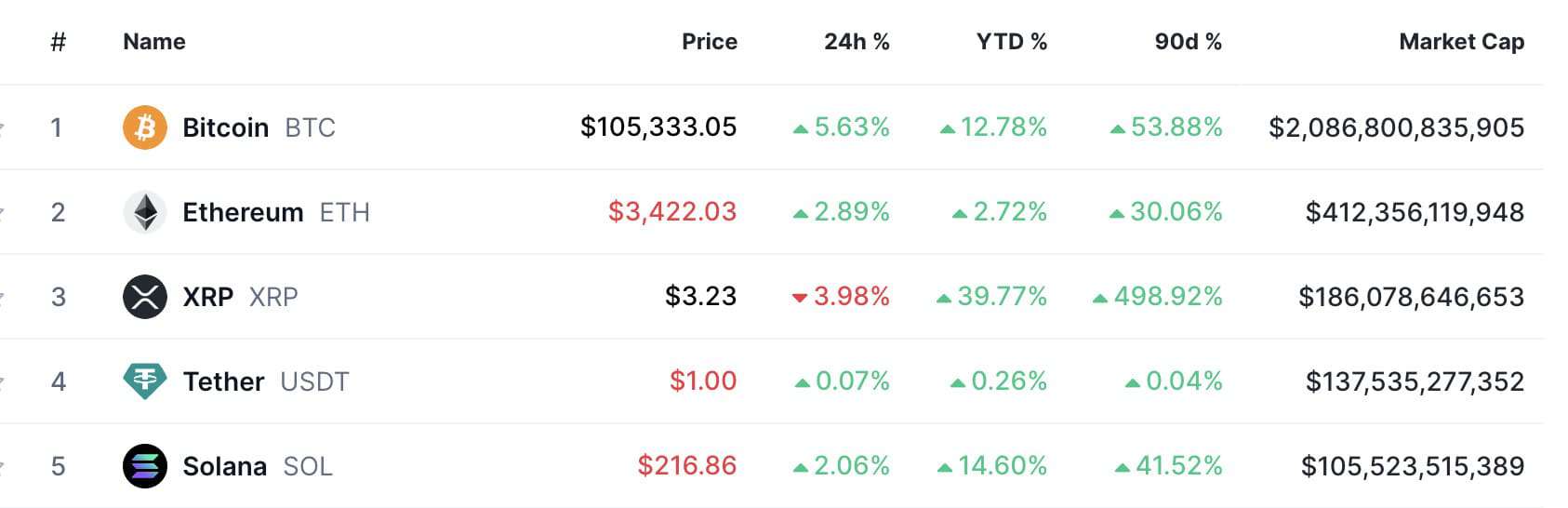

The cost of a single Bitcoin has surpassed $105,000 once more, marking a significant increase of over double in the last year. This growth is propelling the overall value of the cryptocurrency market (which encompasses Bitcoin, Ethereum, XRP, Solana, and others) towards an astounding $4 trillion. Today’s update will delve into the latest news regarding Bitcoin and XRP as both are poised to reach unprecedented new peaks. Let’

s dive in!

