Ethereum (ETH), like an ill-mannered guest overstaying its welcome, has loitered tediously in a trifling price range since February’s debut, showing an astonishing commitment to mediocrity.

Nevertheless, an unshakable breed of futures traders, armed with an optimism bordering on delusion, continue flinging their hard-earned cash at buy contracts, presumably confident ETH might someday awake from its current stupor. How quaint. 🍵

Futures Market: A Ray of Hope or Sheer Stubbornness? 🪙

On the dreary ETH/USD chart, a rather uninspired horizontal shamble is observed. Since February’s onset, this so-called leading altcoin has flirted unconvincingly with resistance at $2,799 and found solace in the arms of its $2,585 support level. Yet, these intrepid traders—admittedly a curious lot—maintain a bullish stance, plumping their buy orders. Bravo. 🎩

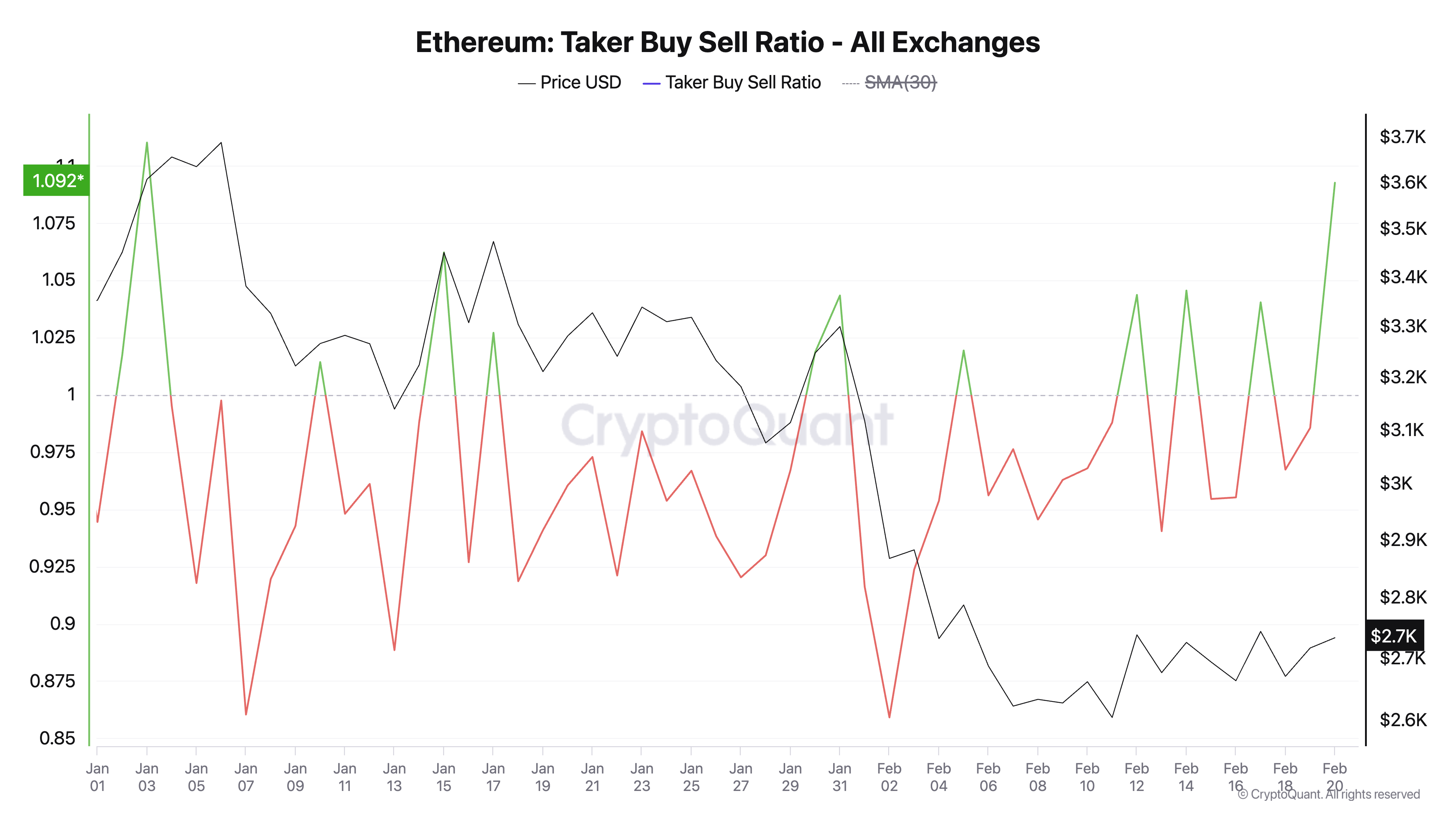

The pièce de résistance of this optimism is Ethereum’s Taker-Buy-Sell Ratio, now boasting its highest levels since early January at a very boastful 1.09, says CryptoQuant. Truly, a stat worthy of a toast—or at least a resigned sigh. 🥂

For the uninitiated, this dull ratio deigns to measure futures market buy versus sell volumes. A value over one signals buyers remain, inexplicably, the braver party; below one? The sellers retreat to lick their wounds. By that metric, ETH, at 1.09, is suddenly the belle of this awkward ball. 🕺

