Alas! The mercurial Bitcoin, that capricious creature of our time, has dared to dip below the fabled threshold of $100,000 in the chaotic ballet of Monday’s trading madness. And though it bravely reclaims its stance at a princely sum of $102,691 as we speak, the valiant short-term holders (STHs) find themselves grappling with fresh wounds, feeling the bite of this fleeting dip. A true comedy of errors! 😂

On-chain data, that unscrupulous mirror of truth, reveals a most unfortunate fate for this cohort of lamenting BTC holders, for they are compelled to sell their treasures at a loss. The irony is palpably rich!

The Mournful Calculations of Bitcoin’s Short-Term Monetizers

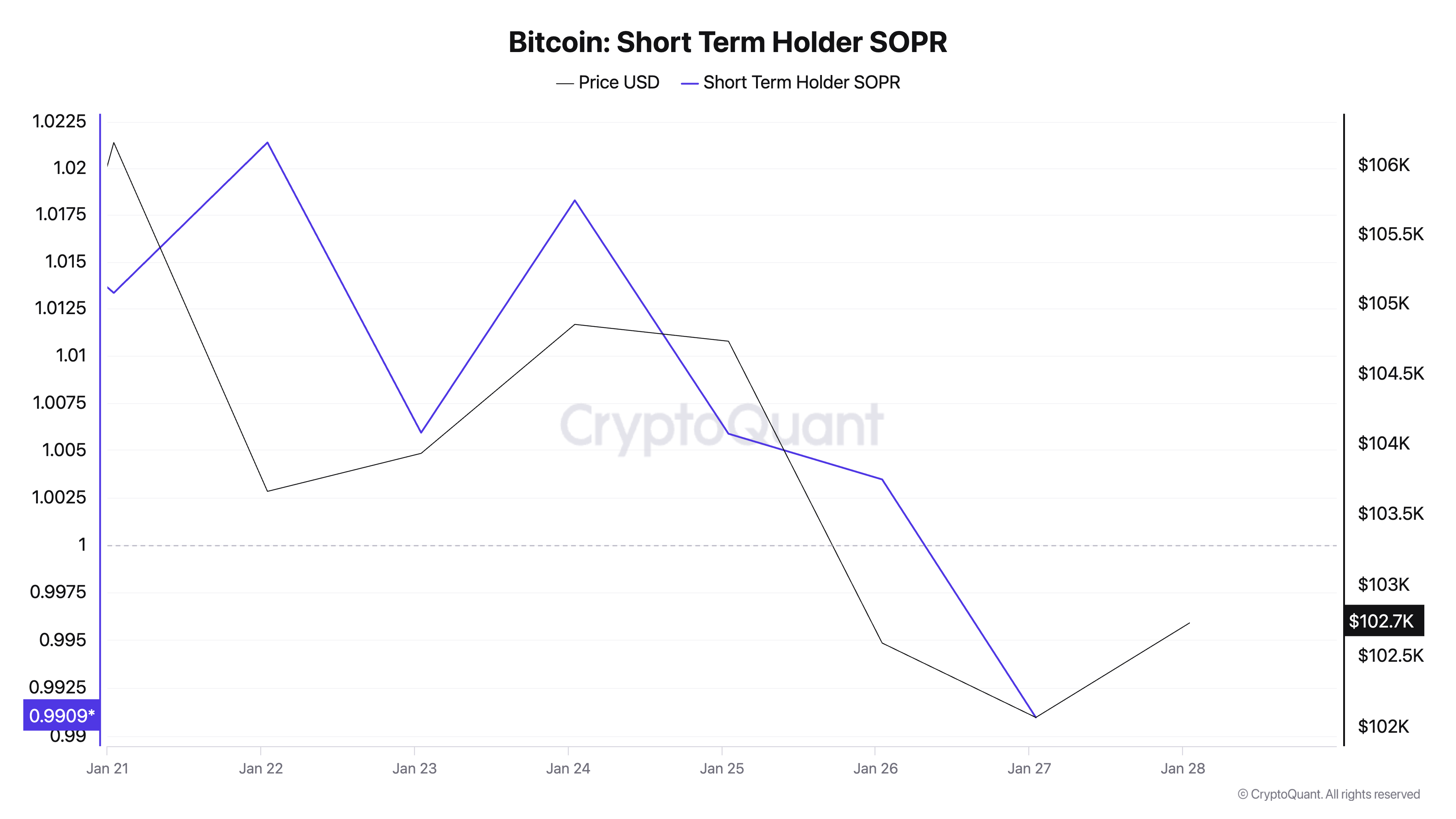

Lo! According to the esteemed sages at CryptoQuant, the Spent Output Profit Ratio (SOPR) for our beleaguered short-term holders has spiraled downwards over the past week like a drunken poet. How fitting! As the coin’s price shattered the $100,000 barrier, the metric fell beneath the ominous mark of 1. We now find ourselves at a sorrowful 0.99. Who could have foreseen such tragedy?

