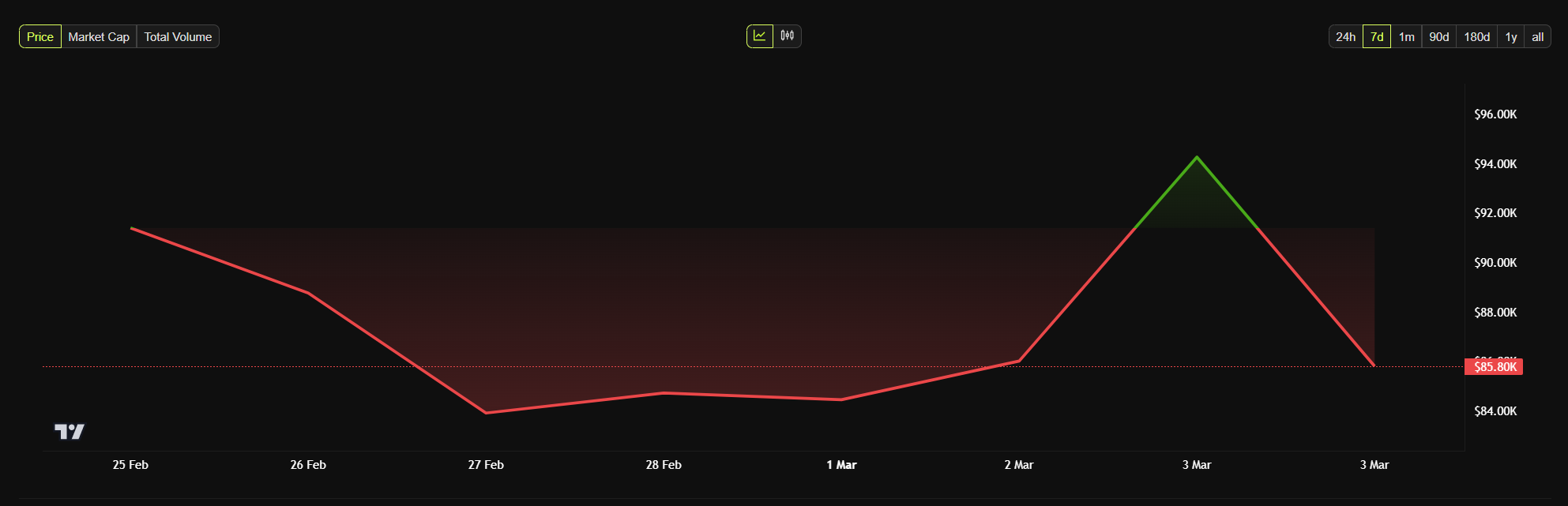

The price of Bitcoin has been more volatile than a cat on a hot tin roof these past few days. Last week, the Crypto Fear and Greed Index plummeted to its lowest level since 2022, leaving Bitcoin looking as bearish as a grumpy old bear in winter.

Just yesterday, Trump’s announcement of a crypto reserve sent token prices soaring, but today? Well, that momentum has vanished quicker than a politician’s promise.

Now, one might wonder why Bitcoin is looking so glum. It seems that Trump’s announcement was merely a bandage on a gaping wound, and not a particularly good one at that.

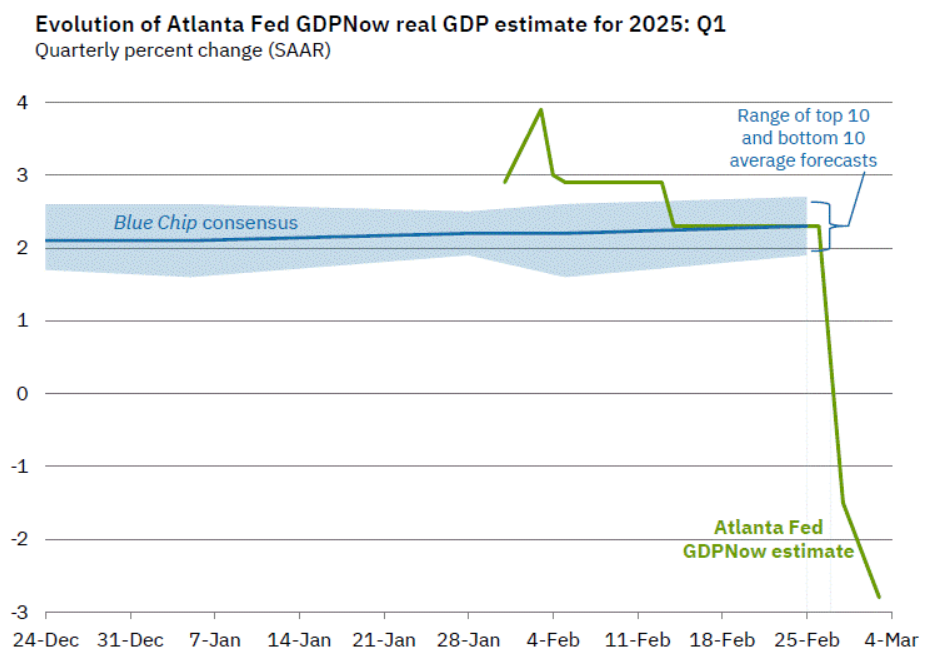

Last week, Bitcoin ETFs experienced their worst week ever, with a staggering $2.7 billion in outflows, as the Federal Reserve Bank of Atlanta predicted a 1.5% GDP decrease. Today, the mood has darkened even further.

