Are you ready for some jaw-dropping news? According to VanEck, Solana’s market growth could skyrocket by a whopping 170% by 2025! That’s right, folks – we’re talking about a potential $520 price target for SOL!

VanEck’s Bullish Projection

VanEck’s research team predicts that Solana’s market share in the smart contract platform (SCP) sector will grow from its current 15% to a staggering 22% by the end of the year. This expansion, coupled with an estimated total SCP market cap of $1.1 trillion, could push Solana’s valuation to approximately $250 billion.

“Using an autoregressive (AR) forecast model, we estimate Solana’s market cap will reach ~$250B, implying a SOL price of $520 based on ~486M floating tokens,” VanEck analysts stated in their report.

The Role of M2 Money Supply in Solana’s Growth

One of the reasons to back this prediction is the growth of M2 money supply in the U.S. M2 money supply refers to cash, checking deposits, and easily convertible near-money assets. Traditionally, expansion in crypto markets has gone hand in hand with growth in M2, since higher liquidity encourages investments in risk assets.

We at VanEck project that the M2 money supply will increase from $21.5 trillion presently to $22.3 trillion by the end of 2025, keeping the annualized growth rate steady at 3.2%. For such a dramatic change in liquidity, demand for digital assets could increase sharply, including for Solana.

Catalysts Driving Solana’s Adoption

Solana’s expanding ecosystem has played a crucial role in its bullish outlook. Activity on the blockchain is increasing, partly because of the memecoin boom. Mainstream users flood into projects such as TRUMP and MELANIA, driving up engagement on the network. Revenue for Solana ecosystem applications surged 213% in Q4 2024 to $840 million alone, demonstrating increasing adoption of the protocol.

Meanwhile, the DeFi part of Solana is also not staying behind. According to DeFiLlama, right now, the total value locked within Solana-based DeFi protocols stands at $19.54 billion. All this is rendering the network a lot of strong competitors in the wider DeFi space and further strengthening its market position.

Potential Impact of a Solana ETF

The prospect of a Solana-based exchange-traded fund in the United States may also act as one big catalyst for institutional investors. VanEck is among the firms that have filed applications with the SEC for a Solana ETF. While past attempts were rejected, recent regulatory moves suggest a changing attitude toward digital asset investment products. Today BlackRock chairman and CEO Larry Fink said he thinks a Solana ETF will be approved as soon as this month. That will be very bullish for the SOL price.

Cboe BZX has refiled the 19b-4 application for multiple Solana ETF proposals, including those from VanEck, Canary Capital, Bitwise, and 21Shares. If approved, an ETF could introduce significant institutional capital into the Solana ecosystem, further supporting its price growth.

Challenges to Consider

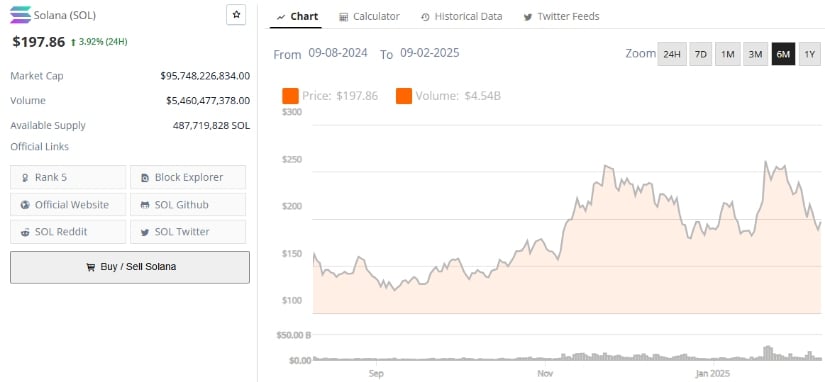

Despite its strong fundamentals, Solana’s path to $520 is not without obstacles. Market-wide corrections, regulatory scrutiny, and broader economic conditions could impact investor sentiment. Recently, Solana’s price experienced a 4.6% decline, trading at around $190 following Bitcoin‘s drop below $98,000. For VanEck’s forecast to materialize, SOL would need to rally by over 170% from its current price.

Additionally, concerns have emerged regarding validator rewards under the SIMD-0096 proposal. The new structure, set to take effect in March 2025, will allow validators to keep 100% of priority fees, potentially reducing incentives for stakers. While this change could boost network security, it has raised questions about long-term staking participation.

Looking Forward

VanEck’s prediction of a $520 price target for Solana by the end of 2025 is based on strong market fundamentals, a Solana Spot ETF approval, increasing adoption, and macroeconomic trends. However, achieving this milestone will require sustained growth in network activity, continued institutional interest, and favorable market conditions. As the cryptocurrency sector evolves, Solana remains a key player to watch in the coming months.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-02-08 20:27