Ah, the trades of our dear Donald Trump! His whimsical tariffs have stirred quite a tempest in the land of crypto this week, causing Ethereum‘s value to tumble like a jester’s hat! At present, this prized altcoin is dancing at the oh-so-charming price of $2,347, a level reminiscent of last November’s gloom.

As the coins spiral downwards, our brave ETH investors, clad in the garb of despair, have chosen to withdraw their treasures from the altcoin’s coffers—oh, what a dire sight!

ETH Spot ETF Outflows Soar to New Heights! 🏔️

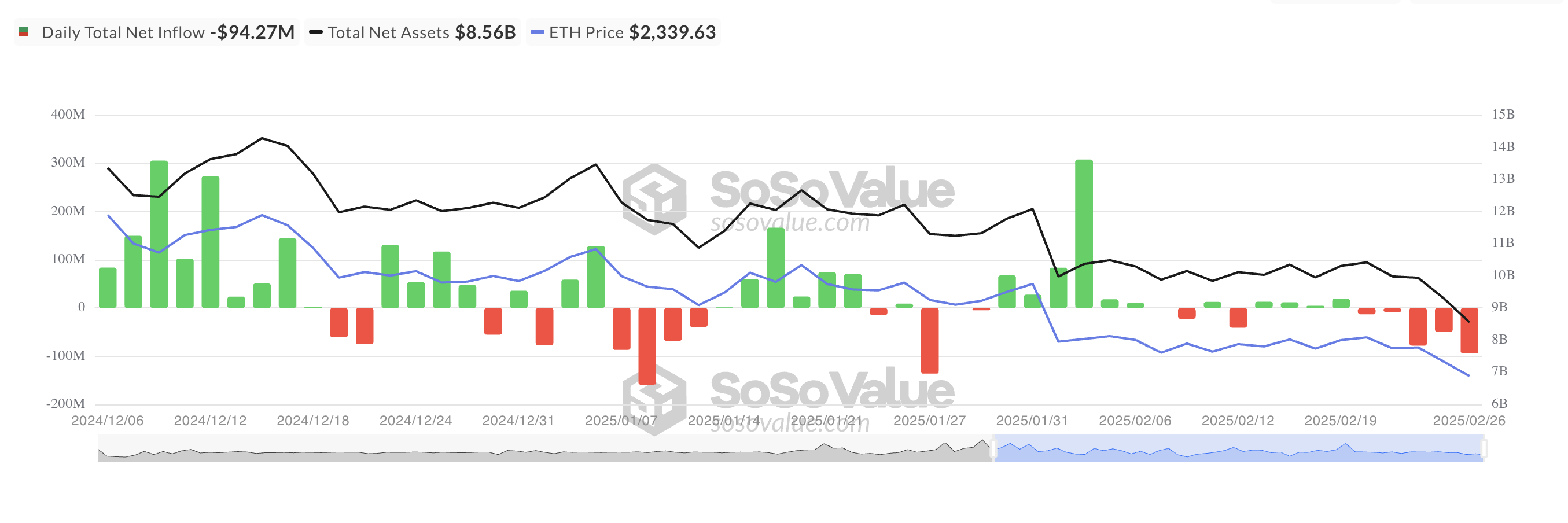

According to the sagacious sages at SosoValue, net outflows from ETH spot ETFs soared to the lofty peak of $94.27 million on February 26. This marked the third-highest single-day exodus since the dawn of the year, following the coin’s descent to a dismal low of $2,251—was it not a merry day?

On the fateful Wednesday, the Blackrock ETF of ETHA saw a remarkable outflow of $69.76 million, thus bringing the grand total of riches that have flowed into the fund since its inception to a staggering $4.33 billion. Fidelity’s FETH, not one to be outdone, boasted a less-than-heroic outflow of $18.38 million that day—hooray for cumulative inflows of $1.51 billion! 🎉

Ah, the cruel irony! When the ETH ETFs witness such grand outflows, investors withdraw more coins than they dare to deposit, signaling a severe lack of faith or, perchance, the sweet taste of profit-taking. Since February 21, ETH spot ETF investors have been retreating with their pouches—how inflammatory for the altcoin’s worth!

