Oh, the delightful news! Solana, our dear cryptocurrency, has experienced a remarkable 24% increase in price. This sudden surge has left many an investor in a state of pleasant astonishment. Our beloved SOL now trades at the handsome sum of $161, a figure that hints at a potential recovery from the recent downtrend.

Despite this encouraging development, one must not forget the ever-present risk of selling pressure. Alas, short-term holders (STHs) have been witnessing a rise in profits, which may lead to further capitulation. However, let us not despair, for there is hope yet.

Solana Finds a Special Spot in the Hearts of Investors

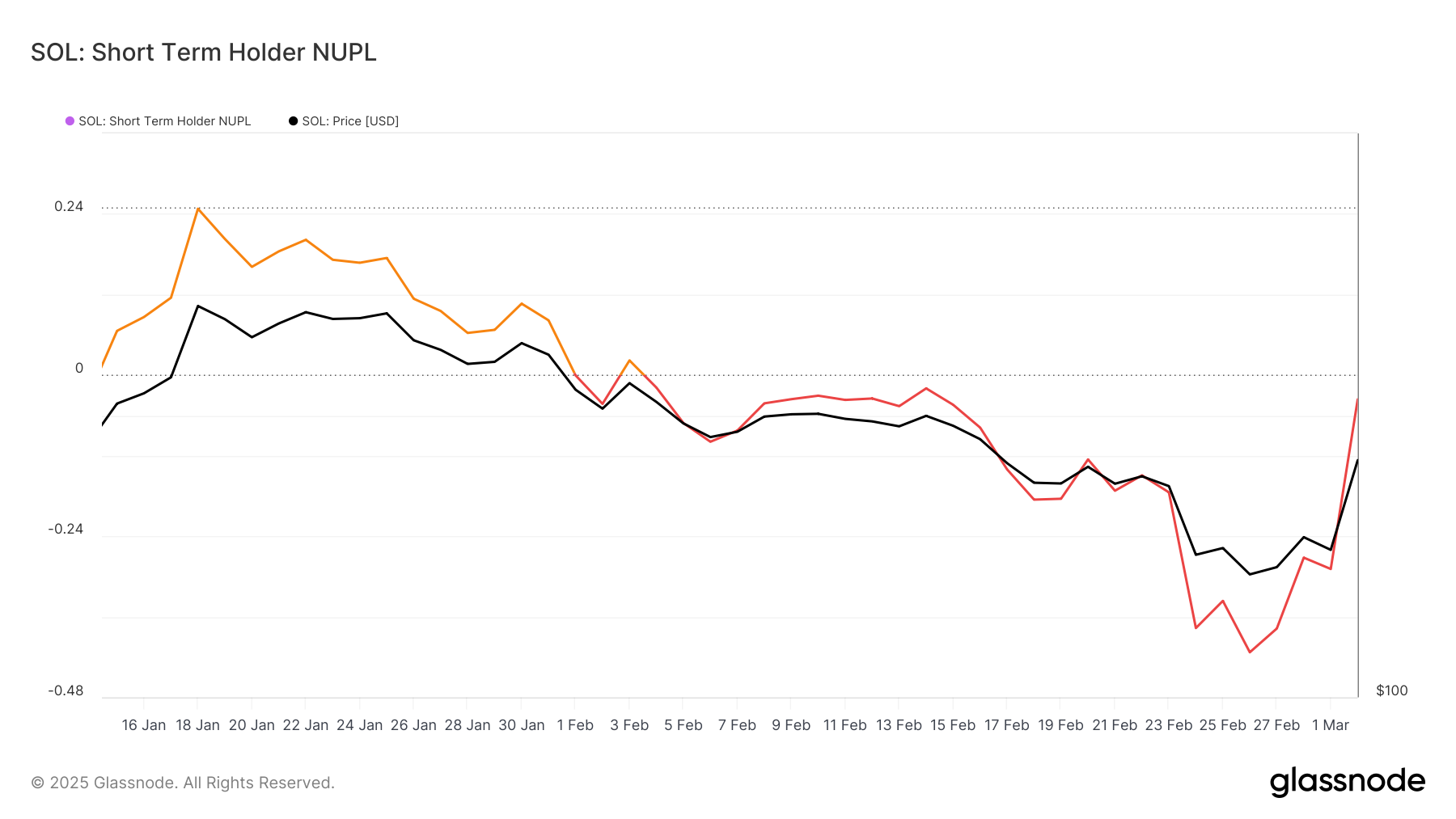

The Short-Term Holder Net Unrealized Profit/Loss (STH NUPL) metric has indicated that STHs are entering the realm of profit. This is indeed a critical shift, as it reduces the likelihood of further capitulation. If profits continue to rise, investors may choose to hold onto their SOL rather than sell, thereby reinforcing market stability. 💸