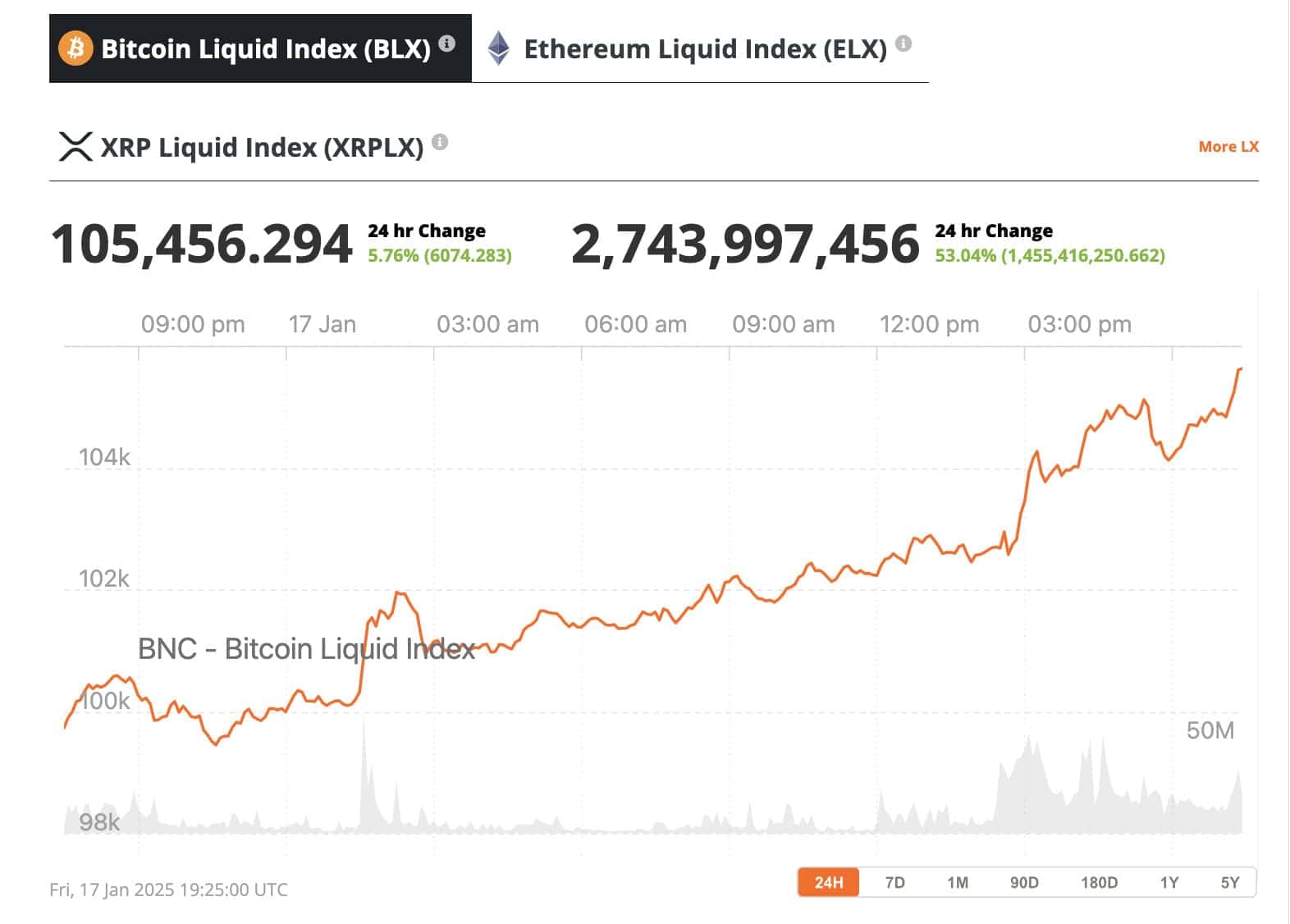

The Bitcoin price jumped 5% overnight to $105456, source: Bitcoin Liquid Index

The rally is sparked by increasing optimism among traders regarding the likelihood of Trump’s proposed U.S. Strategic Bitcoin reserve. This belief, now widely held, is evident in the rising probabilities on the betting platform Polymarket. Currently, the chances that the U.S. will establish a National Bitcoin Reserve stand at 62%, a 20% increase this week.

