In the shadowy corridors of economic power, the mighty bear paw of America has struck once more, and the tremors are felt far and wide. With steely resolve, Trump brandishes tariffs like a Cossack whip, aiming at the heart of key trading partners such as Canada, Mexico, and the ever-formidable China. What, then, could be the fate of the world’s newest financial rebellion—cryptocurrency? 🤔

To say cryptocurrency stands aloof from traditional economic storms is an oversimplification, akin to saying a cat can read Dostoevsky. Trump’s hawkish trade policies are not mere pebbles in the pond; they are boulders, causing waves that shake even the crypto fortresses.

A Global Economic Shockwave

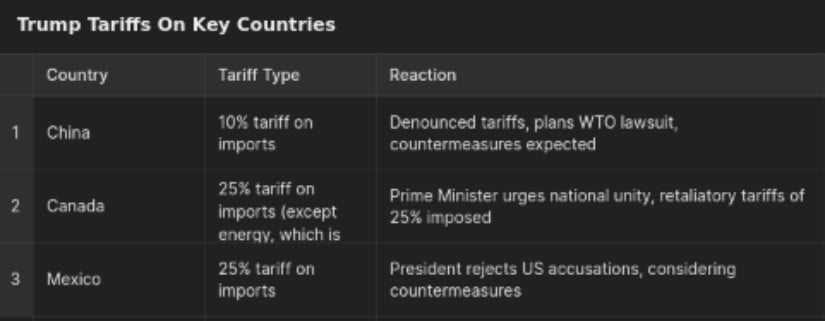

Trump, our modern-day Ivan the Terrible in this tragedy play, targets the world’s largest economies, setting off a chain reaction. Our gentle neighbors, Canada and Mexico, strap on grim masks as they brace for a 25% tariff. Over yonder, China, the dragon of the East, meets a 10% levy. Europe, wearing its classical demeanor, awaits its turn in the economic duel, clutching its chest and bracing for war. 📉

Justin Trudeau, with his trademark cool, fires back, urging his apostles to buy local. Meanwhile, Mexico’s leadership waves the flag of sovereignty, accusing Uncle Sam of wielding economic power as a cudgel. Even the European Union, not yet the victim, warns of countermeasures.

The Crypto Industry Faces Indirect Fallout

But here, in the metallic heart of cryptocurrency, the waves are felt differently. The idealist crypto apostles, who once believed in the separation of coin and state, must confront the harsh reality: Tariffs squeeze capital flow like a miser squeezing coins. With less disposable income and heightened operational costs, the free flow of capital retreats, leaving fewer resources for Bitcoin, Ethereum, and their digital brethren.

Mining operations, ever reliant on Chinese goods, now find themselves in a bind. As tariffs inflate the cost of high-performance computing hardware, the dream of decentralized mining turns paradoxically centralized. 😂

Investor Confidence and Regulatory Uncertainty

Investor sentiment, that fickle muse, wavers. In times of geopolitical tension, many seek solace in gold, not crypto, whose tantalizing allure is shadowed by the instability of the times. Regulatory anxiety compounds the dread; what if governments clamp down, seeing crypto as a way to dodge economic sanctions? The hammer could fall any day, snapping the faint thread holding the industry. 😱

The Global Economic Slowdown and Crypto’s Future

A slowdown—Trump’s tariffs as the wind that blows smoke across the economic chessboard—casts doubt on crypto’s future. The once-full kettles of institutional investments may become mere drips. Hedge funds and asset managers, those great maestros, might just opt for the safety of well-trodden paths. It’s one great game of attrition, and who is to say that Satoshi’s vision won’t become a footnote in the great ledger of history?

And yet, perhaps the dice have not yet landed. The boastful Trumpian tariffs could, by some twist of fate, become the very forge that tempers the American economy—and Bitcoin too. Time, that relentless chronicler, shall tell. For now, dear reader, place your bets as you would on the roulette table, for that’s all we have—spin and win, or spin and lose. 🎰

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-02-03 11:23