Crypto Carnage: Why Onyxcoin Spiraled Down 22% 🚨

Onyxcoin (XCN) has extended its losing streak, plunging another 22% in the last 24 hours. It now trades at a 30-day low of $0.015. At this rate, you’re better off keeping your pennies under the mattress. 🛌💵

With a growing bearish bias toward the altcoin, its price may nosedive further, much like that last speed bump you didn’t see. Here’s why the pessimism is so thick you could cut it with a butterknife:

Onyxcoin Traders: Bearish and Loving It

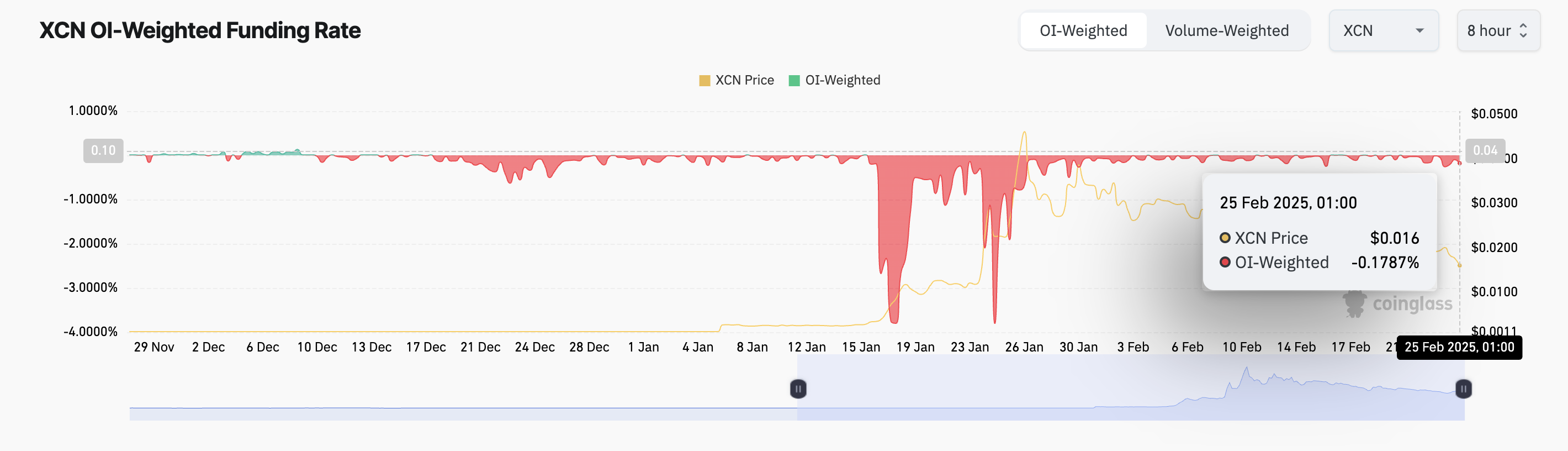

XCN’s nasty habit of clinging to a negative funding rate is fueling the sour mood. According to Coinglass (a website that, honestly, might as well be its therapist at this point), the funding rate for XCN has been doggedly negative since December 9. Currently, it’s parked at a jaw-dropping -0.17%. That’s right, even its funding rate needs cheering up.

Quick finance jargon break: the funding rate is a little fee back and forth between traders in perpetual contracts. If it’s negative, short traders are essentially paying long traders. So, what does that tell us? Most folks holding XCN are convinced it’s heading for the basement. 📉

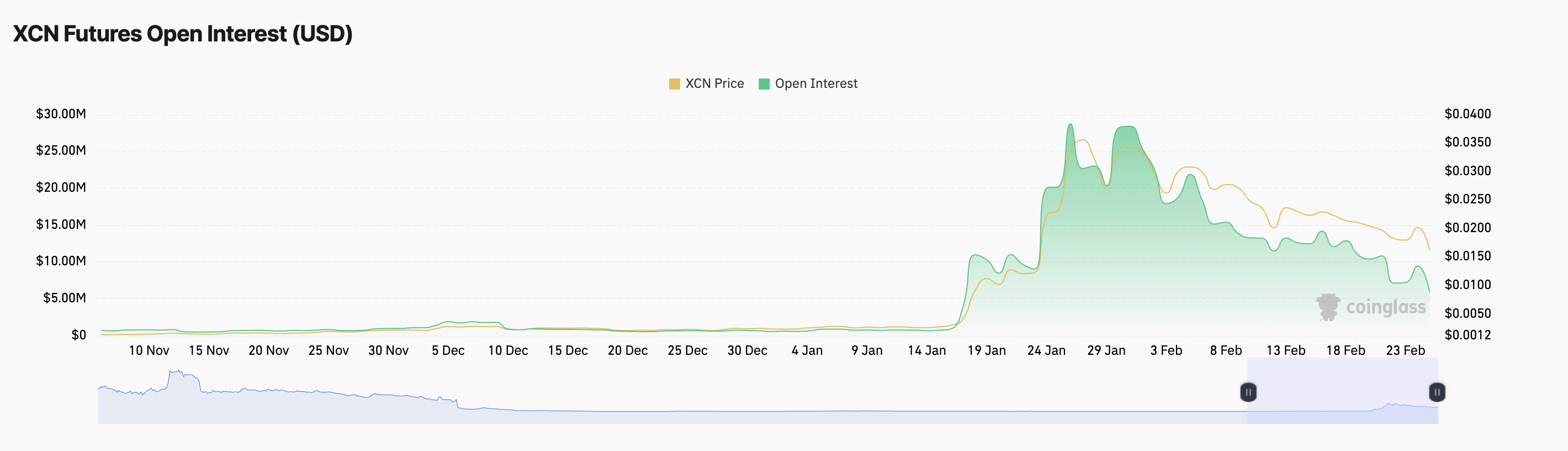

To add insult to injury—or maybe sprinkle some salt on the wound—XCN’s open interest is also shrinking faster than my enthusiasm for diet plans. At the moment, it’s lounging at a not-so-impressive $6 million, a 30-day low, according to Coinglass. Poor demand, poor XCN. Someone buy it a hug. 🫂

What does this mean? Open interest monitors outstanding derivative contracts still up for grabs—basically, those “oh, I promise I’ll hold on” guys. When this falls alongside price (as it’s doing here), it shows people are bailing. They aren’t opening new trades; they’re just walking off with their chips before the table collapses.

Bearish Clouds Over XCN Like a Digital Soap Opera

And if you’re wondering whether the charts look friendlier, rest assured, they’re not. On the daily chart, XCN is huddled sadly beneath the Ichimoku Cloud (I know, it sounds like a villain’s lair), particularly the Leading Spans A and B. Reminder: these are momentum indicators that basically decide where the party’s happening—or not. Spoiler alert: it’s not happening for XCN.

When an asset dares to slip beneath the Ichimoku Cloud, it’s like announcing “I give up!” to the universe. Here, the cloud becomes a cruel, dynamic resistance level, like the line at the DMV that never moves forward. This all points to XCN heading for even deeper price troubles, potentially as low as $0.011. 📉

Of course, there’s always hope, clinging with optimism like a lifeboat to the Titanic. If buyers suddenly decide to rush in and scoop up XCN like clearance candy on Halloween night, the price could bounce back to $0.022—but honestly, even that sounds like wishful thinking right now.🎢

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-02-25 16:38