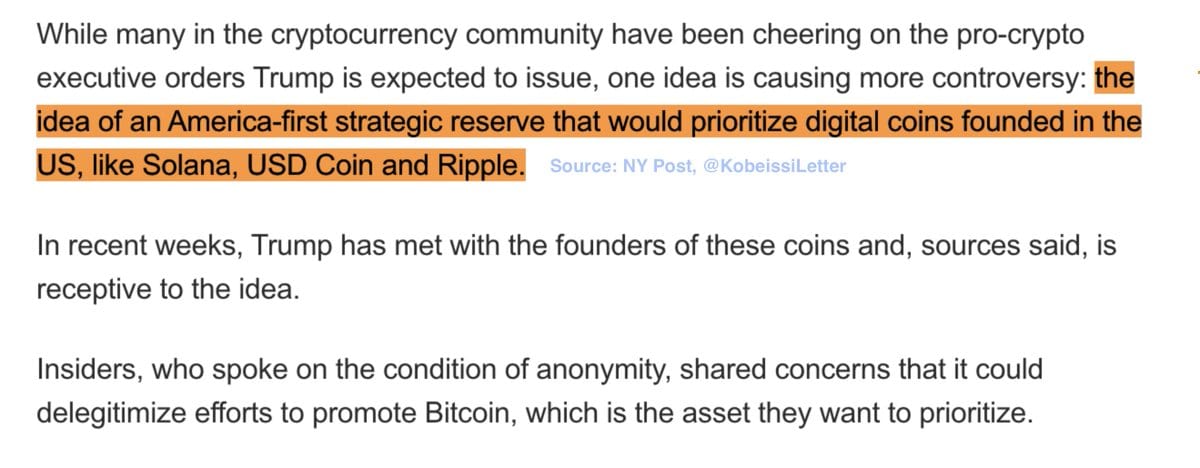

XRP to lead America-first Crypto Strategic Reserve?

Reports released this week indicate that the Trump administration could broaden its cryptocurrency reserve plans, focusing on U.S.-born digital currencies like Ripple‘s XRP and Solana. This proposed strategy, known as the “America-first strategic reserve,” is said to support Solana, a blockchain competitor to Ethereum; USDC, a stablecoin backed by Circle and Coinbase; and XRP, which was developed by Ripple for efficient cross-border transactions.

At the beginning of this month, Jeremy Allaire, the CEO of Circle Inc., disclosed on a certain platform that they donated one million dollars’ worth of USDC to Donald Trump’s inauguration committee. This move places them among other corporations attempting to gain influence within the new government.

