In a twist that could only be described as delightfully absurd, Bloomberg’s very own ETF wizards, James Seyffart and Eric Balchunas, have predicted that the SEC might just decide to acknowledge the pending ETF filings for XRP and DOGE this week. Yes, you heard that right! A significant milestone for two altcoins that have been waiting longer than a Vogon poet at an open mic night. 🎤

SEC’s Growing Engagement with Crypto ETFs

It seems the SEC has been busier than a hyperactive Zaphod Beeblebrox at a party, evaluating cryptocurrency ETF applications with the enthusiasm of a cat chasing a laser pointer. Just recently, on February 6, they acknowledged an amended Solana ETF application from Grayscale, which is like giving a thumbs-up to a particularly ambitious intergalactic travel plan. Analysts are now betting their towels that the SEC will soon recognize Form 19b-4 filings for XRP and DOGE ETFs. 🥳

“The SEC could acknowledge the spot ETF filings for XRP and DOGE within days,” Seyffart proclaimed on X, probably while sipping a Pan Galactic Gargle Blaster. 🍹

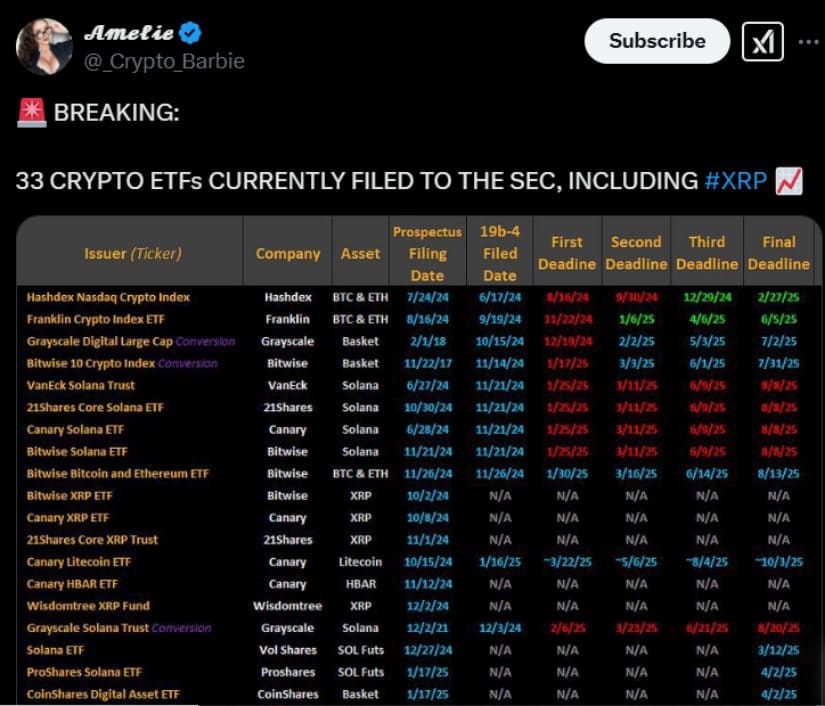

Meanwhile, Cboe BZX has submitted S-1 filings for XRP ETFs from a motley crew of financial adventurers: Canary Capital, WisdomTree, 21Shares, and Bitwise. Grayscale and Bitwise are also in the Dogecoin ETF game. Analysts are placing their bets on the SEC acknowledging these filings on February 13 and 14, which is just around the corner—unless, of course, you’re traveling at the speed of light. 🚀

Approval Odds and Market Sentiment

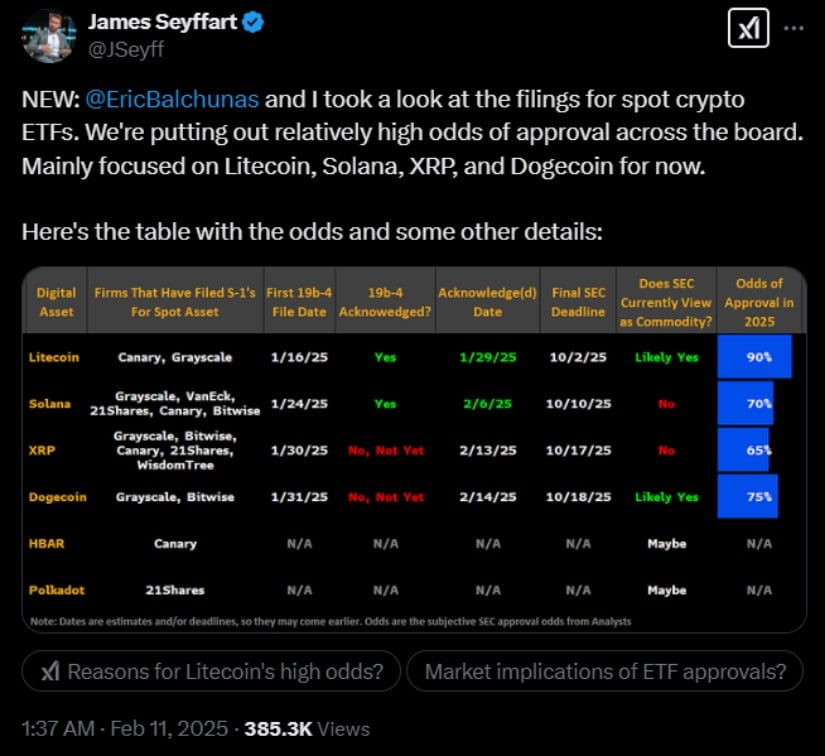

Now, before you start popping the champagne, let’s remember that acknowledgment doesn’t guarantee approval. Seyffart and Balchunas have assigned odds to various altcoin ETF applications, which are about as reliable as a towel in a rainstorm:

