In a week that could only be described as a financial opera, Bitcoin ETFs have witnessed a staggering $2.7 billion in outflows, heralding the arrival of a bear market that even the most stoic of bulls would find hard to ignore. Corporate Bitcoin holders are clutching their pearls, and liquidations are soaring like a kite in a storm. 🎈

Meanwhile, the Federal Reserve Bank of Atlanta, with all the cheerfulness of a rainy day, has predicted a 1.5% decline in US GDP for Q1 2025, adding fuel to the fire of economic gloom. ☔️

Is Bitcoin on the Brink of a Bearish Breakdown?

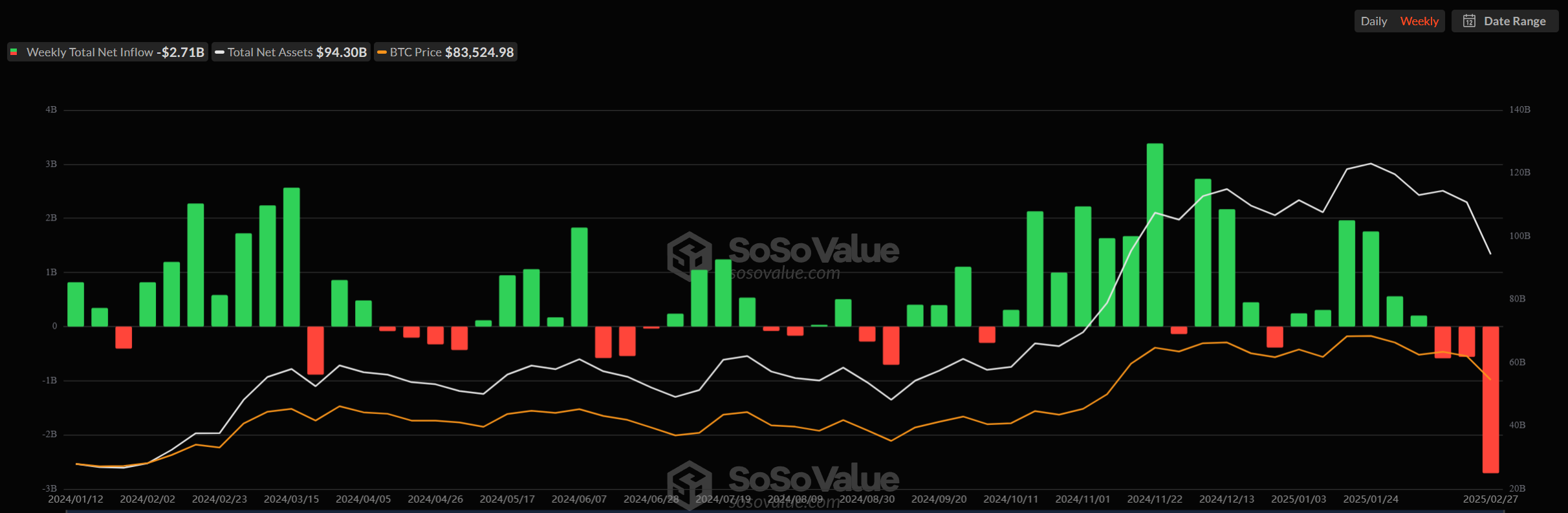

The once-bustling US spot Bitcoin ETF market, which seemed to grow faster than a weed in spring, is now experiencing a mass exodus. Earlier this week, it set a new record for outflows, inching ever closer to the $1 billion mark. With the week’s data in, it’s clear that institutional investors are feeling the jitters. 🥴

Over the past week, Bitcoin ETFs have seen a net outflow of $2.7 billion—a troubling sign indeed, reminiscent of the largest weekly net outflow since March 2024. Talk about a dramatic plot twist! 📉

Fear of a bear market has gripped the crypto realm like a bad horror movie, even affecting corporate Bitcoin holders. Strategy (formerly MicroStrategy) recently splurged nearly $2 billion on BTC, but alas, their stock price is still plummeting like a lead balloon. 🎈

Today’s trade data reveals a 57% drop since last November for them, while Metaplanet has tumbled 54% from its peak, and Tesla isn’t faring much better. All these firms are sitting on mountains of Bitcoin, yet they seem to be sinking faster than a stone. 🪨

