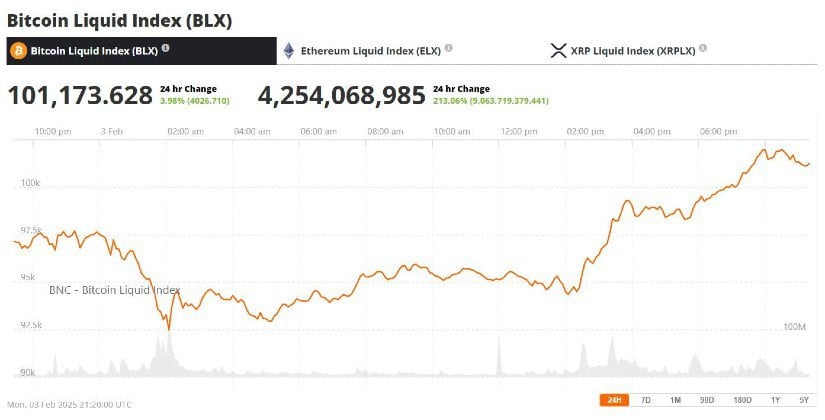

Once upon a time in a universe not so far away, the world’s largest cryptocurrency, Bitcoin, was frolicking around the $91,000 mark, blissfully unaware that it had plummeted from its dizzying heights of $109,000, which it had reached in December. Talk about a rollercoaster ride! 🎢

Meanwhile, Ethereum, Cardano, and Ripple’s XRP were having a particularly bad hair day, with their values dropping faster than a lead balloon. Even the meme coins—those delightful little jesters of the crypto court, like DOGE, SHIB, and TRUMP—took a nosedive that would make a skydiver jealous. 🪂

But wait! Just when you thought it was all doom and gloom, news broke that Mexico had decided to delay the new tariffs for a month. Cue the dramatic music! Investors, however, should probably put on their thinking caps and ponder why the market had a mini-meltdown in the first place.

After all, this was merely the opening act of President Trump’s tariff saga, with more tariffs lurking in the shadows like a cat waiting to pounce on an unsuspecting laser pointer. So, it’s vital for investors to grasp the intricate dance between tariffs and the crypto markets. 💃

Why are Trump tariffs bad news for crypto assets?

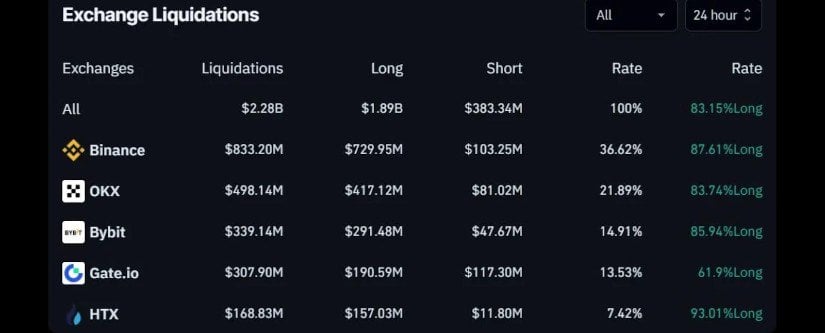

In a move that surprised absolutely no one, President Trump decided to raise tariffs by 10% on all imports from China and a whopping 25% on goods from Mexico and Canada. This little escapade resulted in a staggering $2.0 billion hit to the crypto market on Monday. Ouch! 💸

The sell-off in cryptocurrencies, including Bitcoin, caught many off guard, as the tariffs had nothing to do with digital assets. So, why did the crypto market crash? In a word: “uncertainty.” Markets are like cats; they love certainty and despise uncertainty. And Trump? Well, he’s as unpredictable as a cat on catnip. 🐱

Canada, in a fit of retaliatory enthusiasm, announced a 25% tariff on American goods. And who knows? China, Mexico, the European Union, and possibly your neighbor’s pet goldfish might join in the fun. 🐠

In short, the new US government is steering the world toward a global trade war, which is about as welcome as a porcupine at a balloon party. Trade wars are known to be inflationary, leading to pressure on consumer spending and, ultimately, corporate bottom lines. It’s a recipe for economic uncertainty, and when that comes knocking, investors tend to grab their cash and run. 🏃♂️

So, “profit-taking” after a wild ride in crypto prices, combined with fears of impending doom, is why digital assets took a nosedive following Trump’s tariff announcement. Investors fled cryptocurrencies faster than you can say “volatile,” because volatility is what they avoid like a bad haircut. ✂️

What’s next for crypto amidst fears of a global trade war?

However, fear not! The subsequent recovery in crypto prices suggests that the bulls are still very much in charge. Richard Teng, the chief executive of Binance, remains optimistic, believing that crypto prices will resume their upward trajectory faster than you can say “to the moon!” 🚀

“This too shall pass … the downturn is only temporary,” he proclaimed on X today, probably while sipping a piña colada on a beach somewhere. 🍹

Teng’s sunny outlook suggests it might be time to load up on cryptocurrencies while they’re on sale. After all, Bitcoin is now comfortably lounging above the $101,000 level, translating to a more than 10% gain from its intraday low. How many financial assets can deliver such returns in mere hours? Not many, I assure you! 🤑

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Oblivion Remastered: How to get and cure Vampirism

2025-02-04 15:15