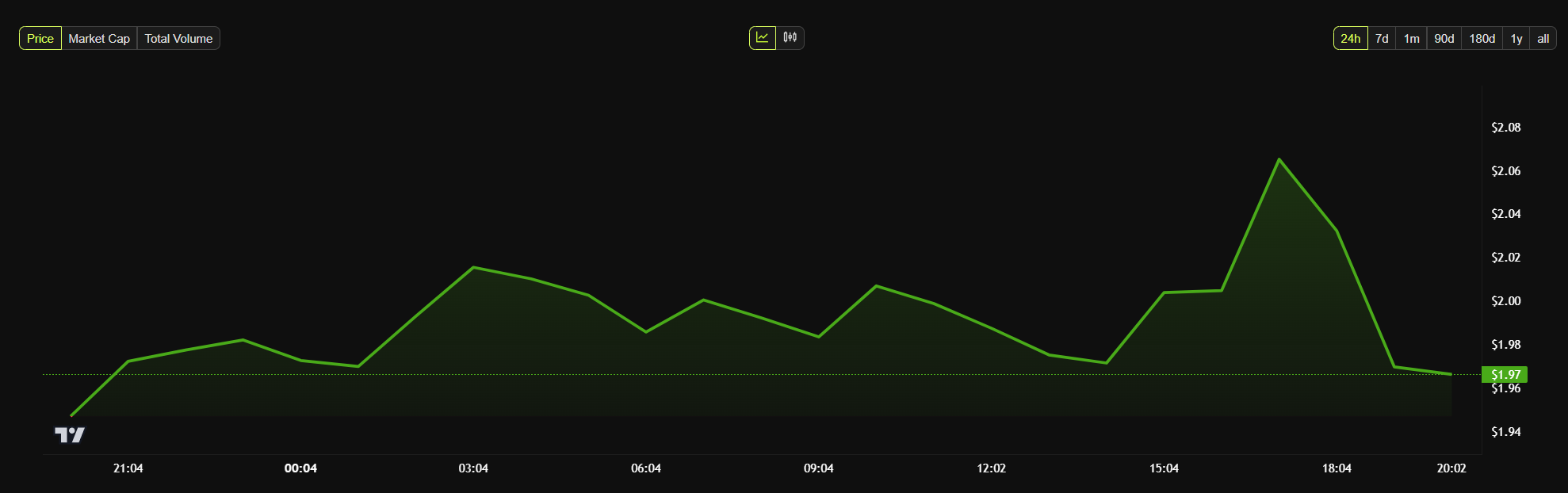

MORPHO jumps nearly 10% before seeing corrections, as Coinbase listed the token. The exchange recently put MORPHO on its roadmap alongside two meme coins with little price impact, but the actual listings have boosted all three assets.

Morpho’s developers also announced that its smart contracts had been independently vetted and have been deployed on several major blockchains.

Coinbase Lists MORPHO: The “Coinbase Effect” Strikes Again! 💥

Coinbase, the largest crypto exchange in the US, has a history of impacting crypto prices after listing announcements. The “Coinbase Effect” is well-documented, with plenty of examples.

Two weeks ago, Coinbase put PENGU, POPCAT, and MORPHO on its listing roadmap to little fanfare; the former two saw big gains upon the actual listing. Now, it’s Morpho’s turn.

“Coinbase will add support for Morpho (MORPHO) on the Ethereum (ERC-20 token) and Base networks. Trading will begin on or after 9AM PT on 27 February, 2025, if liquidity conditions are met. Once sufficient supply of this asset is established trading on our MORPHO-USD trading pair will launch in phases,” the exchange claimed on social media.

Coinbase’s token listing has had a significant impact on MORPHO. The blockchain project was a high performer in January, even entering a major partnership with Coinbase. Although its token value dropped significantly in early February, today’s listing caused a spike of nearly 10% before another drop.

Morpho’s developers prepared a few announcements to accompany this Coinbase listing. The firm claimed that its smart contracts are now deployed on several major blockchains.

These contracts have been vetted by independent third-party audits, which include a $2.5 million bug bounty. This is far from the largest bounty in crypto history, but it is still quite substantial.

With these developments, the company wishes to emphasize its focus on transparency and credibility. Morpho is a decentralized, noncustodial lending platform built on Ethereum that optimizes lending pools by facilitating efficient peer-to-peer interactions.

The protocol promises to improve interest rates for borrowers and lenders by matching liquidity directly while still relying on underlying lending pools as a fallback, ensuring both security and capital efficiency.

The ecosystem also includes a governance framework, where the native MORPHO token plays a key role in decision-making and incentivization.

Read More

2025-02-26 23:37