In the grand pantheon of financial shenanigans, we now have Reeve Collins, a co-founder of Tether, stepping into the arena with a new brainchild: the Pi Protocol. If this doesn’t scream “take my money!” I don’t know what does. Collins, in his infinite wisdom, dreams of democratizing stablecoin minting, as if saying, “Hey folks, let’s all be rich together—who’s in?” 🤔💰

Thanks to those ever-looming US stablecoin regulations that smell suspiciously of opportunity, Pi Protocol might just be the underdog story we didn’t know we needed. It promises to pop up on the regulatory radar while waving its smart contracts around like they’re high-value treasure maps—ideal for building reserves where Tether, bless its heart, has tripped over its own shoelaces.

Can Pi Protocol Outshine the Behemoth That Is Tether?

Cast your minds back to 2013 when Collins, the guy who put the “T” in Tether, first graced the stablecoin scene. Fast-forward to today, and he’s back, like a star who should’ve quit while ahead, with a promise to challenge the very empire he helped build by launching Pi Protocol—a name that sounds more like a dessert option than a financial product, if you ask me.

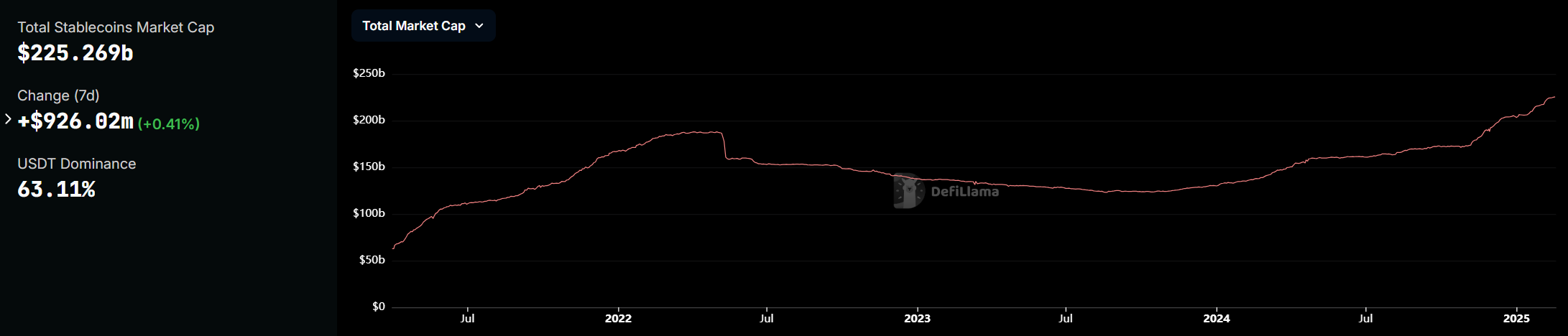

“We view Pi Protocol as the evolution of stablecoins. Tether has been extremely successful in showcasing demand for stablecoins. But they keep all the yield. We believe 10 years later the market is really ready to evolve,” Collins mused in an interview, possibly while sitting in a hot tub filled with money. 🛁💵

In a world where Tether hoards minting like a dragon with gold, Collins’ shiny new toy will let everyone jump on the minting bandwagon. Just submit your collateral (a pineapple on a Sunday would do, I’m sure), and watch the yields roll in like an underappreciated mailman. 📬🌊

Collins is also convinced that the cosmic forces of timing are aligned just right for Pi Protocol to take a swing at Tether’s shiny crown. All paths lead to the imminent regulations—it’s like waiting for the bus, but instead of a bus, you get a market opportunity that could send Tether packing. Somehow, late last year, Tether faced a gentle nudge out of the EU—adios, MiCA!—and US regulations could either bolster our hero or crush Tether under the weight of impending doom.

Regulations: The Ever-Present Overbearing Aunt of Tether

Oh, Tether—how bad can you be? For years, you’ve refused audits like a teenager dodging chores, while hefty Bitcoin holds money-couch in your reserves, probably collecting dust alongside those missing socks. Regulations are coming to demand transparency like a nosy neighbor peeking through your curtains.

Sneaky as it is, Pi Protocol is aiming to ride the regulatory wave, making sure to value Treasury bonds as highly as we value our morning coffee—essential. Nothing sweetens the deal quite like high collateralization rates, which will make Tether just wish it had hit the gym every now and then. 💪

The bright light gleaming in Pi Protocol’s future? It’ll accept all sorts of collateral, not just those old, dusty Treasury bonds. Picture a smart contract evaluating every bit of collateral like an overqualified Tinder date, but only the Treasuries get that sweet, sweet offer to mint tokens. 🎉

According to Marty Folb, “The so-called decentralized project is expected to debut on both the Ethereum and Solana blockchains in the second half of this year or sooner. No financial terms were disclosed.” Basically, it’s a date, folks! Mark your calendars for the best in crypto soap opera. 📅🍿

Pi Protocol, bless its heart, comes completely unassociated with Pi Network, which is all the rage. Let’s just hope it stands on its own legs and doesn’t trip over the “who would’ve thought?” factor of jumping into an already crowded market. 🚀

In the end, the fate of Pi Protocol balancing on a precariously high cliff of luck, new regulations, and investor buy-in could either land Collins in a throne worthy of a king or kneeling at the gates of history’s often unforgiving courtroom. Let’s raise a glass (of something carbonated) to see how this tumultuous tale unfolds. Cheers! 🥂

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-18 23:53