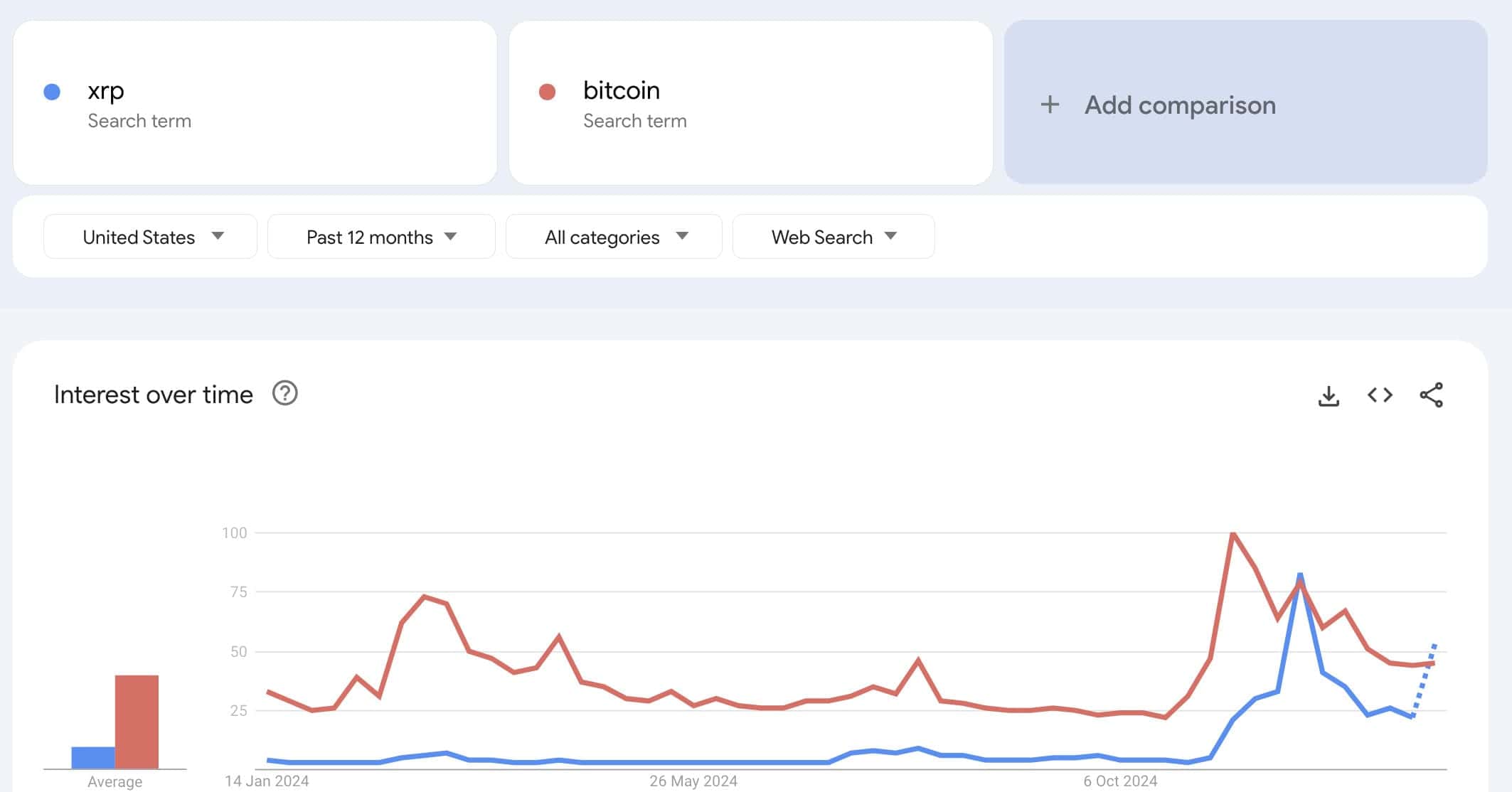

Ripple’s XRP has experienced a staggering 500% increase since Donald Trump was elected in November, driven by anticipation that his administration will lighten regulatory restrictions on the company. Furthermore, online searches for XRP have surpassed those for Bitcoin as individual investors rush to purchase XRP.

This week’s speculation about XRP being included in an American Cryptocurrency Reserve led to a price surge, followed by a phase of selling off profits today.

According to analyst Jason Jones from Brave New Coin, XRP has demonstrated remarkable resilience compared to other cryptocurrencies. Unlike most digital currencies that have faced setbacks or stagnation, XRP has been soaring and seems poised to surpass its previous record high.

Regulatory Environment Will Favour Ripple’s XRP Under Trump

The regulatory climate for cryptocurrencies has been unstable lately, largely due to the firm enforcement policies under the leadership of SEC Chair Gary Gensler. Gensler’s term in office is marked by strict measures, including notable cases like the SEC vs Ripple, leading to a cloud of uncertainty surrounding digital assets.

With Donald Trump’s election win, there’s hope in the crypto community for a more favorable regulatory environment to emerge. The appointment of Paul Atkins, known for his supportive stance towards cryptocurrencies, as the new SEC Chair could lead to less stringent regulations. Atkins is expected to advocate for clearer guidelines and policies that encourage innovation, which may greatly benefit Ripple’s XRP and other crypto ventures.

What to Expect From Trump’s Pro-Crypto Agenda

Under President Trump’s administration, strong measures are being promised to redefine cryptocurrency regulations. This includes potential Executive Orders that could elevate the industry as a focus for technological advancement. Key aspects of this plan include:

- Loosening Regulations

Crypto-focused restrictions could be lifted or eased as early as Day One of Trump’s administration. - Reversing Biden-Era Policies

- Eliminating the rule requiring banks to treat digital assets as liabilities on their balance sheets.