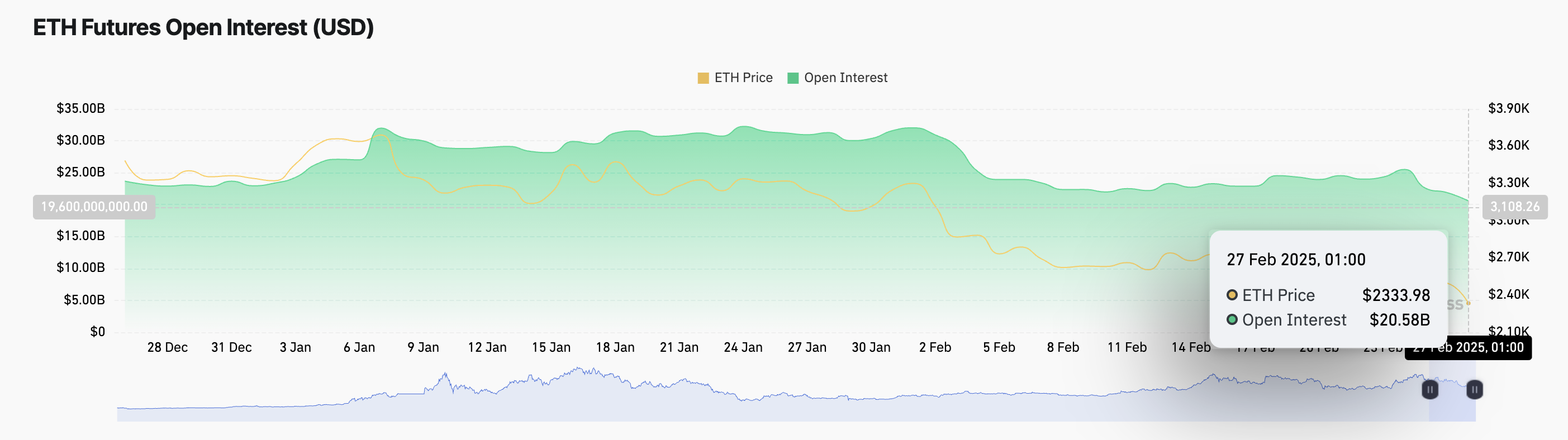

In an even graver twist, the vanishing open interest in ETH’s futures market mirrors the somber sentiment suffocating the market. As we speak, it languishes at $20.58 billion, falling by 20% since this week’s inception. In tandem, ETH’s price has plummeted by a lamentable 17%—the audacity!

Now, dear audience, behold the significance of this open interest! It portrays the total count of unfulfilled derivative contracts, the futures or options that remain unsettled. When it diminishes alongside the asset’s worth, traders take their leave rather than opening new vaults—a most telling sign of the waning interest!

This connection, dear friends, suggests a weakening desire in the market for ETH and hints at the unhappy possibility of a continued decline in its stature.

ETH Shatters Support, Eyes the Gloomy Depth of $2,150 🌑

In the art of charting, ETH findeth itself beneath the lower threshold of a horizontal channel that it hath graced with its presence for most of February. Such a breach indicates a notable collapse of support, foreshadowing further dismay. Might we brace ourselves for the coin to revisit its year’s most sorrowful low of $2,150?

Yet, fear not! Should the winds of market sentiment shift and fresh demand begin to pour like a warm summer rain into the ETH garden, we could witness its value joyfully ascending to $2,467. A break above this tempered resistance might just catapult ETH’s worth to stratospheric heights of $2,585—imagine the revelry! 🎈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-27 16:33