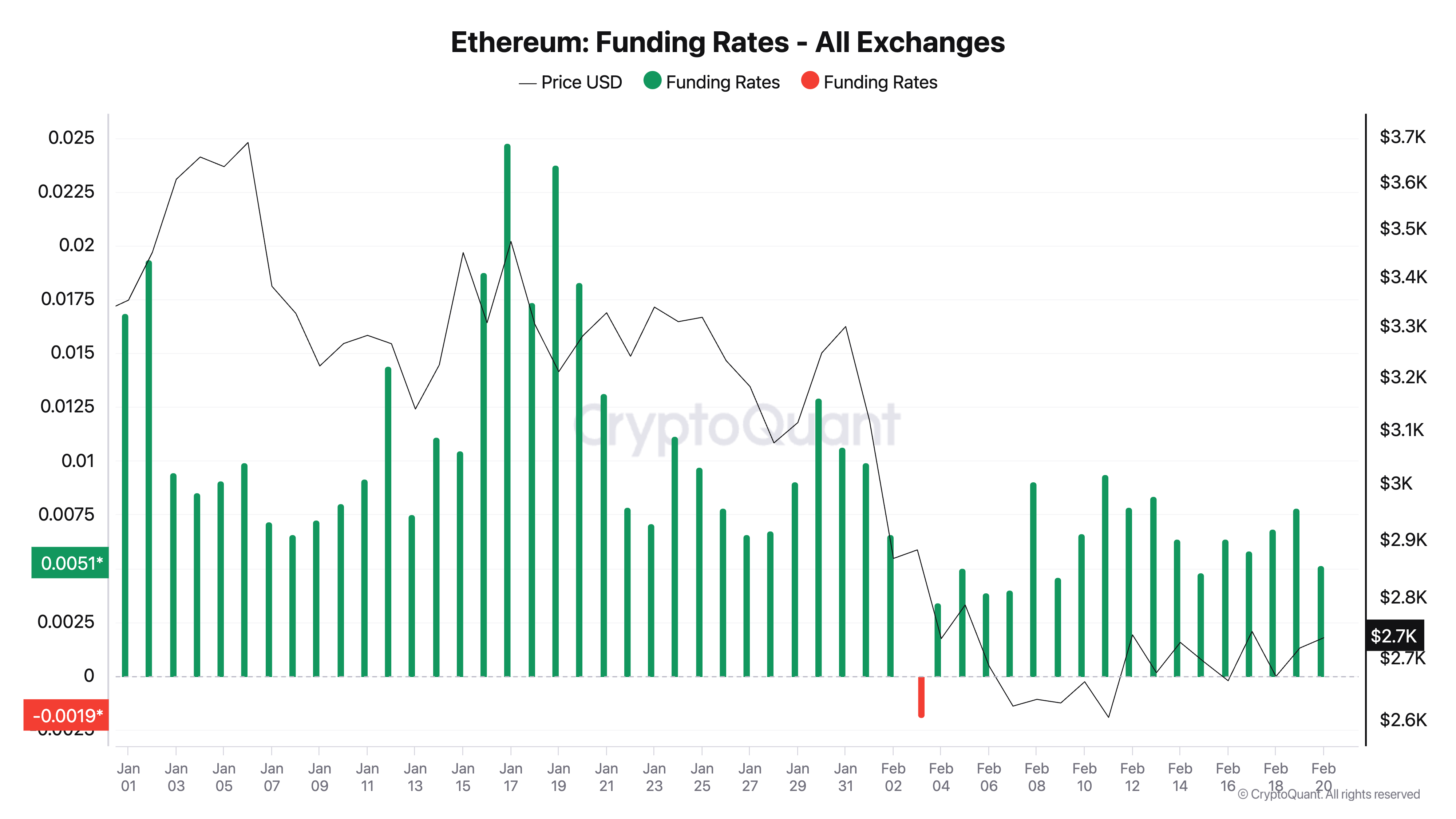

But wait, there’s more! Ethereum’s funding rate—a number as scintillating as lukewarm tea—remains sufficiently positive at 0.0051%, hinting futures traders still foolishly believe in the bullish dream amid this tiresome consolidation. Quite riveting. 🫖

For those who relish technicalities, the funding rate reflects periodic payments between long and short holders of futures contracts. A positive rate indicates longs are paying shorts, smugly suggesting the bulls rule the coop—or at least think they do. During humdrum price stasis like this, such positivity suggests buyers are betting on ETH doing something—anything—worth noticing soon. We wish them luck. 🍀

Price Hopes & Dreams: Will ETH Wake Up to Dance with $3,000? 💃

Should Ethereum miraculously muster the ambition to breach resistance at $2,799, the heavens may part, angels may sing, and the price—oh, the drama—may climb to a tantalizing $2,967, possibly even caressing $3,000 before collapsing into smug self-congratulation at $3,202. Such hubris. 🎯

On the flip side, if bears awaken from hibernation (presumably bored by all this nonsense), ETH could plummet below $2,585, victim to gravity’s cruel embrace at $2,467, maybe even collapse to a soul-crushing $2,150. And if that happens? Well, cue violins—or perhaps a jazz funeral. 🎻

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-20 17:54