- Revoking Biden’s AI Executive Order, criticized by tech leaders for stifling innovation.

- Promoting Crypto Freedoms

Reducing compliance burdens to encourage startup growth and entrepreneurial activity in the digital asset space. - Streamlined Federal Oversight

Advocating for a unified, transparent framework to replace the patchwork of federal and state regulations. - Regulatory Clarity

Addressing the unpredictability that has hindered market stability, laying the groundwork for long-term growth. - XRP ETF Approval

The anticipated approval of new spot XRP ETFs, and new spot Litecoin ETFs could occur as early as 2025, offering new investment avenues. - Bitcoin Strategic Reserve

Trump’s administration is expected to explore the creation of a national Bitcoin reserve, intended to safeguard against fiat instability and global economic uncertainty. This move will position the U.S. as a leader in the digital economy and drive Bitcoin prices even higher, with analysts already revising upward their 2025 Bitcoin price projections.

XRP’s Primary Use Case: A Double-Edged Sword

To grasp why Ripple and XRP hold such promising prospects, it’s crucial to delve into their history. Year after year, banks and financial institutions shell out hundreds of billions in fees for international fund transfers, frequently enduring lengthy wait times until transactions are completed. This outdated system is ripe for modernization, and that’s precisely what XRP was created to achieve: streamlining the process of cross-border payments.

XRP streamlines swift, secure financial transactions between institutions at a significantly reduced cost compared to conventional methods. Unlike Bitcoin, which is sometimes suggested as an alternative, XRP excels in this area due to its speed, affordability, and scalability. In contrast, Bitcoin can be slower, pricier, and faces limitations in handling transactions; the XRP network handles thousands of transactions per second, while Bitcoin manages only a modest seven.

As a researcher delving into the world of digital assets, I’ve observed that the practical benefits of XRP have garnered significant attention. The global financial sector has embraced its underlying network, RippleNet, with numerous institutions utilizing it. Given that traditional systems drained banks to the tune of $193 billion in fees last year, the prospect for disruption is immense. If XRP manages to carve out a substantial market share, the transaction fees could prove lucrative. It’s also worth noting that banks engaging with RippleNet would require XRP as a means of transaction, potentially leading to a supply shortage and further increasing its worth.

Is There a Crack in this Narrative?

Here’s another way of saying that:

“Sure, the allure of Ripple and XRP is undeniable, and that’s precisely why they’ve been causing quite a stir. But upon careful examination, there are several notable issues with the underlying presumptions.

- Fee Collection Is Minimal by Design

The core value proposition of XRP is its ability to reduce fees drastically. While this makes XRP attractive to financial institutions, it also means the total value of fees collected by the network will always be small. If XRP didn’t offer such savings, banks wouldn’t adopt it in the first place. So, while the scale of the opportunity is massive, the revenue potential may not be. - RippleNet Doesn’t Require XRP

A common misconception is that using RippleNet mandates using XRP. In reality, most of RippleNet’s functionality operates independently of XRP. Banks often bypass XRP due to its volatility, opting for the network’s other features without holding the token. This undercuts the “supply shock” theory because many institutions simply don’t need XRP to benefit from RippleNet.

Although XRP has the potential to shake up the financial industry due to its design and purpose, its long-term worth is contingent on the widespread use of the token itself, rather than just the RippleNet network. If XRP isn’t essential for using RippleNet, its impact on transforming global transactions remains questionable. Fortunately, there’s a viable option to address this issue.

The exceptional minds at Ripple, often referred to as ‘gigabrain talents’, are taking the lead and meticulously preparing for the upcoming major breakthrough in international finance – a concept known as tokenization. Ripple’s XRP plays a crucial role within this framework, which is why experts predict that it will surpass all optimistic projections and reach unprecedented price heights associated with XRP throughout 2025.

