In the dusty roads of the digital market, Pi Network (PI) has tumbled like a drunkard, losing nearly half its worth in a mere four days. Yet, amidst the chaos, theTechnical Wizards whisper of a potential rebound, as the mystical DMI and BBTrend hint at a pause in the relentless fall.

Should the bulls rear their heads once more, PI might just dance above the magical resistance lines, teetering on the edge of a $3 dream. But if the bears roar louder, a plunge below $1.50 awaits, testing the depths of despair.

DMI Says “Whoa There, Cowboy!” to Pi Network’s Slide

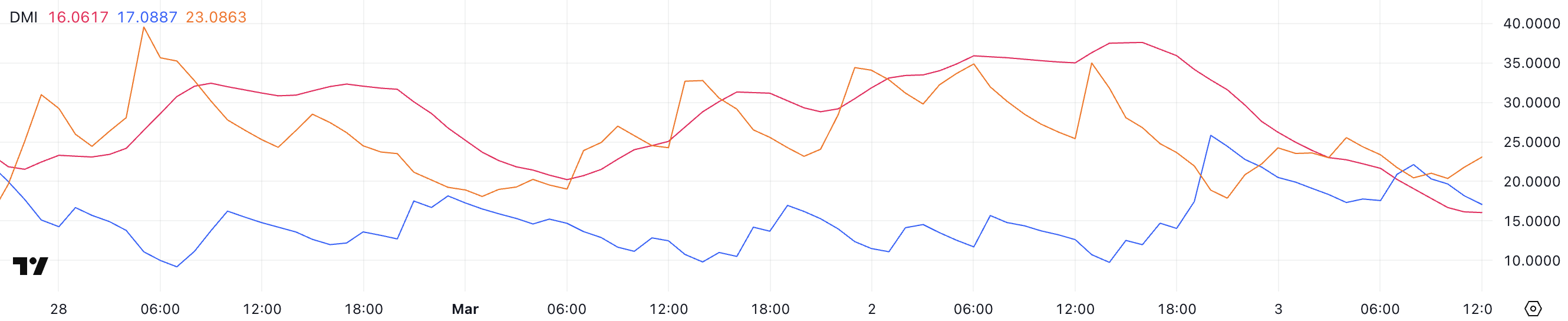

As if a tired horse, Pi Network’s trend strength has stumbled, as told by the Directional Movement Index (DMI).

The Average Directional Index (ADX), a gauge of trend muscle, has shriveled from a robust 37.5 to a meager 16, suggesting the prior downtrend has lost its steam, much like a train without coal.

The ADX, a fickle friend, speaks not of direction but of passion in the trend’s heart. A reading above 25 yells “strong trend ahead!” while anything below 20 mumbles “indecision reigns.” At 16, PI’s momentum is as faint as a ghost’s whisper, hinting that neither buyers nor sellers hold the reins.

And so, the +DI (positive directional index), once a proud 25.8, has fallen to 17, a sign that the bulls are weary. Meanwhile, the -DI (negative directional index) has grown from 17.8 to 23, like a weed in a neglected garden, showing that selling pressure is on the rise.

This shift is a sly nod that PI is still caught in a downtrend, albeit a lazy one, as the ADX hints at a trend as strong as a wet noodle. If -DI keeps climbing while ADX stays below 20, PI could wallow in a slow downtrend rather than a headlong dive.

But if ADX and -DI start a upward tango, selling pressure could surge, leading to a sharper nosedive. Conversely, if buyers find their courage and boost +DI above -DI, PI might just find its feet and consolidation could be on the cards.

BBTrend Says “Not So Fast, Partner!” to Pi Network’s Bearish Dance

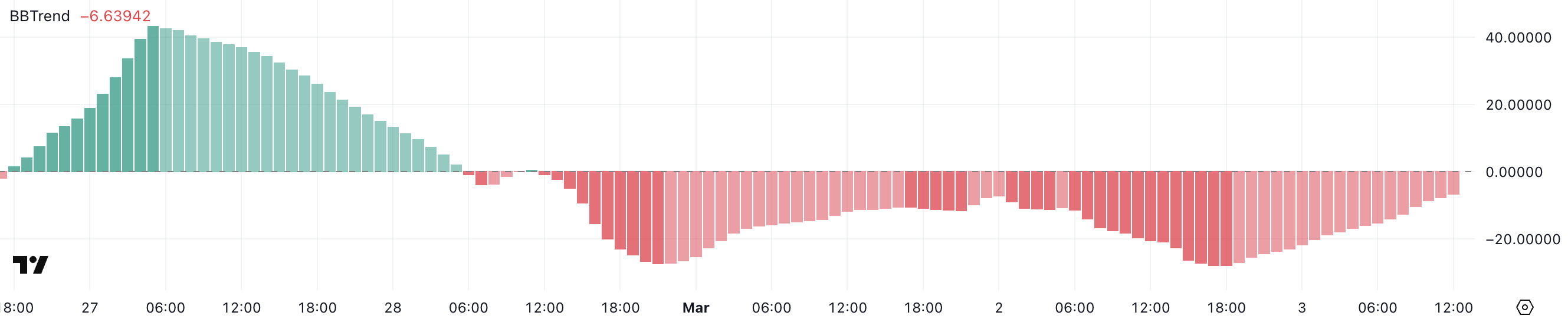

Since the end of February, Pi Network has been caught in a lengthy downtrend, as its BBTrend indicator has remained in the dumps.

Yesterday, PI’s BBTrend hit a nadir of -27.9, a sure sign of intense selling pressure, before clawing its way back to -6.6. The BBTrend, derived from the mystical Bollinger Bands, is an indicator that reads the market’s mood like a fortune teller’s crystal ball.

Readings above zero are a sunny forecast, while negative values hint at stormy skies ahead. When BBTrend dips below -10, it’s like a town crier shouting “oversold!” while a rise back toward neutral territory suggests the storm might be blowing over.

Although PI’s BBTrend is still glum at -6.6, it’s perked up significantly from yesterday’s abyss, indicating that selling pressure is like a spent storm.

This hints that the market could be finding its sea legs, though PI is not yet ready to hoist the bullish flag. If BBTrend keeps ascending and edges closer to zero, it could signal a trend reversal or at least a breather before the next big move.

But if BBTrend sinks back down and fails to surface, PI could face renewed pressures, making it a nail-biter to see if the recent reprieve is here to stay or just a fleeting mirage.

Pi Network: A March to $3 or a Retreat to Lower Grounds?

After a nearly 43% haircut in four days, Pi Network is like a trimmed hedge, having reversed from its recent heights with an 18% chop in a single day following Vietnam’s legal grumblings.

If the trend swings back up, the first key resistance to eye is at $1.80. A surge above this level could light a fire under PI, potentially propelling it toward $2.35.

If the bulls gather their strength and mimic the earlier charge, PI could rally to $2.97, with a shot at breaking the $3 barrier for the first time.

However, this dream relies on buyers mustering the courage to seize control and push the price beyond these resistance levels.

On the flip side, if selling pressure regroups and the downtrend resumes, PI could visit the $1.50 support level.

A breach below this zone would leave PI vulnerable to further cuts, with $0.80 looming as the next major support. Such a move would suggest that bearish momentum is as relentless as a winter storm, possibly leading to an extended period of chilly declines.

Read More

- Snowbreak: Containment Zone Katya – Frostcap Guide

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

- 30 Best Couple/Wife Swap Movies You Need to See

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- ATH PREDICTION. ATH cryptocurrency

- Blue Lock: Is Kaiser Yoichi Isagi’s True Rival? Explored

2025-03-03 22:22