This week has seen a flurry of significant events unfold in the cryptocurrency sector. Notable occurrences include Binance listing three AI-related token offerings, Grayscale unveiling a list of 39 assets that will be incorporated into its investment portfolio, and the announcement of Donald Trump’s Cryptocurrency Inaugural Ball.

As a researcher immersed in the dynamic world of cryptocurrencies, I’ve observed an exciting surge: XRP has reached a six-year peak, causing ripples throughout the market. Moreover, intriguing predictions from JPMorgan suggest a potential $14 billion market expansion if XRP and Solana were to be included in Exchange Traded Funds (ETFs).

Binance Lists Three AI Agent Tokens to Great Success

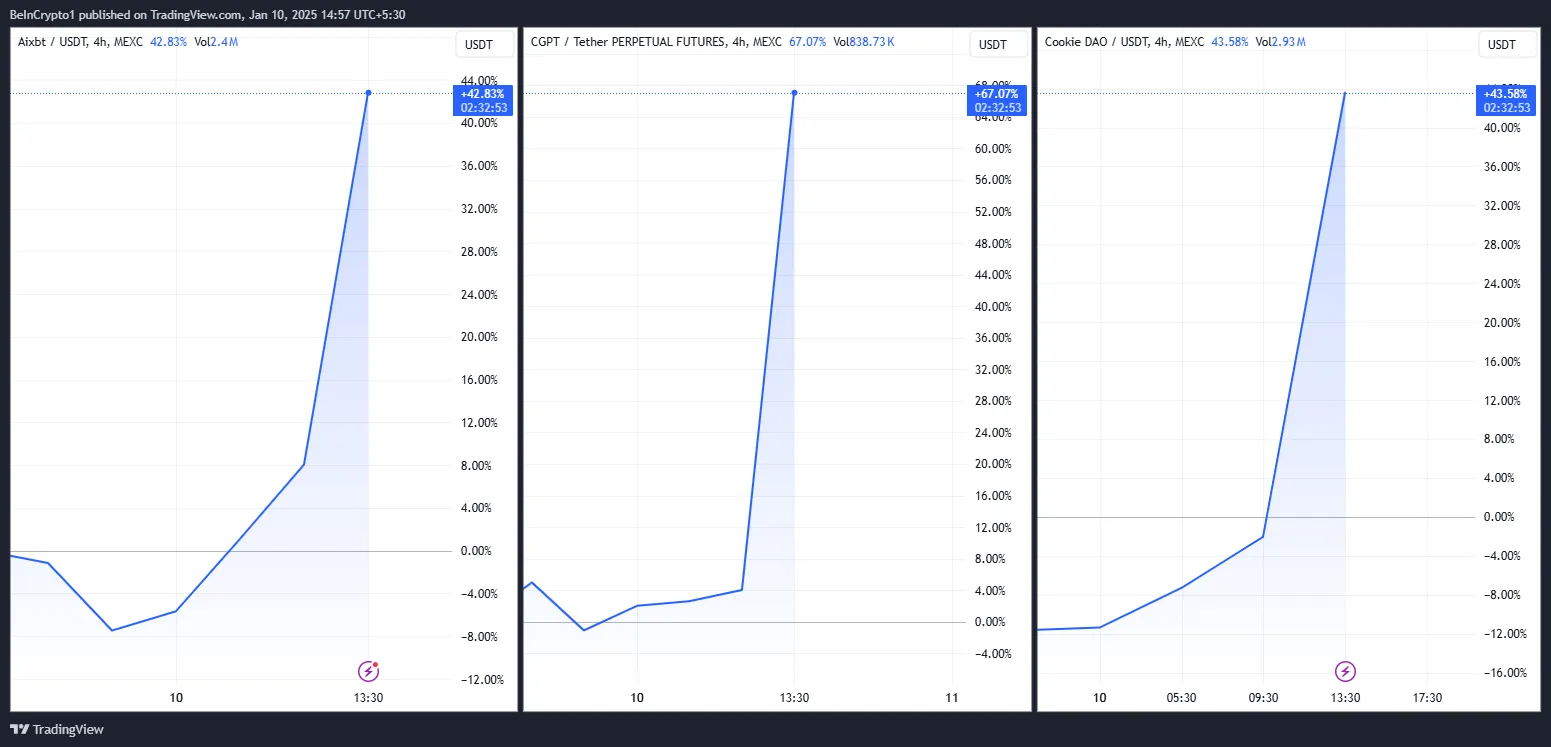

On January 10th, one of the world’s top crypto exchanges, Binance, introduced three new AI-related tokens to its platform: aixbt by Virtuals (AIXBT), ChainGPT (CGPT), and Cookie DAO (COOKIE). Remarkably, Binance also offered zero-commission trading for these tokens. Consequently, following the listing, all three assets experienced a significant surge exceeding 40%.

