On its debut, the network processed an impressive 711,000 user transactions, signaling strong initial interest. Or maybe it was just a bunch of bored people clicking buttons while waiting for their coffee to brew. ☕️

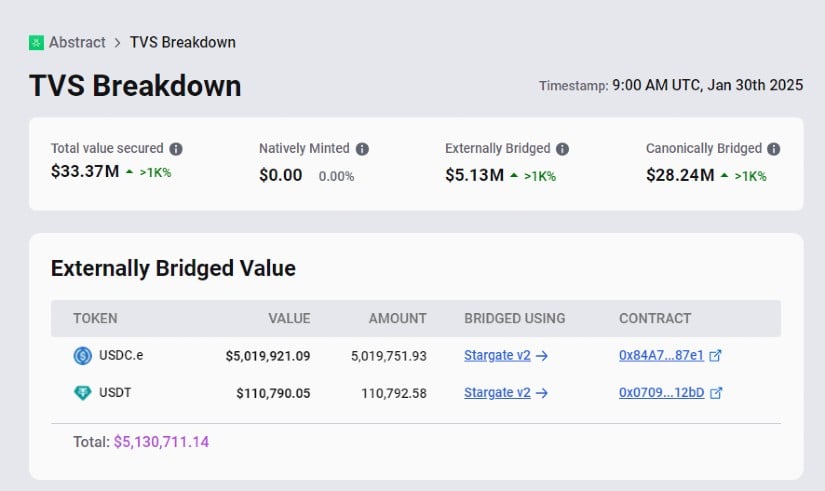

However, a closer look at the numbers reveals a different story. According to L2Beat, the total value secured (TVS) sits at just $33.37 million in ether (ETH) and stablecoins—significantly lower than the massive inflows seen in other high-profile Layer-2 launches. It’s like showing up to a party with a bag of chips while everyone else brings caviar. 🥴

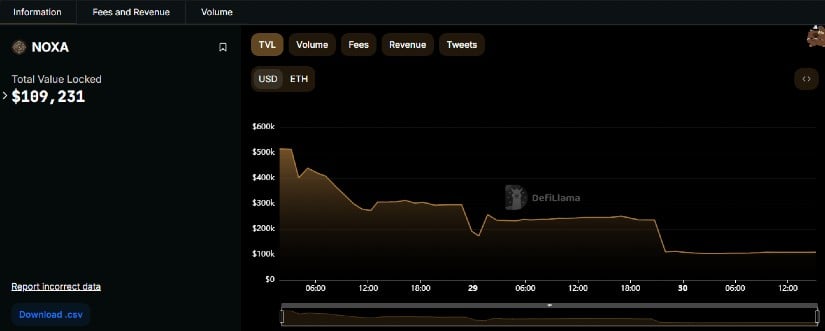

Liquidity concerns are becoming increasingly evident. NOXA, Abstract’s native decentralized exchange, has seen a sharp decline in total value locked (TVL). From an initial $515,000 on launch day, its TVL has plummeted to just $109,231, according to data from Defi Llama. That drop has overshadowed the project’s ability to retain liquidity despite the substantial early transaction activity. It’s like watching a balloon deflate at a kid’s birthday party. 🎈

The platform was marketed as the start of a “new era of consumer crypto,” offering users a simplified onboarding experience that allows wallet creation through email. While that approach was expected to bring mainstream adoption, the network’s ability to hold user engagement remains in question. It’s like promising a rollercoaster ride but delivering a merry-go-round instead. 🎠

XP Rewards Fail to Drive Adoption

Abstract introduced an incentive mechanism where users can accumulate “XP points” through interactions with the network, with the promise of unlocking rewards. However, the reception has been lukewarm. A supporter of Abstract said:

“Most people don’t care about XP as much as flipping their NFTs.” And honestly, who can blame them? The NFT sector has struggled to reclaim the heights of the 2022 boom. OpenSea’s trading volume, which spiked in December amid airdrop speculation, is now averaging $15 million per day in January—a steep drop from $160 million daily three years ago. That trend has impacted interest in blockchain-based reward systems as users increasingly prioritize immediate financial incentives over long-term engagement schemes. It’s like trying to sell ice to an Eskimo. 🥶

Despite its struggles, Abstract allows users to bridge funds, swap tokens, and launch new tokens via zoo.fun, a token launchpad similar to pump.fun. However, none of that has been enough to bring the liquidity required to sustain the network’s growth. It’s like trying to fill a bathtub with a garden hose. 🚿

CEO Netz Focuses on ‘Fun’ Over DeFi

Luca Netz, CEO of Pudgy Penguins and the driving force behind Abstract, is steering the project away from traditional DeFi-heavy applications that typically attract liquidity. He made his stance clear, stating:

“If it’s not fun and viral there’s no reason for you to build on Abstract. I’m optimizing for fun, viral, simple, stupid. If you want to build the next DeFi application, I really recommend you use Berachain or Arbitrum.” Because who needs stability when you can have a good time, right? 🎉

That strategy sets Abstract apart from its competitors, which tend to focus on maximizing DeFi adoption. While Netz’s vision aims to cultivate an ecosystem that thrives on entertainment, social engagement, and viral trends, it remains uncertain whether such an approach can sustain long-term user investment. It’s like trying to build a house of cards in a windstorm. 🏠

Penguin Token’s 40% Decline Raises Concerns

The market has not responded kindly to the launch. Pudgy Penguins’ native token, PENGU, has dropped 5.80% in the past 24 hours and is down 40% over the last week. While broader market trends have been weak, some analysts argue that the lack of direct rewards for Pudgy-linked assets on Abstract has accelerated the token’s decline. It’s like

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE PREDICTION. DEXE cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- ‘Did Not Expect To See That Fiery Bully’: Hell’s Kitchen Alums Recall ‘sharp-tongued’ Gordon Ramsey’s Behavior On Set

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-01-31 15:12