It is a truth universally acknowledged that a crypto exchange in possession of a handsome number of users must be in want of regulatory approbation. Such is the case in South Korea, where the number of registered virtual asset service providers has seen a decline of over 26% within a year, as per a report from the Financial Intelligence Unit (FIU) on the 7th of February.

Out of the 42 exchanges that were in operation in the previous year, only 31 remain active, with many of the fallen, such as GDAC, ProBit, Huobi Korea, and Bitrade, being token-only platforms that could not sustain operations due to the lack of fiat trading support.

The reasons for these closures are manifold – the failure to renew registrations, the stringent anti-money laundering (AML) policies, and Know Your Customer (KYC) requirements, and the martial law in early December 2024 that caused a significant Korean crypto market decline.

“It is a truth universally acknowledged that a single crypto exchange in possession of a good fortune must be in want of regulation” – Mr. Darcy, probably

Indeed, the token-only exchanges have been in a vulnerable position, with over 90% of them in a state of complete capital erosion last year. The FIU report states that these exchanges lacked real-name bank accounts, making it difficult to sustain user interest and operations.

As the market continues to contract, the FIU warns that more exchanges could soon follow. Some firms still registered in South Korea have already expressed intentions to exit the market, while others are looking toward overseas expansion to escape domestic regulatory uncertainty.

South Korea’s regulatory environment has made it difficult for crypto businesses to operate smoothly. The nation’s strict AML policies and KYC requirements have placed an additional burden on exchanges, especially those lacking direct banking support.

“I have been most severely threatened by a licentiousness of conduct in those exchanges” – Mr. Bennet, most likely

One of South Korea’s largest exchanges, Upbit, is now under scrutiny and could face sanctions for allegedly failing to comply with the country’s AML and KYC regulations. Local news outlet Maeil reported that the Financial Information Analysis Institute (FIU), under the Financial Services Commission, has already notified Upbit of the pending penalties.

If the sanctions are confirmed, Upbit could be prohibited from onboarding new customers for up to six months. Such restrictions would pose significant challenges for the platform, which has remained one of the few dominant players in South Korea’s shrinking crypto market.

Upbit informed users that the decision would limit new customers from moving virtual assets off the exchange for a specific duration.

“There is nothing like desperation to make a man bold” – Mr. Wickham, certainly

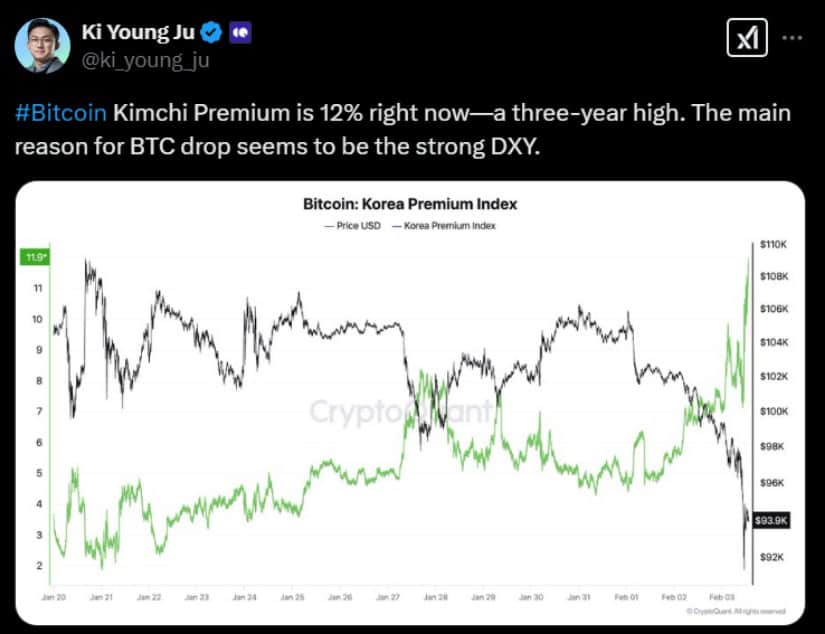

Meanwhile, South Korea’s Bitcoin kimchi premium has surged, hitting a 10-month high. According to a recent post by CryptoQuant CEO Ki Young, the premium reached 12% on Monday, marking a three-year high. At the time of writing, it has settled at 8.20%.

Kimchi premium refers to the price difference when Bitcoin trades higher on South Korean exchanges compared to other global platforms. This gap arises because foreign investors cannot access South Korea’s crypto market, and local investors who attempt arbitrage could face penalties under capital control laws.

The premium is often a sign of strong local demand for crypto despite market downturns. However, it also underscores the regulatory walls that prevent the free movement of digital assets, limiting opportunities for traders.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-09 20:17