Amidst the tumultuous waves of fortunes, the famed ‘Trump Trade’ now finds itself ensnared in a fierce backlash, as Bitcoin (BTC), Tesla (TSLA), and the venerable US dollar all plummet to troubling depths. Not so long ago, a wave of optimism surged through the hearts of investors, invoking the sun-kissed vision of President Donald Trump’s pro-growth policies. Alas! This bright dawn has dimmed into a gloaming of disillusionment befitting a Dostoevskian novel.

Once the herald of rise and riches, Bitcoin transcended a lofty height of $100,000, buoyed by fervent wishes of a triumphant return of Trump to his throne. However, like the dreams of an overwrought peasant, it has now tumbled below $85,310, leaving behind but echoes of concern and fragile hope. Analysts point their fingers at this perilous abyss of uncertainty between $90,000 and $70,000, where thoughts of further declines dance like shadows of an unsettling ghost.

The descent has provoked a myriad of reactions from traders, who seem to express the classic sentiments of a jilted lover. President Trump’s promises of alleviating restrictions on cryptocurrencies now appear as fleeting as a mirage, leading to stinging disillusionment.

“Trump promised us a strategic Bitcoin reserve. Instead, we received a cacophony of trade wars!” thus lamented the crypto sage known as Crypto Rover, in a twist of fate had it not been for social media.