-

Litecoin ETF: 90% (approval probability)

-

Dogecoin ETF: 75%

-

Solana ETF: 70%

-

XRP ETF: 65%

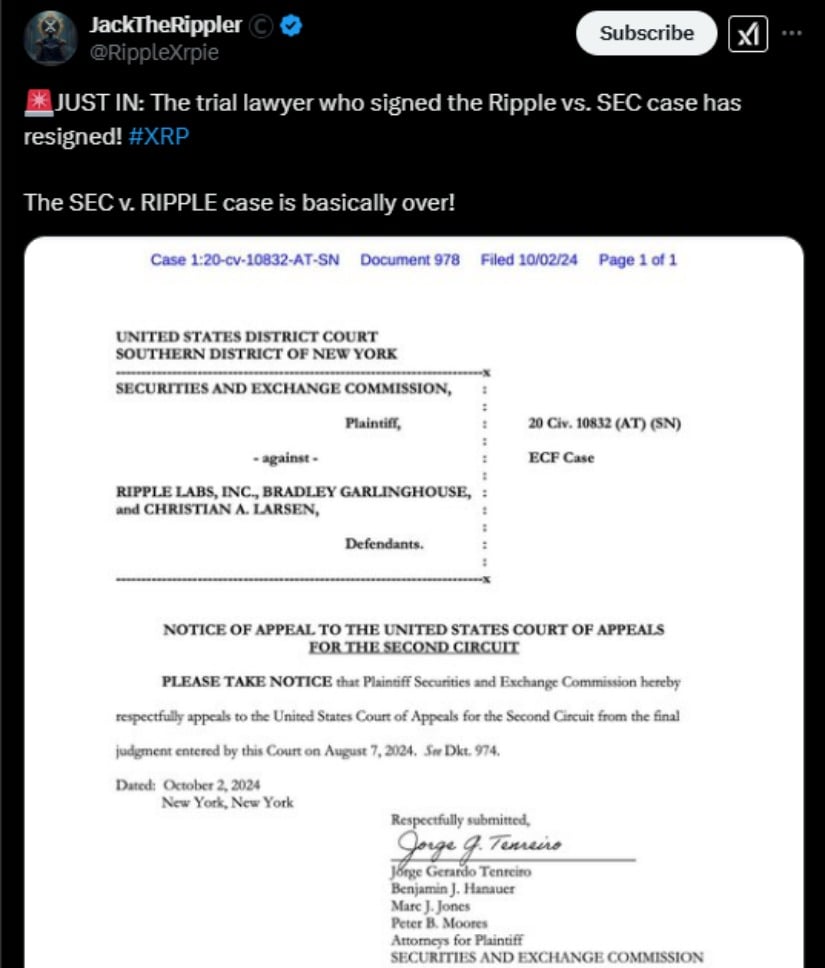

XRP’s lower odds are due to its ongoing legal tango with the SEC, which once deemed it a security—like calling a spaceship a glorified tin can. However, a federal court ruling in 2023 decided to flip that classification on its head, opening the floodgates for institutional interest in XRP-related financial products. 🛸

Watch XRP Price Analysis

Regulatory Clarity and the Road to Final Approval

Industry insiders are buzzing with the hope that, despite some lingering regulatory fog, the crypto asset task force appointed by the Commission will bring clarity by the end of 2025. Among the burning questions is whether assets like XRP should be classified as securities or commodities—like trying to decide if a Pan Galactic Gargle Blaster is a drink or a weapon. 🍸

As Seyffart sagely notes, “The SEC’s position on crypto regulation is constantly evolving, and by year-end we would expect to have a better sense of how altcoins fit into the ETF landscape.” Which is a fancy way of saying, “We’re not quite sure yet, but stay tuned!” 📺

The final verdict on XRP and DOGE ETFs is expected in October 2025, giving the SEC ample time to review the applications—because who doesn’t love a good cliffhanger? If they get the green light, it would be a monumental win for these institutional cryptocurrencies, akin to finding out that the universe is, in fact, a giant cosmic joke. 😂

Legal Factors and Institutional Interest

Some legal eagles argue that the ongoing Ripple v. SEC saga won’t directly impact the ETF approval process. Pro-XRP attorney Jeremy Hogan recently pointed out that the ETF filings follow a separate regulatory framework, which is about as clear as a foggy day on Betelgeuse. 🌫️

“

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DODO PREDICTION. DODO cryptocurrency

- Everything We Know About DOCTOR WHO Season 2

2025-02-13 01:18