Ripple and XRP: Transforming Finance Through Tokenization

In this text, I’ve rephrased the given sentences for clarity and flow:

1. Instead of saying “Here’s the solution to the above problem,” you could say “Let me explain the current situation.”

2. Instead of saying “Ripple, having spent over $100 million fighting the SEC to establish that $XRP is not a security, is shifting from defense to offense,” you could say “After spending over $100 million defending its stance with the SEC, Ripple is now taking an offensive approach regarding the classification of XRP.”

3. Instead of saying “Often misunderstood as merely a payments company, Ripple is poised to disrupt the financial world far beyond its origins,” you could say “Despite being commonly perceived as just a payment service provider, Ripple has the potential to revolutionize finance on a global scale, surpassing its initial scope.”

4. Instead of saying “Here’s how Ripple and XRP are set to transform global finance through tokenization,” you could say “Let me show you how Ripple and XRP aim to redefine global finance using tokenization.”

Building a New Financial System

Rather than merely trying to enhance outdated financial systems, Ripple dared to construct a completely novel one from the ground up. The XRP Ledger (XRPL) has emerged as a beacon of innovation, specifically designed for streamlined payments and tokenization. Instead of simply competing with industry leaders like Stripe and PayPal, Ripple is compelling them to act, with multi-billion dollar acquisitions and expanded product portfolios aimed at preserving their market position.

Ripple’s ambition transcends the $500 billion fintech industry; its focus now lies on tokenization. In the United States alone, there are over $55 trillion worth of assets that could potentially be tokenized, and Ripple is capitalizing on this massive opportunity for growth. This transition may propel Ripple and XRP from billions to trillions, reshaping the landscape of global finance.

Key Investments and Strategic Growth

Ripple has boosted its infrastructure by acquiring prominent companies like Metaco and Standard Custody. These acquisitions have bolstered Ripple’s capabilities in providing secure storage for digital assets. Last year, Ripple invested approximately $250 million in these deals, demonstrating their dedication to the tokenization of assets and interoperability within the banking sector.

As an analyst, I find myself standing at a significant juncture in Ripple’s development with the introduction of the New York Department of Financial Services (NYDFS)-regulated stablecoin, Ripple USD (RLUSD). This innovative coin marks a crucial advancement in Ripple’s tokenization strategy, opening up fresh prospects for the XRP Ledger (XRPL) while facilitating effortless integration within the expansive financial infrastructure. By doing so, Ripple strengthens its capacity to capitalize on tokenization and transaction fees, further bolstering the effectiveness of its On-Demand Liquidity (ODL) offerings for international payment solutions.

The Power of XRPL and Partnerships

The design of the XRP Ledger allows for swift, affordable transactions and large-scale tokenization. To fully utilize its capabilities, Ripple is adopting a straightforward yet effective approach: collaborate with leaders. By establishing partnerships with top industry players, Ripple aims to be the most prepared entity to take advantage of the 100x growth potential in tokenization.

The development of the XRPL is additionally focusing on unexplored income sources. Currently, its expansion primarily depends on transaction fees, however, Ripple is devising strategies to collect fees from other blockchain networks as well, thereby increasing its overall financial influence.

Ripple is spearheading a financial transformation. Through the integration of asset digitization, strategic purchases, and the robust blockchain technology known as XRPL, it is reshaping the way value is generated, moved, and kept. As Ripple emphasizes tokenization and compatibility, the company is poised to unveil vast opportunities worth trillions of dollars, solidifying its role as a trailblazer in the digital economy.

Bullish Outlook for XRP and the Crypto Market

1. For today’s update on XRP, there’s plenty to digest!

2. These prospective developments set up an optimistic outlook for XRP and the broader crypto sphere.

3. With President Trump expressing a favorable view towards cryptocurrencies, coupled with regulatory clarity and institutional backing, we can expect positive momentum to drive digital assets into a period of expansion.