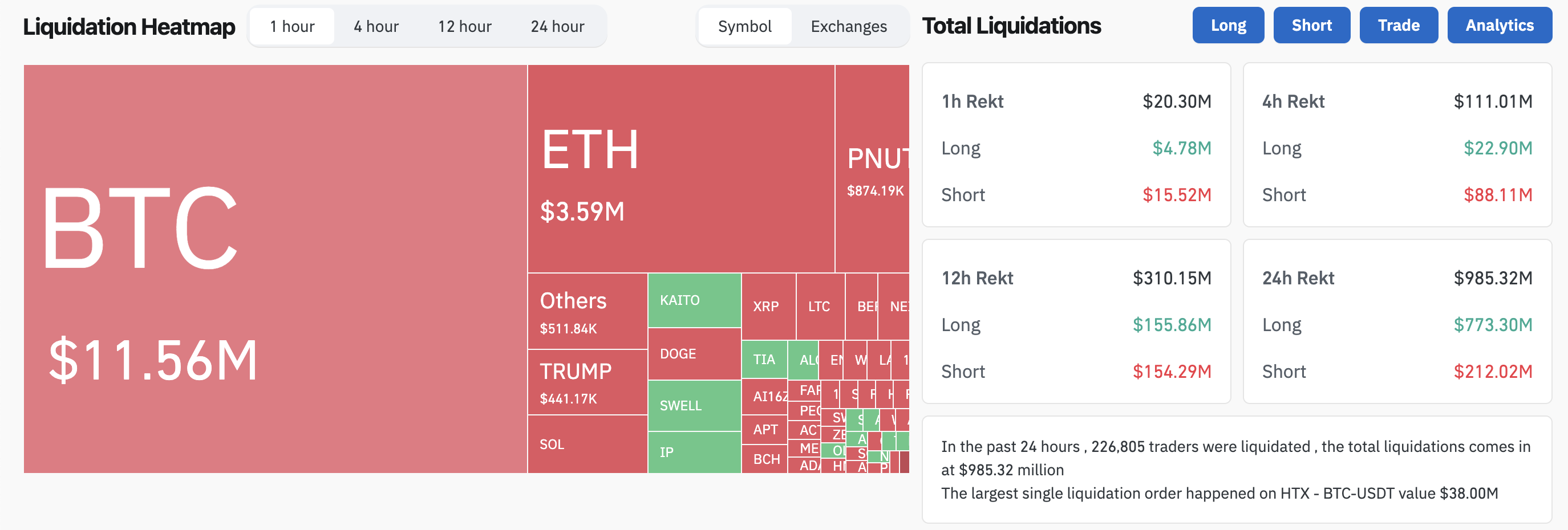

While Bitcoin may be taking the brunt of this impending bear market, liquidations are skyrocketing across the crypto landscape. The latest figures show nearly $1 billion liquidated in just the last 24 hours. Traders are currently gripped by Extreme Fear, the lowest level since the infamous 2022 FTX collapse. 😱

Yet, amidst the chaos, a few optimistic souls are trying to find the silver lining. Michael Saylor, in a moment of dark humor, urged the community not to panic sell, suggesting they “sell a kidney if you must, but keep the Bitcoin.” 😂

Arthur Hayes, the former CEO of BitMEX, has revised his predictions, suggesting that while BTC may drop, it will eventually bounce back. He remains convinced that Bitcoin will rise again after this bear market, like a phoenix from the ashes. 🔥

“We are making lower lows in this current wave. I was tempted to add risk this morning, but looking at this price action I think we have one more violent wave down below $80,000, most likely over the weekend, then crickets for a while. Hold on to your butts!” Hayes proclaimed on social media, channeling his inner prophet. 📉

Dark economic clouds have loomed for days, and a market correction seems as inevitable as Monday following Sunday. This afternoon, the Federal Reserve Bank of Atlanta reiterated that the US GDP is on a downward trajectory, set to decline by 1.5% in Q1 2025. 📉

Even a baseless rumor could wreak havoc. Overall, the current macroeconomic landscape suggests a short-term bearish cycle for Bitcoin and the entire market, leaving us all to wonder: will we ever see the light again? 🌧️

Read More

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Snowbreak: Containment Zone Katya – Frostcap Guide

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

2025-03-01 00:35