Oh, what a tangled web we weave, dear reader! 🕸️ On a frosty day in 2025, our hero, President Donald J. Trump, wielded his mighty pen and declared war on the invisible forces of free trade. He imposed hefty tariffs on our neighbors to the north and south, and even on the dragon across the sea. Canada, Mexico, and China felt the sting of a 25%, 10%, and 10% tariff, respectively. But fear not, for this was not an act of madness, but a cunning plan to save America from the scourge of illegal immigration and the insidious flow of drugs, particularly the deadly fentanyl.

Trump Tariffs target China, Canada and Mexico, source: White House

Our fearless leader accused the Canucks, Mexicans, and Chinese of failing to keep their end of the bargain, allowing the dark arts of drug lords to flourish. The International Emergency Economic Powers Act (IEEPA) was invoked, and the battle cry was heard: “Access to the American market is a privilege, not a right!”

But lo and behold, the Canucks and the Mexicans, not ones to be trifled with, retaliated with their own tariffs on American goods. The Canadian dollar trembled before the almighty greenback, signaling the beginning of a trade skirmish.

The End of American Hegemony: A Shift Towards a Multipolar World 🌎

Behold, the United States, once the colossus of the globe, now embarks on a journey towards a multipolar world order. The dismantling of foreign influence, the acknowledgment of waning power by Marco Rubio, and the redefinition of alliances mark this seismic shift. The U.S., no longer the world’s policeman, is retreating from its global responsibilities, albeit in a controlled manner.

A Controlled Retreat, Not a Collapse 🛡️

Some may see chaos, but this is a strategic choice, my dear reader. The U.S. chooses to step back on its own terms, rather than wait for the inevitable collapse. Our traditional allies, caught off guard, find themselves negotiating with an America that no longer sees them as protected partners, but as equals in a new world order.

Why Trump’s Tariffs Are Good for the U.S. Economy 💰

For ages, Chinese fashion titans like Temu, SHEIN, and AliExpress flooded our shores with cheap goods, exploiting the “de minimis” loophole. This loophole, a relic of a bygone era, allowed any package valued under $800 to enter our land without duties, taxes, or inspections. This was not free trade, but a Trojan horse for subsidized foreign competition to undermine our businesses.

The Loophole Is Finally Closing 🔒

With the stroke of a pen, the loophole was sealed, and the impact was colossal. American retailers no longer faced unfair competition, and more products went through proper inspections, ensuring that only the finest goods entered our markets. This was a victory for American businesses and trade fairness, long overdue.

Why Bitcoin Is the One Trade to Rule Them All 🍀

Jeff Park, the sage of Alpha Strategies at Bitwise, proclaimed on X that Bitcoin was the trade of the century. With the Plaza Accord 2.0 looming and financial warfare heating up, Bitcoin would soar to new heights.

The Triffin Dilemma and Tariffs 🤔

The Triffin dilemma, the curse of the global reserve currency, was at play. To escape the constraints of an overvalued dollar and persistent trade deficits, tariffs were wielded as a weapon in global financial warfare. The endgame? A weaker dollar and lower yields, the holy grail of fiat.

Trump’s Personal Play: Real Estate and the 10-Year Yield 🏢

Trump’s motivation was clear: drive down the 10-year yield to benefit his real estate empire. His profit-driven nature made his actions predictable. The 10-year yield would come down, one way or another.

The Asset to Own: Bitcoin 🪙

Bitcoin was the asset to own in this new world order. As the dollar weakened and yields dropped, risk assets in the U.S. would skyrocket. Foreign economies, crippled by tariffs, would seek refuge in Bitcoin. The stage was set for a Bitcoin bull run, fueled by financial warfare.

