Well, well, well! Raydium’s (RAY) price has decided to play a game of hopscotch, rebounding more than 10% after a rather dramatic Monday morning crash. It’s now flirting with a market cap close to $2 billion, which is quite the comeback! Technical indicators are now waving their flags, hinting at a potential bullish continuation. Who knew numbers could be so dramatic? 🎢

RAY’s revenue and trading volume are strutting their stuff, remaining among the highest in the land, solidifying its position as a leading Web3 protocol. The big question is: can RAY keep this momentum going, or will it face another downturn? It all hinges on its ability to hold key support levels and confirm an uptrend. No pressure, right? 😅

Rayd: The Heavyweight Champion of Blockchain Applications

Raydium has emerged as one of the top revenue-generating blockchain protocols, raking in over $42 million in just the last week. That’s right, it’s out-earning major players like Circle, Uniswap, and even Ethereum. Talk about a financial heavyweight! 💰

Over the past year, Raydium has generated nearly $1 billion in revenue, coming remarkably close to Solana’s $965 million. It’s like a financial race, and Raydium is sprinting ahead! 🏃♂️💨

In terms of trading volume, Raydium has handled around $3.4 billion in the last 24 hours and a staggering $21 billion over the past week. It’s solidifying its place as one of the most used Web3 projects ever Who needs sleep when you can trade billions? 😴💸

RAY RSI: The Comeback Kid

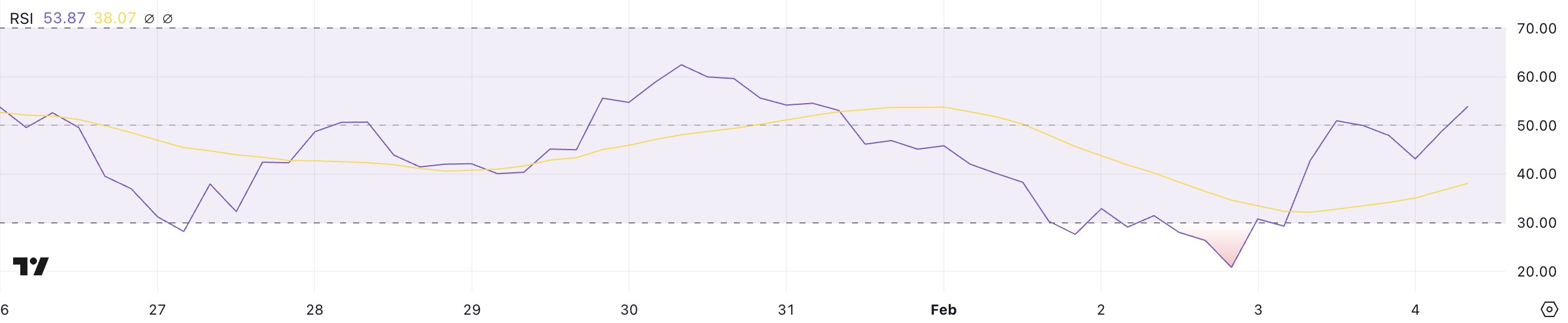

Raydium’s RSI is currently at 53.87, making a sharp recovery from a dismal 20.8 just two days ago. The Relative Strength Index (RSI) measures momentum by tracking recent price movements, with values below 30 indicating oversold conditions and above 70 signaling overbought levels. It’s like a rollercoaster for numbers! 🎢The recent jump suggests that buying pressure has increased, bringing Raydium out of the depths of despair and into a more neutral range. Hooray for

Well, well, well! Raydium’s (RAY) price has decided to play a game of hopscotch, rebounding more than 10% after a rather dramatic Monday morning crash. It’s now flirting with a market cap close to $2 billion, which is quite the comeback story! Technical indicators are now their little flags, hinting at a potential bullish continuation. Who knew numbers could be so dramatic? 📈

RAY’s revenue and trading volume are strutting their stuff, remaining among the highest in the land, solidifying its position as a leading Web3 protocol. The big question is: can RAY keep this momentum going, or will it face another downturn? It all hinges on its ability to hold key support levels and confirm an uptrend. No pressure, right? 😅

dium: The Heavyweight Champion of Blockchain Applications

Raydium has emerged as one of the top revenue-generating blockchain protocols, raking in over $42 million in just the last seven days. That’s right, folks! It’s outpacing heavyweights like Circle, Uniswap, and even Ethereum in the earnings department. Talk about a financial heavyweight! 💰

Over the past year, Raydium has generated nearly $1 billion in revenue, coming remarkably close to Solana’s $965 million. It’s like a race where everyone’s trying to outdo each other, and Raydium is sprinting ahead! 🏃♂️💨

In terms of trading volume, Raydium has handled around $3.4 billion in the last 24 hours and a staggering $21 billion over the past week.’s solidifying its place as one of the most used Web3 projects ever. Who knew blockchain could be so popular? 🎉

RAY RSI: The Comeback Kid

Raydium’s RSI is currently at 53.87, making a sharp recovery from a rather dismal 20.8 just two days ago. The Relative Strength Index (RSI) measures momentum by tracking recent price movements, with values below 30 indicating oversold conditions and above 70 signaling overbought. It’s like a rollercoaster for numbers! 🎢

The recent jump suggests that buying pressure has increased, bringing Raydium out of the oversold territory and into a more neutral range. It’s like a phoenix rising from the ashes, but with more numbers and less fire. 🔥

At 53.87, Raydium’s RSI is neither strongly bullish nor bearish, leaving room for further price movement in either direction. Notably, RAY hasn’t touched the 70 levels, which would indicate overbought conditions, since January 19. It’s like a teenager who hasn’t quite figured out their style yet. 😜

This suggests that while the asset has seen renewed strength, it hasn’t yet entered a strong bullish phase. The next trend confirmation will depend on whether the RSI continues to rise or stalls at levels. Stay tuned, folks! 📺

RAY Price Prediction: A Further 33% Upside? Or Just Wishful Thinking?

Raydium’s price recently corrected by 34% between January 30 and February 3 but has since rebounded nearly 30%. Its EMA lines suggest that a golden cross, where the shortest-term moving average crosses above the longer-term ones, could be forming soon. It’s like a financial dance-off! 💃

If this happens, RAY price could continue its recovery, with a strong uptrend potentially pushing it to retest $7.92. A breakout above that level could lead to further gains, with $8.7 as the next major target, representing a possible 33% upside. Fingers crossed! 🤞

However, if RAY fails to its momentum, it could test support at $5.85, with a breakdown leading to $5.36

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2025-02-05 00:03