Ah, the crypto market! A veritable circus of hopes and dreams, where participants cling to the edge of their seats, eagerly awaiting the unveiling of five US economic data points this week, commencing on the fateful Tuesday. The air is thick with anticipation, as if the very fate of Bitcoin (BTC) and the broader crypto realm hangs in the balance.

Once again, the influence of US macro data on Bitcoin is as clear as a babushka’s crystal ball, especially after a year where the effects seemed to evaporate like vodka on a hot summer day.

Consumer Confidence

First on the agenda is the consumer confidence survey, scheduled for Tuesday, January 28. This survey is akin to a weather forecast for spending trends, revealing the collective psyche of consumers—what they intend to buy, where they plan to vacation, and whether they’ll splurge on that new pair of shoes or stick to last year’s model.

The median forecast stands at a hopeful 106.3, a slight uptick from the previous 104.7. Should consumer confidence rise, it would suggest that folks are ready to loosen their purse strings, potentially flooding the crypto markets with fresh investments. But beware! A dip in confidence could send spending plummeting, leading to a more dovish Federal Reserve (Fed) and a liquidity bonanza that might just make Bitcoin the darling of the day.

Thus, Tuesday’s data will serve as a litmus test for the optimism or pessimism that pervades the economy, much like a family gathering where everyone pretends to get along.

FOMC and Fed Chair’s Speech

Next, we turn our gaze to the Federal Open Market Committee (FOMC) interest rate decision on Wednesday, January 29. This marks the first FOMC decision since President Trump took office, and oh, what a spectacle it promises to be!

“Trump is demanding rate cuts, but Powell’s signaling no change. This showdown could rock the markets,” quipped crypto trader Roger Smith, as if he were narrating a soap opera.

Policymakers are fretting over inflationary pressures, particularly those tied to Trump’s grand fiscal schemes. The last FOMC minutes offered little hope for rate cuts, solidifying the Fed’s hawkish stance. As BeInCrypto reported, this stance has been a wet blanket on risk assets, including our beloved cryptocurrencies.

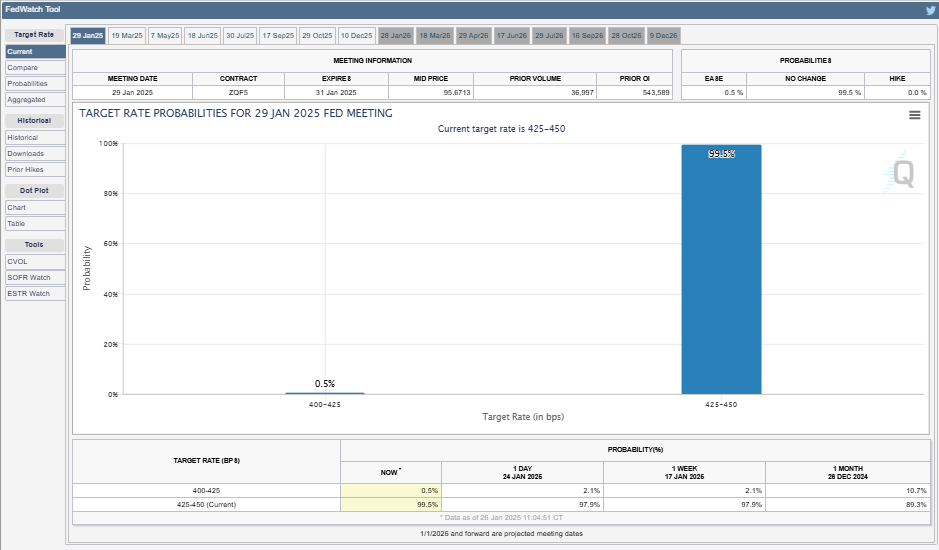

With the CME FedWatch tool indicating a 99.5% probability of a 25-basis-point (0.5% bps) rate cut, all eyes will be glued to the press conference with Fed Chair Jerome Powell. Traders are bracing for volatility, as if they were preparing for a rollercoaster ride at the county fair.

“I’ll decide that after Wednesday, January 29, 2024, FOMC interest-rate decision 2:00 pm ET – Fed Chair Powell press conference 2:30 pm ET. No position at the moment but I see a small chance for positive,” one trader mused, as if contemplating the meaning of life.

Let us not forget the Fed’s dual mandate: to keep the Consumer Price Index (CPI) rising at a steady 2% per year and to maintain full employment. A noble cause, indeed!

GDP

On Thursday, January 30, the US GDP (Gross Domestic Product) report will grace us with its presence. The median forecast is a modest 2.5%, down from the previous 3.1%. This data measures the total value of goods and services produced in the land of the free.

A positive GDP revision could signal a robust economy, prompting investors to throw caution to the wind and dive into riskier assets like Bitcoin. Conversely, a downward revision might send investors scurrying for cover, leading to a temporary decline in crypto prices, much like a cat avoiding a bath.

Initial Jobless Claims

Also on Thursday, the initial jobless claims report will provide a glimpse into the health of the US labor market. Recently, the number of Americans filing for unemployment benefits has ticked up, but it seems to be stabilizing, much like a tightrope walker on a windy day. The previous data stood at 223,000, with a current projection of 225,000.

A higher-than-expected number of jobless claims could spell economic doom, leading investors to seek refuge in Bitcoin as a hedge against traditional markets. On the flip side, a decrease in jobless claims could bolster confidence in traditional markets, diverting funds away from cryptocurrencies like a squirrel avoiding a cat.

Fed officials are keenly aware of the labor market, knowing that waiting too long to cut rates could lead to a disaster of epic proportions.

Personal Income and PCE Index

Finally, on Friday, the US Bureau of Economic Analysis (BEA) will unveil the personal income, spending, PCE index, and core PCE. Weaker personal income and spending, coupled with softer inflation figures, could signal a slowdown in economic activity, much like a car sputtering to a halt.

//beincrypto.com/wp-content/uploads/2025/01/BTC-opt-57.png”/>

As we stand on the precipice of these US economic events, BeInCrypto data reveals that BTC was trading at $100,355, down almost 5% since the opening of Monday’s session. Ah, the sweet taste of uncertainty!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2025-01-27 10:38