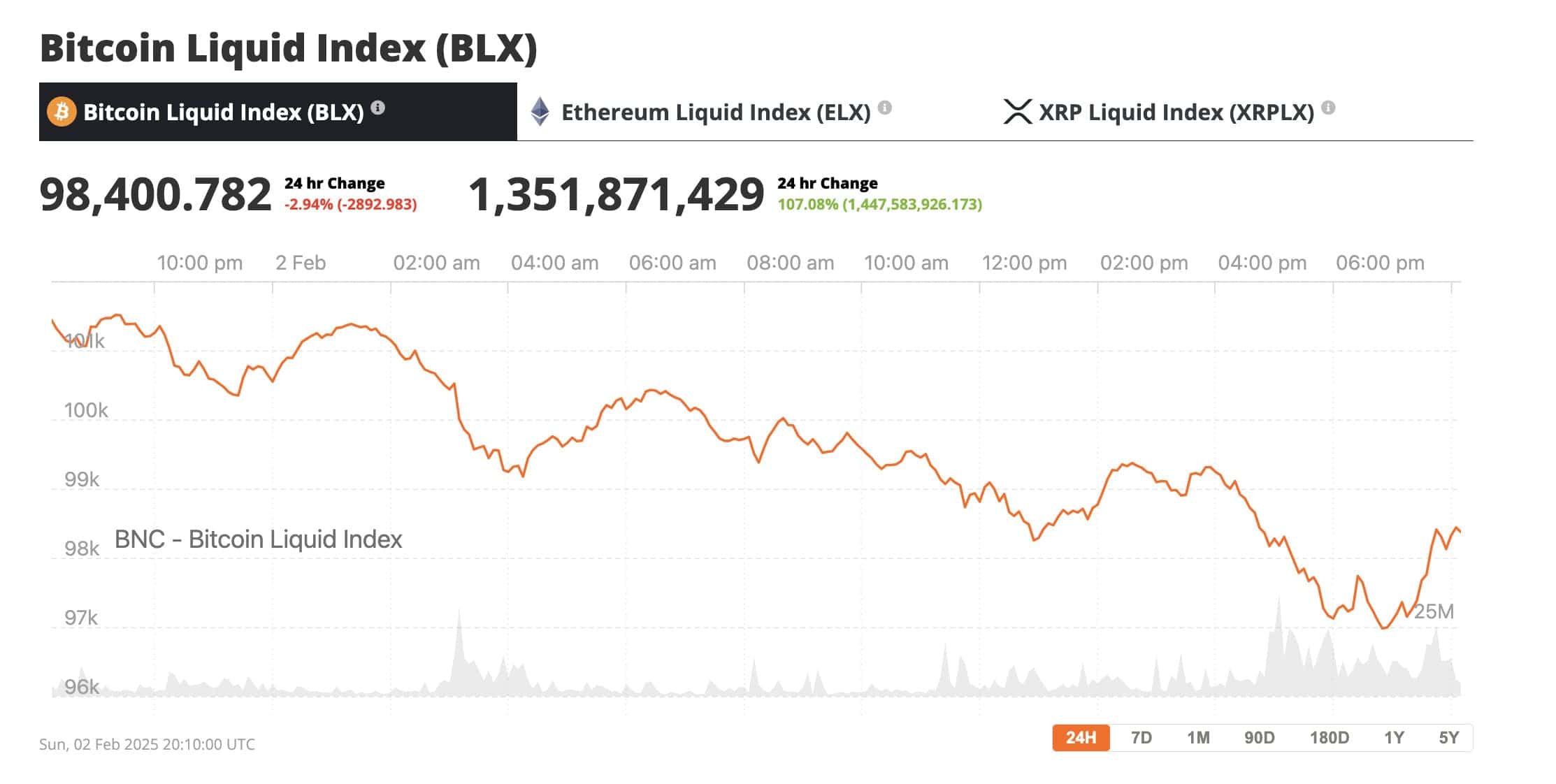

Bitcoin dumped under $100,000 but could recover if Park’s thesis plays out, source: Bitcoin Liquid Index

As Stockholder wrote on X, the Canadian Dollar was plunging, and the Canadian government was preparing a “pandemic level” stimulus package. And yet, some dared to be bearish on Bitcoin? The market had it wrong, for now. This could be a hugely bullish setup for Bitcoin, as Stockholder wrote on X.

And so, dear reader, we find ourselves at the crossroads of history. Will Trump’s tariffs save the U.S. economy and propel Bitcoin to new heights? Only time will tell. Until then, let us savor the spectacle of a world in flux, where heroes and villains are not so easily discerned. 🎭

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE PREDICTION. DEXE cryptocurrency

- ALEO/USD

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

- ‘He Knows He’s Got May…’: Gwyneth Paltrow Reveals Husband Brad Falchuk’s Reaction To Her Viral On-Set Kiss With Timothee Chalamet

2025-02-02 23:40