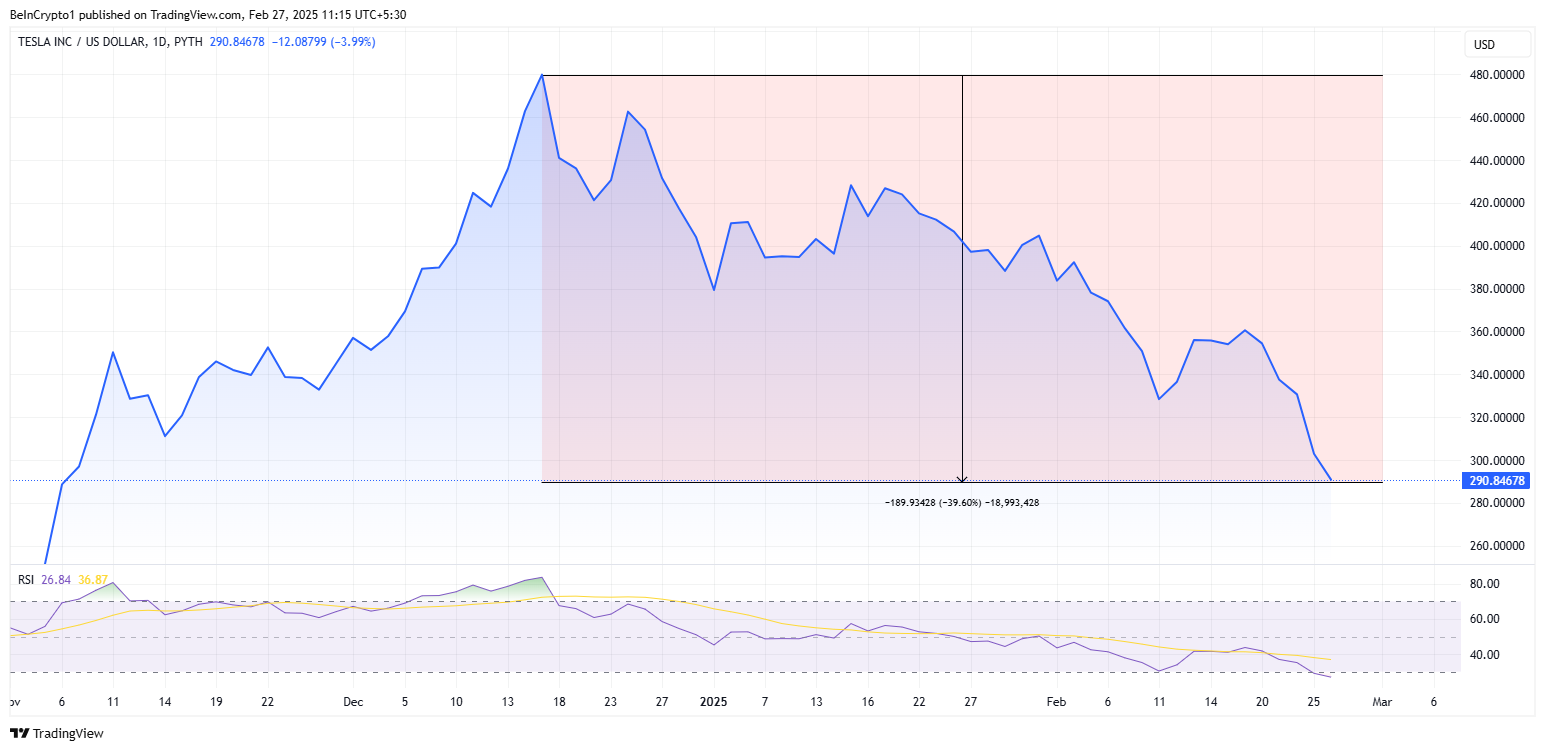

Tesla, the sparkling chariot of the electric revolution, is hardly in a better state. Its stock finds itself shackled in a downward spiral, down nearly 40% since the blissful peak post-Trump’s electoral victories. On a dismal February 26, it plunged nearly 4%, further extending a bleak trend that has seen its value wilt by 24% this calendar year, reminiscent of a summer garden lay waste by an unforeseen frost.

Furthermore, the apprehensions of investors are amplified by the curious fixation of CEO Elon Musk on matters of federal reforms. The political paysage, with Musk’s tendencies towards polarization, has not only rattled cages in his homeland but has also cast long shadows over Tesla’s performance in Europe. January witnessed a grim decline in sales by a staggering 45%, despite the collective enthusiasm across electric vehicle markets which otherwise surged by a more cheerful 37%.

The once-steadfast US dollar, alongside Treasury yields that basked under the warmth of Trump’s economic proclamations, now finds itself in retreat. Analysts warn of the treacherous flames of inflation that could once again rise, fueled by Trump’s newly unleashed tariffs—a grim echo of days gone by.

Trump’s Trade War: A Study in Chaotic Contradictions

In an insightful commentary, The Kobeissi Letter aptly notes the far-reaching implications of Trump’s trade gambits. Recently, the president unleashed a torrent of tariffs—25% on goods flowing from Canada and Mexico, the chilling same to the European Union, and 10% aimed at China, with murmurs of a staggering 100% on the BRICS countries looming ominously on the horizon.

Such aggressive commerce maneuvers are poised to inflate prices across the United States, summoning inflation expectations back from their slumber, with alarming predictions that the inflation rate might well double from its recent lows.

“The markets brace for an uptick in inflation, as the prices of many a good are predicted to rise” observed The Kobeissi Letter with an air of authority.