This STH-SOPR, a beguiling gauge of fortune and folly, elucidates the state of those who held this volatile gem for a mere three to six moons. If they find themselves above the sacred number of 1, glory be! They sell their coins at a profit, basking in the sun of financial victory. But lo! Below the threshold, they become unwilling participants in a grim farce, selling at a loss.

As we witness this pitiful 0.99, the implication is clear: these beleaguered investors, having clutched their coins with hope and dreams for less than six fleeting months, are finding themselves adrift in an ocean of financial despair, selling well below their initial aspirations. How tragic, indeed!

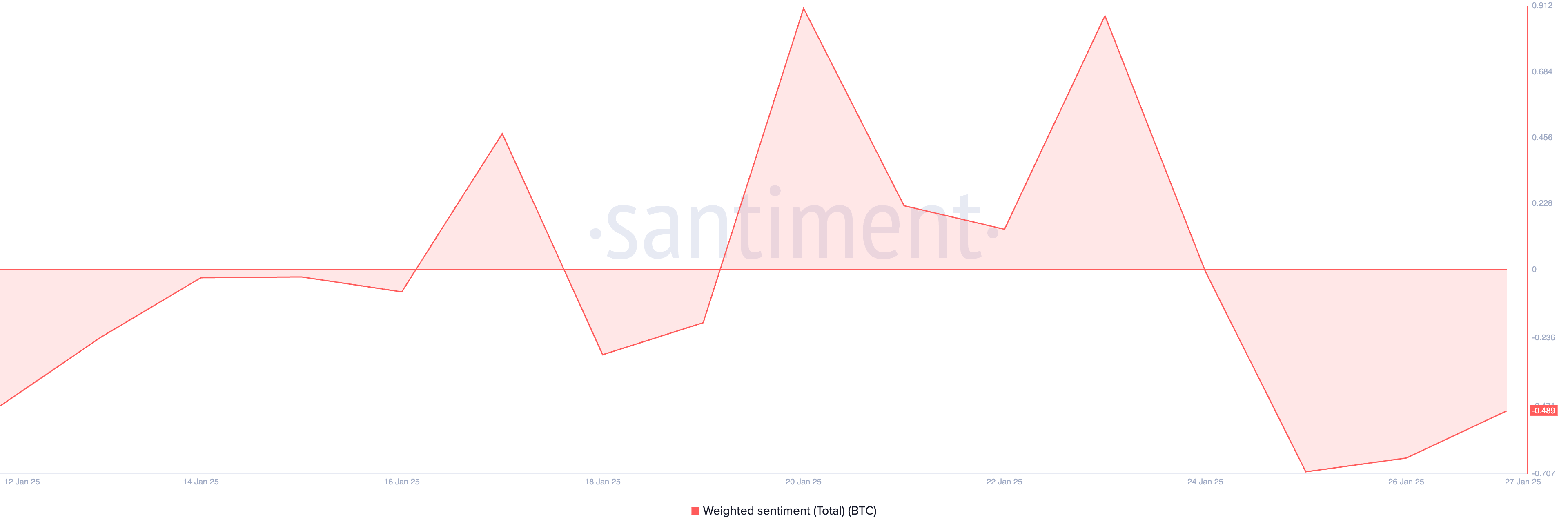

Despite the brave resurgence of BTC’s price following Monday’s nadir, a heavy shroud of negativity continues to loom over our noble king coin, weighed down by a sentiment score of -0.48. Such opposition! How does one even navigate such turbulent waters?

This weighted sentiment, that fickle portent, seeks to measure the collective fervor or dismay of the masses, tracking the chattering of souls across the vast social media landscape. When the scales tilt towards negativity, it becomes a sorrowful bear signal; a proclamation that our investing friends are more skeptical than ever about the omniscient future of this digital artifact, leading them to refrain from trading. How endearing!

Much like our own lives, the narrative weaves itself as a cautionary tale—negative sentiment paints a bearish picture for our prized possession, instilling justifiable doubt among the weary investors. Shall they sell their threads before the curtain falls?

The Pensive Prediction of BTC’s Fate: Shall It Dance Once More Above $109K or Sink into the Abyss Below $100K?

Lo! Should this negative cloud billow ever larger, and momentum wane like a flickering candle, we may see BTC relinquish its recent accolades, plummeting to the piteous depths of $99,378. Such tragedy, one cannot help but chuckle at the audacity of fate!

Yet, should fortune smile upon our weary protagonists, and the winds of sentiment shift favorably, Bitcoin might just muster the strength to reach for its celestial heights again, striving towards its once-grand apex of $109,356. Hope dances on the horizon, if only for a fleeting moment!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-29 00:33