To reach our destination, we require a strong surge in the cryptocurrency market, fueling global interest and propelling prices to unprecedented heights. This surge begins this week as President Trump, known as the first crypto president, assumes control. Prepare for Bitcoin’s and Ripple’s XRP’s price to break new record highs right away.

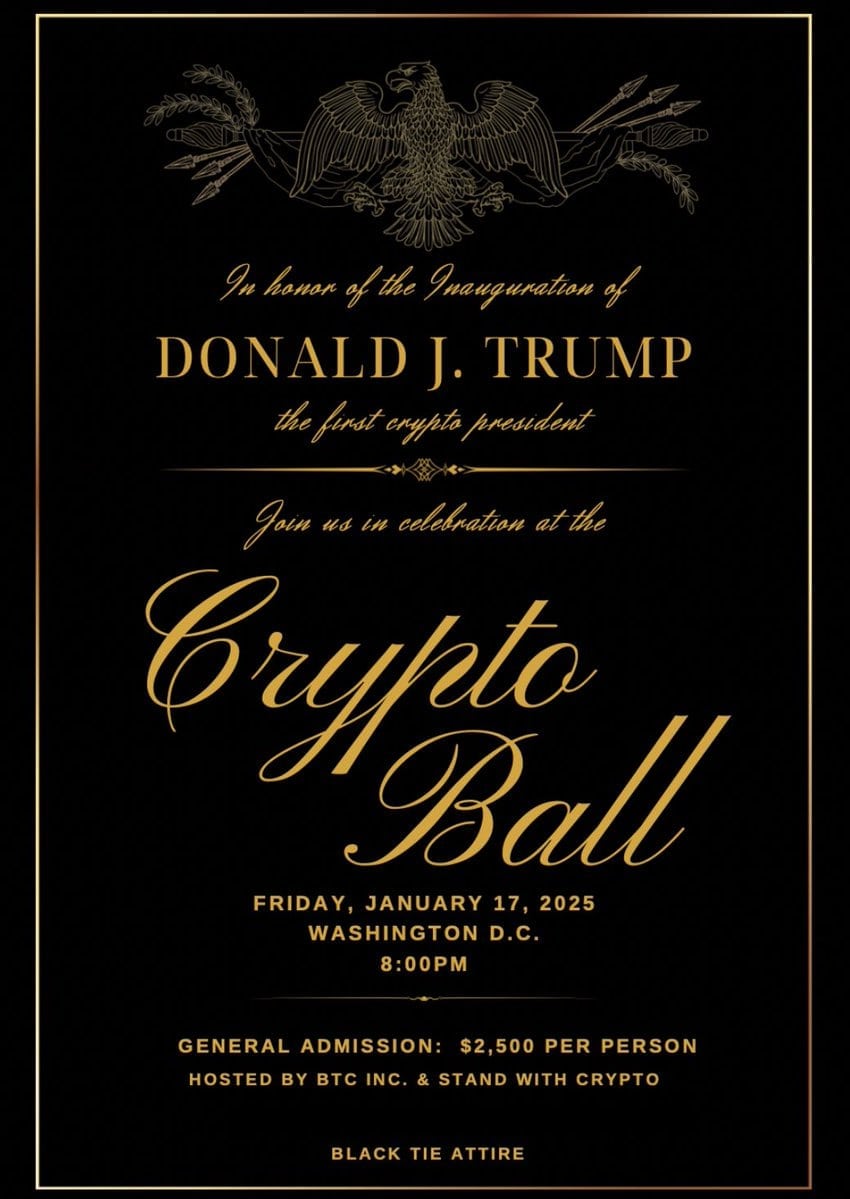

In a few hours, the Crypto Ball is happening tonight in Washington DC. President Trump will socialize with Michael Saylor, Bard Garlinhouse, and other heads of American cryptocurrency firms. The excitement surrounding crypto is bound to grow even more. You might not be as optimistic as others, but I hope you’ll join us at the ball… or perhaps on a future lunar expedition!

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2025-01-17 23:45