Ah, Ethereum (ETH), that capricious creature of the crypto realm! Since it lost its grip on the illustrious $3,000 mark on February 2, it has been floundering about like a fish out of water, remaining below that lofty perch ever since. In the past 30 days, our dear ETH has taken a nosedive of over 20%, reflecting a market that seems to be as confused as a cat in a dog show. 🐱🐶

Technical indicators, those fickle friends, are suggesting a distinct lack of direction, with both bullish and bearish pressures weakening faster than a soufflé in a thunderstorm. Meanwhile, the supply of ETH on exchanges has plummeted to its lowest level in six months, which might just be the signal for a grand accumulation and a reduction in selling pressure. Could this be the stage set for a recovery attempt? Only time will tell! ⏳

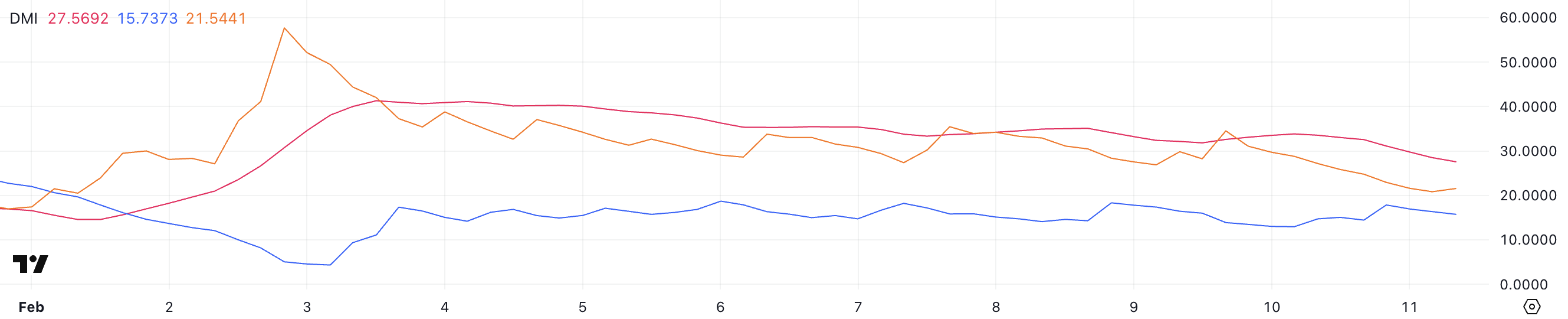

Ethereum DMI: A Trendless Tango

Now, let us gaze upon Ethereum’s DMI chart, which reveals a trend that is weakening faster than a politician’s promises. The ADX has dipped from 33.8 to a rather lackluster 27.5 in the past day. The ADX, or Average Directional Index, is the oracle of trend strength, and readings above 25 typically signal a strong trend, while values below 20 indicate a trend as weak as a cup of tea left out overnight. ☕

The downward movement of the ADX suggests that Ethereum’s recent trend is losing momentum, which could indicate that the market is as indecisive as a squirrel crossing the road. 🐿️

As we scrutinize the directional indicators, we see that +DI has dropped from 17.8 to 15.7, while -DI has also declined from 22.9 to 21.5. This suggests that both buying and selling pressures have weakened, leaving Ethereum without a clear directional bias, much like a ship lost at sea. 🚢

With -DI still above +DI, the bears are maintaining a slight edge, but the declining ADX indicates that the trend is not gaining traction. This setup points to a phase of consolidation or a potential trend reversal, rather than a continuation of strong bearish momentum. Until we see a clear divergence in the directional indicators or a rise in ADX, Ethereum’s next move remains as uncertain as a cat in a room full of rocking chairs. 🐈

