Last week, crypto inflows took a nosedive, plummeting to a mere $527 million, as if someone pulled the rug out from under the digital asset party.

It’s like watching a balloon deflate—one moment you’re soaring high, and the next, you’re just a sad, crumpled piece of rubber on the floor.

DeepSeek: The Party Crasher of Crypto

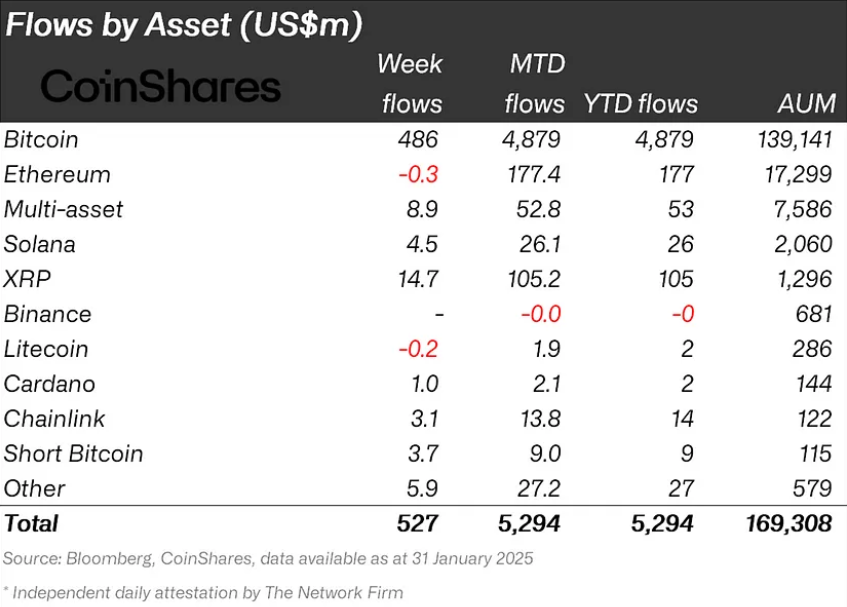

According to the latest CoinShares report, crypto inflows were about as exciting as watching paint dry, hitting just $527 million in the last week of January. This is a far cry from the two weeks prior, where inflows were strutting around like they owned the place at $1.9 billion and $2.2 billion, respectively.

James Butterfill from CoinShares blames the DeepSeek hype for this sudden retreat. Apparently, this AI agent has been busy sucking liquidity out of both crypto and stock markets like a vacuum cleaner on steroids.

“Digital asset investment products saw inflows totaling $527 million last week. However, intra-week flows reflected volatile investor sentiment, heavily influenced by broader market concerns, such as the DeepSeek news, which triggered $530m in outflows on Monday,” the report lamented.

And just when you thought it couldn’t get worse, news about China’s AI platform sent $530 million packing on Monday. The initial DeepSeek frenzy was like a bad hangover, but the market managed to rebound later in the week, with over $1 billion in fresh inflows. Still, it wasn’t enough to keep the party going near the $2 billion mark, which was the hot spot during the second and third weeks of January.

Despite the rollercoaster ride, it seems investors are still holding onto their crypto dreams. Bitcoin (BTC) managed to charm its way into $486 million worth of inflows last week, proving that it’s still the prom queen of the crypto dance floor.

Just a week ago, the DeepSeek-related euphoria led to a staggering $1 billion in crypto liquidations in a single day. Talk about a party foul! This chaos didn’t just rattle crypto; it sent shockwaves through crypto miner stocks and even AI-related equities like Nvidia, leaving everyone wondering if they should just stay in bed.

“DeepSeek vibes are definitely shaking things up,” said Emily, a popular user on X, probably while clutching her pearls.

These comments capture the uncertainty swirling around the industry like a bad perfume. But fear not! There are signs of recovery, especially among AI agent coins, which seem to be bouncing back like a rubber ball after DeepSeek’s misadventures.

However, let’s not forget the broader economic concerns lurking in the shadows, like trade tensions and US jobs data, which could throw a wrench in the inflow machine this week.

As BeInCrypto reported, President Donald Trump’s new tariffs have already caused over $2 billion in liquidations. According to Coinglass data, over 730,000 traders were blown out of the water on Monday, probably wondering where it all went wrong.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- The Last Of Us 2 Teaser: Pedro Pascal And Bella Ramsay Promise An Emotional-Tense Ride In The First Glimpse Of The Post-Apocalyptic Drama

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

2025-02-03 17:56