Ah, the tragic tale of Hedera (HBAR), a valiant warrior ensnared in the clutches of a merciless bearish tide, forever yearning to breach the elusive $0.25 barrier. With a market cap languishing at a mere $8.7 billion, the technical indicators whisper ominously of impending doom.

The ADX, that ever-watchful sentinel, confirms the downward spiral remains as robust as a stubborn weed in a garden of despair, while the Ichimoku Cloud and EMA structures conspire to suggest further weakness. Unless the fortifications of key resistance levels crumble, HBAR finds itself in a precarious position, teetering on the brink of deeper corrections, like a tightrope walker with a penchant for missteps.

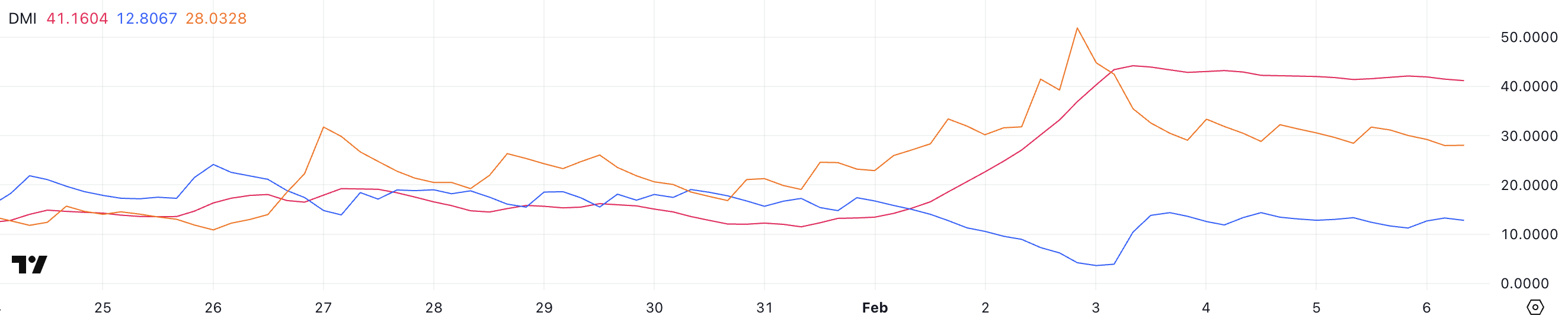

Hedera DMI Suggests Selling Pressure Is Easing (But Not by Much!)

Behold the Hedera ADX, currently perched at 41.1, having clung to the lofty heights above 40 for three long days, peaking at a dramatic 44.1 on February 3. The Average Directional Index (ADX), that fickle arbiter of trend strength, reveals that readings above 25 herald a strong trend, while lower values are akin to a soggy biscuit.

While it may not point the way, HBAR’s high ADX confirms that its bearish trend has been as steadfast as a cat on a windowsill, basking in the sun of recent days.

The +DI has ascended to 12.8 from a paltry 3.9 just three days prior, stabilizing between 11 and 14, while the -DI has plummeted to 28 from a lofty 44.7, now hovering between 28 and 33 like a confused bird.

This shift suggests that selling pressure is easing, albeit slightly, like a gentle breeze on a sweltering day. Yet, alas, Hedera buyers remain as feeble as a kitten in a dog park, lacking the strength to reverse the trend. With ADX still above 40, the downtrend remains as unyielding as a stubborn stain, though the slowing momentum could hint at a potential consolidation phase before the next act in this tragicomedy.