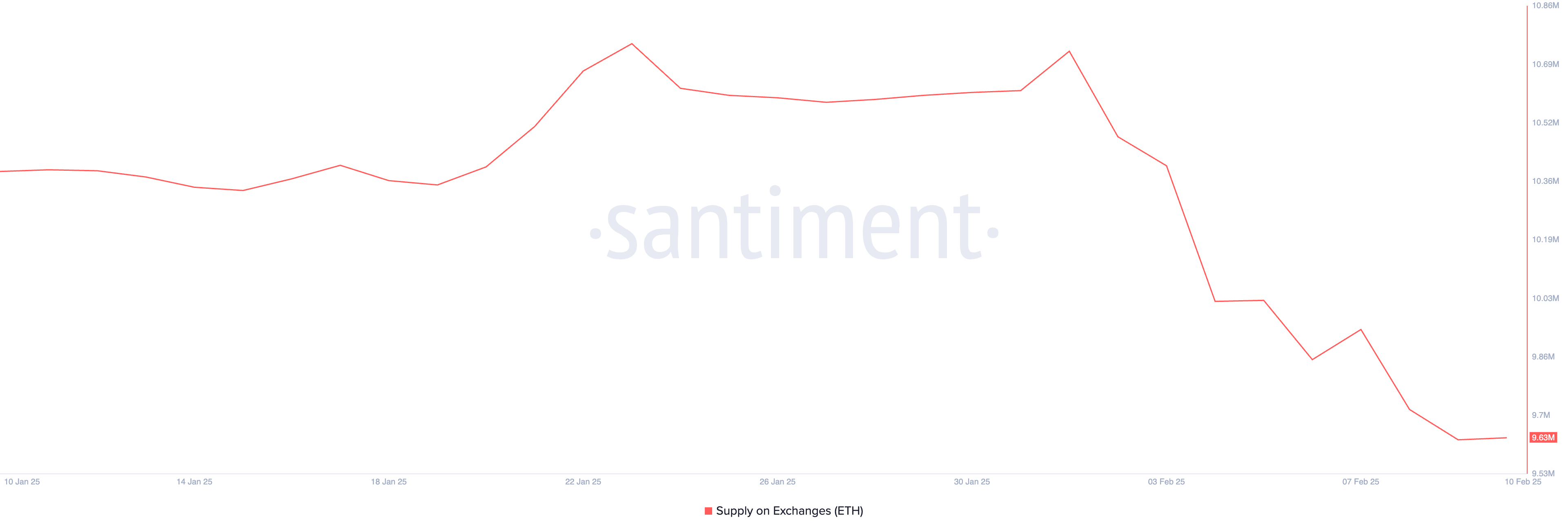

ETH Supply on Exchanges: A Dwindling Delight

Now, let’s turn our attention to the supply of ETH on exchanges, which has seen a notable shift over the past few weeks. After a brief flirtation with 10.73 million on February 1, exchange balances have since plummeted to 9.63 million – the lowest level in six months, harking back to August 2024. 📉

This steady decrease in ETH held on exchanges signals a significant shift in investor behavior, potentially impacting price action in the near term. It’s as if investors are moving their prized possessions to private wallets, reducing the immediate sell-side liquidity. 🏦

The supply of ETH on exchanges is a key metric in understanding market sentiment. When exchange balances rise, it often suggests that investors are preparing to sell, as more ETH is readily available for trading. This can create selling pressure, leading to bearish conditions. Conversely, when Ethereum supply on exchanges declines, it implies that investors are moving their holdings to private wallets, reducing the immediate sell-side liquidity.

This trend is generally considered bullish, as it suggests confidence in holding rather than selling. With ETH exchange supply now at its lowest level in six months, it could indicate strong accumulation, reducing selling pressure and potentially setting the stage for upward price momentum. 🚀

ETH Price Prediction: The $3,000 Conundrum

As we peer into the crystal ball of Ethereum price charts, we see that its EMA lines still indicate a bearish structure, with short-term moving averages positioned below long-term ones. This suggests that ETH price has not yet established a confirmed uptrend. However, if buying momentum strengthens and ETH can recover

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-12 02:33