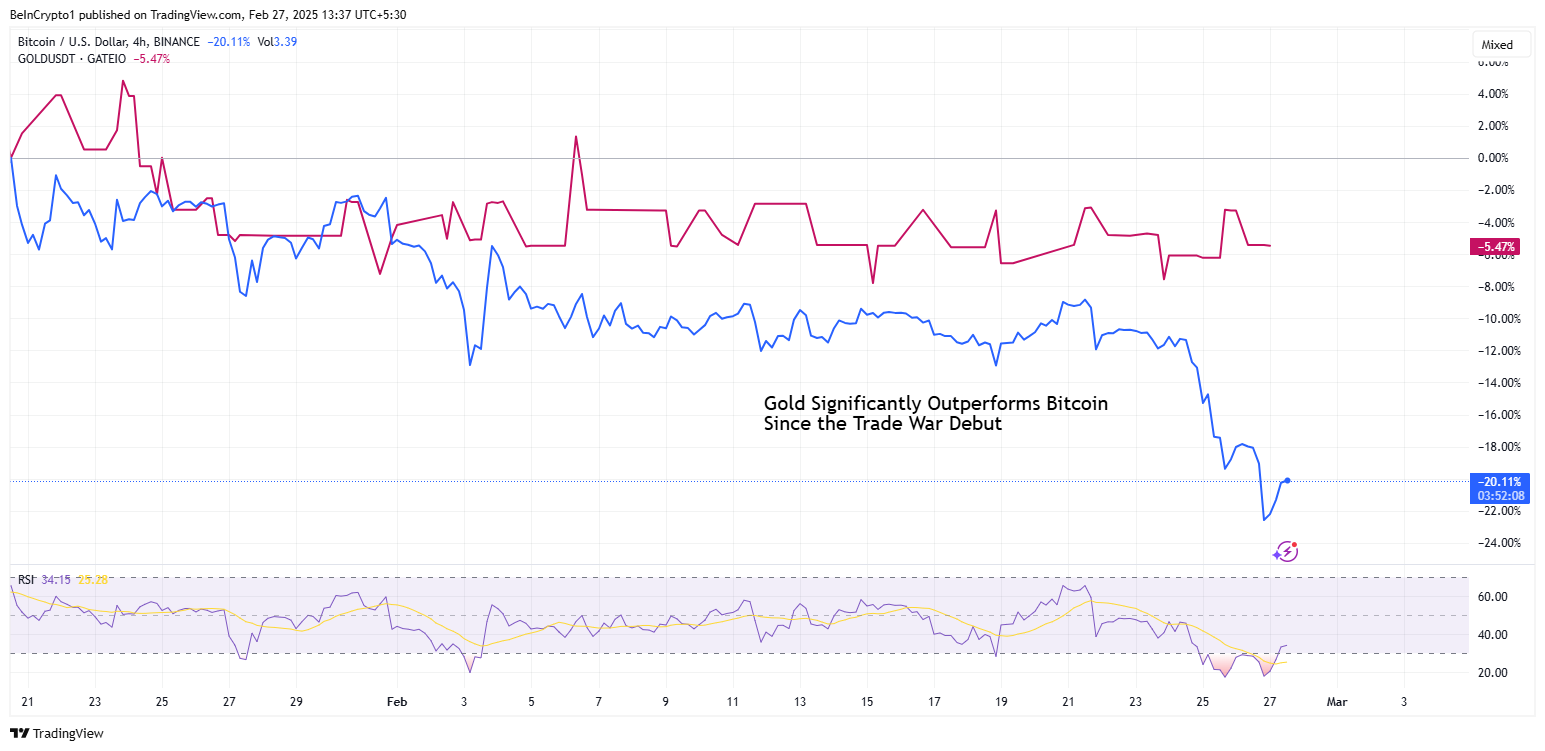

Conversely, a peculiar development has emerged—a stark divergence between Bitcoin and the traditional safety of gold. While the latter flourished, with an increase of 10%, Bitcoin’s fortunes wane, trailing off by an unfortunate 10%. Where does this leave our noble Bitcoin, once heralded as a shield against economic tumult?

Sipping the bitter cup of irony, a recent study from Dancing Numbers purports that Trump’s tariff vision could potentially liberate the weary American taxpayer by replacing income taxes with tariffs on imports. It suggests that the average American might save a hefty $325,561 over a lifetime! Such revelations could certainly spark many a celebratory toast—albeit bittersweet given the context.

In states like New Jersey, Connecticut, and New York, the windfall may exceed $146,160, $149,535, and $136,215, respectively, spreading joy akin to a bountiful harvest after a strife-ridden winter.

Nevertheless, the cautionary tales linger, as skeptics express anxieties about the implications of relying solely on tariffs. Could this reliance usher forth an inflationary Pandora’s box, exacerbating existing dilemmas instead of resolving them?

“This could shatter the very fabric of global markets! In this tempest of volatility, US inflation may persist unabated—rate cuts, you say? Not on the horizon, my friend!” exclaimed Jagadish, a voice crying out from the digital wilderness of X.

As the dust settles in this chaotic landscape shaped by Trump’s decisions, investors tread lightly, wary of the impending tempests. The ‘Trump Trade’ stands at a crucial crossroads, teetering with inflation concerns while key assets falter like actors caught in a tragic play.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-27 12:50