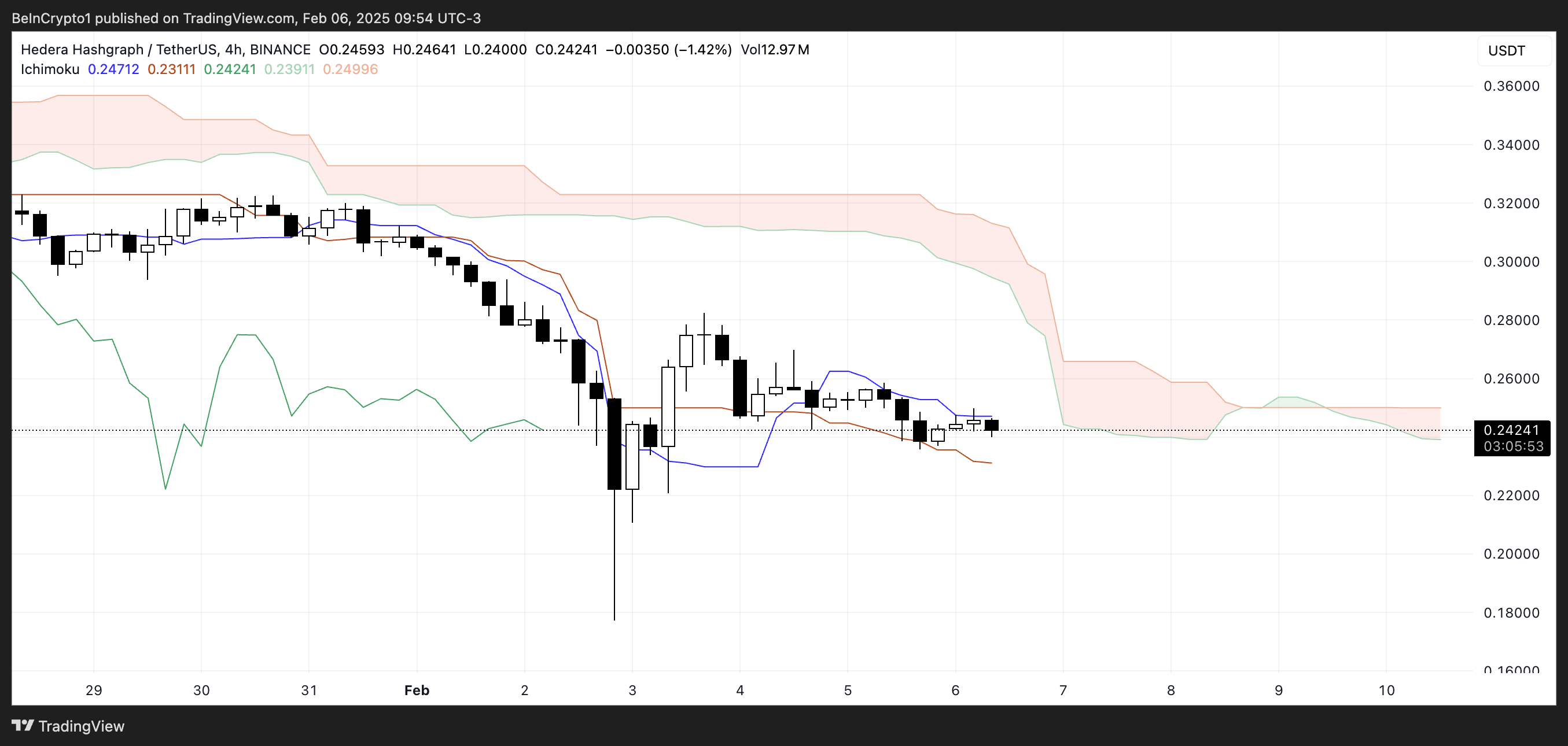

HBAR Ichimoku Cloud Shows a Bearish Setup (Surprise, Surprise!)

The Ichimoku Cloud chart for HBAR presents a bearish tableau, with the price languishing below the cloud like a lost soul. The ominous red cloud ahead suggests that downward pressure will continue, as it indicates that future resistance remains as formidable as a bouncer at an exclusive club.

The conversion line (blue) is slightly below the baseline (red), reinforcing short-term weakness and signaling that bearish momentum is still the reigning monarch of this realm.

Moreover, the lagging span (green) is positioned below the price, confirming that the downtrend remains as steadfast as a loyal dog. The price has also been shuffling sideways within a tight range, struggling to muster any upward momentum, much like a turtle trying to outrun a hare.

If the cloud continues its downward expansion, it could herald further bearish continuation, while a flattening baseline might suggest a potential slowdown in this relentless trend.

HBAR Price Prediction: Can Hedera Correct by 78% In February? (Spoiler Alert: Probably!)

The Hedera EMA lines paint a clear picture of doom and gloom. Just four days ago, a death cross formed as short-term EMAs remained below their long-term counterparts, indicating that the downtrend is still very much alive and kicking. If this continues, Hedera’s price could test the $0.17 support, like a hapless swimmer in a riptide.

A breakdown below this level could fling open the doors to further declines, potentially plunging to $0.12, and if the bearish momentum persists, it could nosedive as low as $0.05, marking a staggering 78% correction and its lowest level since November 12. Talk about a dramatic fall from grace!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-02-07 02:44