In a most unfortunate turn of events, Bitcoin ETF outflows have become the talk of the town, as Jerome Powell, in his infinite wisdom, has decided that rate cuts are not on the menu. High inflation, that ever-present specter, has sent institutional investors scurrying like startled rabbits. Meanwhile, Ethereum investors, with their characteristic bravado, are boldly buying the dip, as if it were a delightful pastry at a tea party. 🍰

One might be tempted to argue that high inflation would send the entire crypto market into a tailspin, but fear not! There are always other factors lurking in the shadows, ready to defy the odds and provide a glimmer of hope.

Bitcoin ETFs: A Comedy of Errors

Since the SEC graciously bestowed its approval upon Bitcoin ETFs in 2024, we have witnessed a rather theatrical integration of the crypto industry with traditional finance. It’s a bit like watching a cat and a dog attempt to share a bed—awkward yet oddly fascinating. BlackRock’s IBIT has emerged as a star performer, but alas, this entanglement has its downsides, as evidenced by the recent outflows:

Just yesterday, the Bitcoin ETF market experienced a staggering $56.76 million in outflows, bringing the total for the week to a jaw-dropping $243 million. One might wonder how this could happen, considering these funds were poised for a dramatic recovery just a month ago. Ah, the fickle nature of finance!

Last week marked the first week of net outflows for BTC ETFs in 2025, and the trend has continued, much to the chagrin of hopeful investors.

Analysts, those ever-optimistic seers, have predicted that US inflation and economic policies would play a significant role in the crypto market, and lo and behold, they were right! Yesterday, Powell, in a move that could only be described as theatrical, rejected President Trump’s plan to use rate cuts to combat inflation.

While Powell’s decision may have some silver linings for crypto, it has left investors feeling as jittery as a cat in a room full of rocking chairs. With US inflation climbing to a staggering 3% YoY this morning, capital has retreated from Bitcoin and its ETF market like a shy child at a school dance.

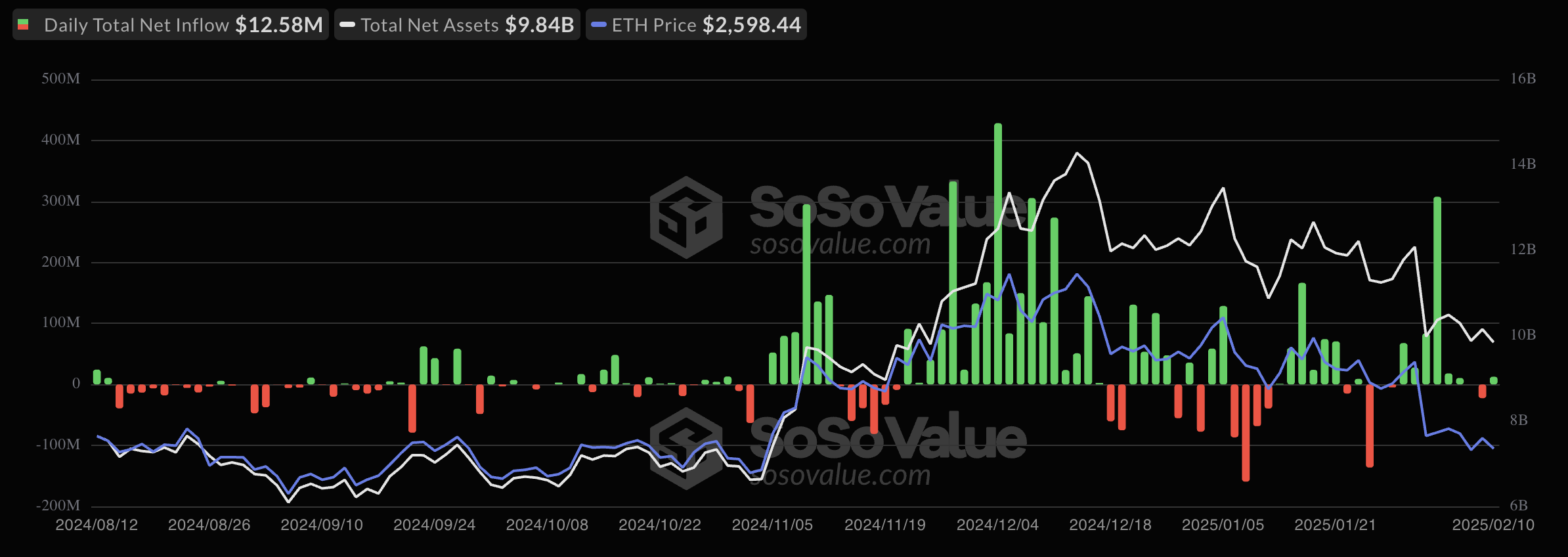

Yet, in a delightful twist of fate, Ethereum ETFs have not only survived but thrived, with inflows of $12.58 million just yesterday. Who would have thought? 🎉

Perversely, this ETF category is actually benefiting from the woes of its Bitcoin counterpart. Last week, a veritable stampede of trading volume surged as investors rushed to buy the dip, as if it were the last slice of cake at a party. Ethereum has remained low, pushing ETF inflows to a two-month high.

In summary, while inflation and other market forces have caused a temporary setback for Bitcoin ETFs, they are not the only players on the field. Ethereum, with its newfound confidence, seems poised for a short-term renaissance.

With the upcoming Pectra upgrade in March and recent purchases from the illustrious Donald Trump-backed World Liberty Financial, institutional interest in the largest altcoin is on the rise. As long as ETH remains below $3,000, the US spot Ethereum ETF market may continue to see net inflows, much to the delight of its investors. 🤑

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-12 20:32