Breaching the NUPL threshold could restore confidence among SOL holders. Historically, positive shifts in this metric have opened the altcoin up to potential rallies. If investors resist the urge to sell, Solana could see a sustained uptrend, attracting further capital inflows and improving market sentiment. 🎉

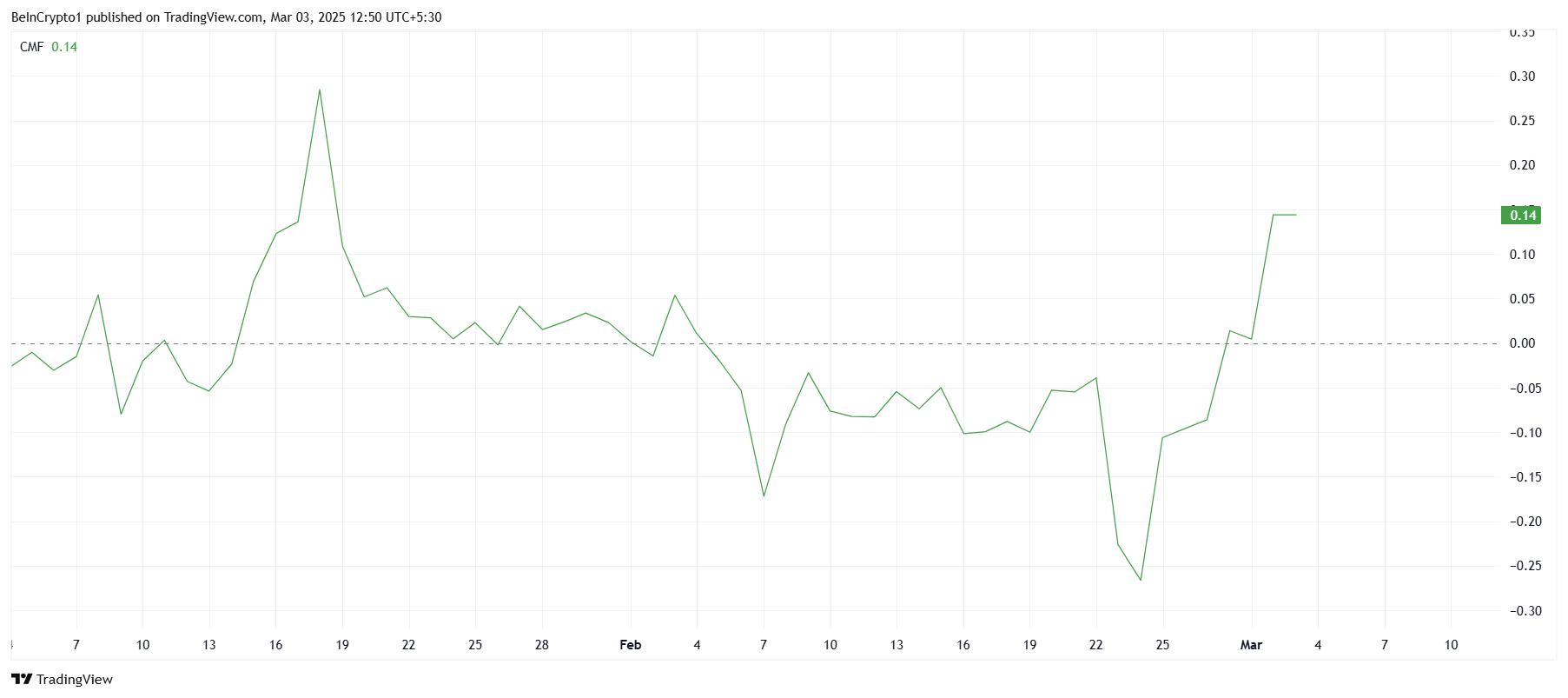

Solana’s macro momentum remains strong, backed by the Chaikin Money Flow (CMF) indicator. A significant uptick in CMF suggests strong buying pressure, with capital inflows increasing over the past few days. This indicates that investors remain committed to Solana despite recent volatility. 📈

Notably, these inflows began even before Solana’s inclusion in the US Crypto Strategic Reserve. This suggests that institutional and retail investors see long-term value in the asset. Sustained inflows could help Solana maintain its upward trajectory, potentially reversing its recent bearish trend. 🌟

SOL Price: A Sight for Sore Eyes

Solana surged 24% on Monday before retracing, now trading at $161. Holding this level of support is critical. A bounce from here could push SOL toward $183, marking the next resistance level. 📈

Reclaiming $183 as support would set the stage for a move toward $200. This level remains a psychological barrier, and securing it could confirm Solana’s recovery. A strong push past $200 would reinforce bullish momentum, attracting more buyers. 📈

However, failure to break $183 could lead to renewed selling pressure. A drop below $161 would invalidate the bullish outlook, potentially reviving Solana’s price’s downtrend, potentially pushing it to $150 or lower to $138. 📉

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Elder Scrolls Oblivion: Best Bow Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-03-03 14:10