In recent times, several prominent figures within the cryptocurrency sector are growing more optimistic about the role of AI agents. Yesterday itself, OKX Ventures highlighted them as a significant investment focus for the year 2025, and Nvidia’s CEO predicted that it would expand into a market worth trillions of dollars.

The demonstration of these three digital assets highlights the increasing excitement within the cryptocurrency sector about artificial intelligence-based agents.

Grayscale Reveals 39 Altcoins For Investment Consideration

Leading ETF provider, Grayscale, unveiled a comprehensive selection of prospective cryptocurrency investment possibilities, encompassing meme coins, artificial intelligence tokens, among others.

The company is contemplating expanding its roster of tradable digital assets by incorporating a total of 39 different altcoins. These can be grouped into five distinct categories: cryptocurrencies, platforms for smart contracts, financial instruments, consumer-oriented and cultural assets, and utilities and service-based coins.

Grayscale indicated that the given list might be modified within the current quarter since certain multi-asset funds are being revamped, and they plan to introduce new single-asset offerings.

Previously, Grayscale introduced a flurry of fresh cryptocurrency options in this fashion. To illustrate, they listed 35 tokens last October, though not every one of them was approved for the official catalog.

Multiple assets like KAS, APT, ARB, and TIA appeared in both the lists, indicating commonalities. Differences observed in these two lists suggest that Grayscale might be adjusting its focus or priorities over time.

Over the last few months, I’ve noticed that Grayscale seems to be focusing more on AI agents, yet there’s also a rising significance being attributed to sectors like meme coins, RWAs, and DePINs.

The First-Ever “Crypto Ball” Will Take Place Ahead of Trump’s Inauguration

David Sacks, who has recently taken on the roles of AI and Cryptocurrency Advisor under President Trump, is set to organize the inaugural Crypto Ball. This formal gathering swiftly sold out its initial $2,500 priced tickets, demonstrating a high level of interest in the event.

Notable companies such as Coinbase, Sui, Mysten Labs, Metamask, Galaxy Digital, Ondo, Solana, and MicroStrategy have expressed support for it.

According to Mario Nawfal’s post on X (previously known as Twitter), this high-end gathering offers VIP passes priced at $100,000 and private dining experiences with Trump for $1 million. Notable supporters such as Coinbase, MicroStrategy, and Galaxy Digital are endorsing the event, suggesting a growing inclination towards a pro-cryptocurrency government in the U.S.

Following his election win in November, Trump has pledged significant changes favoring cryptocurrencies within the United States. At this point, it’s not anticipated that he himself will be present, but representatives supportive of the industry are expected to show up instead. Additionally, there are plans for Trump to sign a pro-crypto directive on his inaugural day in office.

XRP Surged to an All-Time High at $3.39

Ripple’s digital currency, XRP, reached its highest price in more than seven years, causing a ripple effect across the larger cryptocurrency market. As a result, several meme coins that are based on XRP, like ARMY, PHNIX, and LIHUA, saw significant increases in value, thanks to the devoted fanbase of XRP.

In recent times, Ripple (XRP) has exceeded many other cryptocurrencies in performance, which has sparked a feeling of optimism. Today, its trading volume peaked at approximately $20 billion, largely driven by anticipation that President Trump might endorse a U.S. reserve encompassing not only Bitcoin but also multiple assets.

JPMorgan Predicts XRP, SOL ETF Market at $14 Billion

Experts from leading financial institution JPMorgan forecasted that the market for Exchange Traded Funds (ETFs) related to XRP and SOL could potentially surpass $14 billion. They suggested that an ETF based on XRP may yield higher profits, yet they believe both could secure approval from the Securities and Exchange Commission (SEC) by 2025, with potential success for both.

JPMorgan analysts, including Kenneth Worthington, point out that the main issue at hand is whether investors will continue to show interest in more financial products, particularly new crypto Exchange Traded Products (ETPs), and if these launches will have an impact.

Back in the early part of the year, Ripple’s CEO, Brad Garlinghouse, forecasted an XRP Exchange-Traded Fund (ETF) as unavoidable, and his prophecy seems more plausible by the day.

It appears that Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), along with the Chair of the Commodity Futures Trading Commission (CFTC), is planning to step down from their roles. Their departures are likely to be followed by individuals who favor the crypto industry taking up these positions. This could potentially lead to a more pro-crypto direction in U.S. financial regulation.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-18 05:12