The Fed is now predicting that the US GDP will shrink by 2.8% by the end of Q1 2025. From an economic standpoint, this is nothing short of apocalyptic, especially when compared to the rosy predictions of 3.9% growth just four weeks ago. Talk about a plot twist!

Macroeconomic Factors Spell Trouble for Crypto

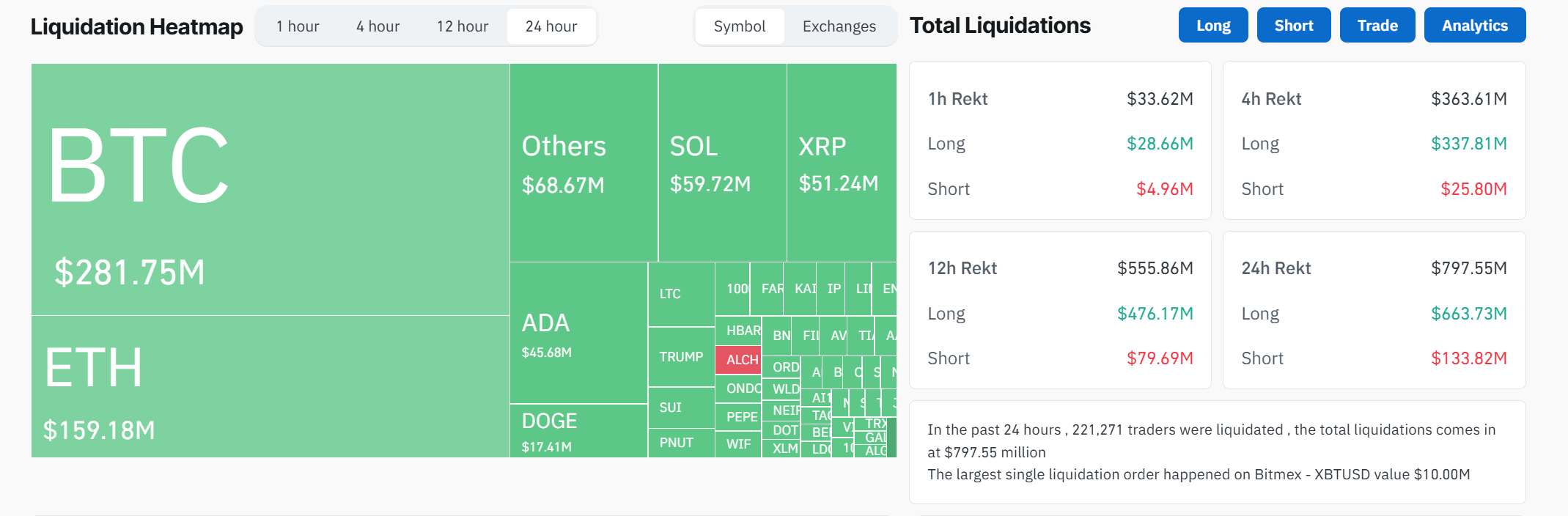

The US economy hasn’t shrunk this much since the early days of the Covid-19 pandemic five years ago. These macroeconomic factors are sending out distress signals that Bitcoin might be in for a rough ride in the short term. In fact, market liquidations have soared to nearly $800 million today. Yikes!

Another delightful factor contributing to Bitcoin’s rollercoaster ride is President Trump’s proposed tariffs. Some analysts have theorized that they aren’t the main culprit, and they might just be onto something.

However, the crypto market took a nosedive when Trump recently announced a 25% tariff on the EU, joining the merry band of tariffs on Canada, Mexico, and China.

“Trump: no room left for deal on tariffs on Mexico, Canada. [He] reiterates plan to double China tariff from 10% to 20%,” claimed Walter Bloomberg via social media. Well, that’s just peachy!

In summary, macroeconomic factors are largely steering the ship of market sentiment in the crypto industry. Since the approval of Bitcoin ETFs, crypto has been snugly integrated into traditional finance. However, should the US economy tumble into a recession, the downsides of that integration will come crashing down like a poorly constructed house of cards.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2025-03-04 00:49