Despite recent price fluctuations, the cryptocurrency market has demonstrated remarkable strength, managing to push Bitcoin back up to the $100k level following a drop that took it to its lowest point since November.

As President-elect Donald Trump prepares to take office and there are indications of favorable crypto policies, the market is buzzing with hopefulness.

As Bitcoin strives towards hitting the $100K mark, shrewd investors may find attractive prospects in alternatives such as Monero (XMR), XRP, and Uniswap (UNI).

Bitcoin’s Journey Back To $96K And Beyond

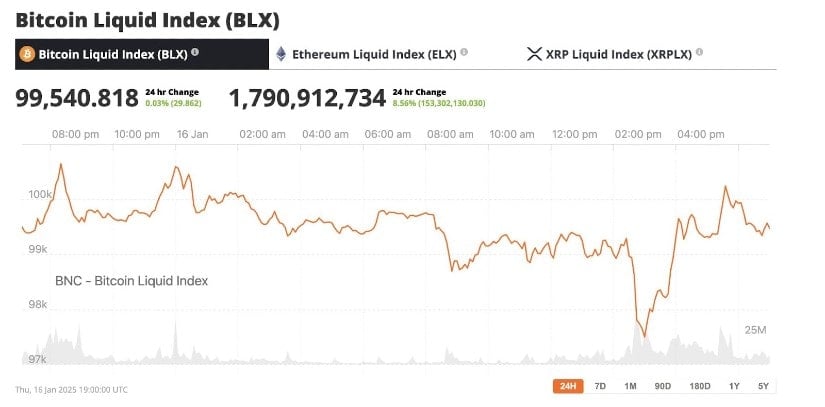

Following a dip down to $90,000 on January 13, Bitcoin experienced a significant surge and is currently trading at $99,580 (as of publication). This represents a 5.8% rise in the past 24 hours, according to data from Bravenewcoin. The recovery seems to be attributed to analysts’ observations.

- Speculation on Stable US Interest Rates: Promising employment data has sparked optimism about economic stability.

- Trump’s Pro-Crypto Agenda: Reports suggest plans for a crypto council, A Bitcoin Strategic Reserve, and relaxed SEC regulations, fostering investor confidence.BTC weekly price action.

Monero (XMR): Gearing Up For A Bullish Breakout Towards $259.64

In the bustling world of digital currencies, Monero distinguishes itself by its exceptional focus on user privacy. As financial regulations become stricter, Monero emerges as a decentralized choice that ensures absolute anonymity for its users. It employs advanced cryptographic methods like ring signatures and stealth addresses to make transactions untraceable, making it an appealing option for those who value privacy above other considerations.

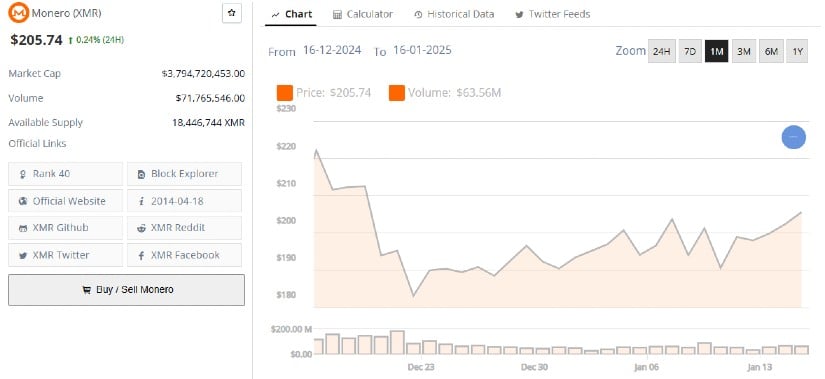

Monero currently stands at $205.63, marking a 4.45% gain for the week. It recently peaked at $206.77 following a rebound from a significant upward trendline that has served as support since November 2024. The technical indicators suggest positive momentum. The Relative Strength Index (RSI) is at 56.23, indicating there’s still potential for further growth before it becomes overbought. Moreover, the Moving Average Convergence Divergence (MACD) has crossed upward, signaling increased buying activity.

As an analyst, I’m observing a drop in volume to approximately $49.32 million, but open interest has surged by 4.96% to $19.74 million. This suggests that traders are positioning themselves for potential market volatility. Over the past 24 hours, we’ve witnessed around $92.18K in liquidations, predominantly impacting shorts. This could be indicative of further upward momentum.

The potential price range for Monero is currently between $230.57 and $259.64. Should it surpass the $230 mark, it might indicate a strong bullish trend, potentially pushing the price up to $260-$300, which represents a 26-46% increase. Conversely, if Monero fails to maintain its current position between $202 and $200, it may see a decline. If the price drops below $180.79, it could further drop to $167, representing an 18% decrease.

Investors seeking a promising cryptocurrency with strong potential for growth might find Monero appealing due to its robust privacy features and technical aspects. With the growing need for privacy technology, Monero is poised to capitalize on the heightened market attention and price fluctuations as demand escalates.

XRP: Peter Brandt Predicts XRP To $9.50

In financial circles, XRP continues to garner significant focus due to its part in cross-border payment systems. Following a string of victories by Ripple Labs in their legal battles with the SEC, investor trust in XRP as a global transaction asset has noticeably increased. This newfound faith is evident in XRP’s market behavior and price fluctuations.

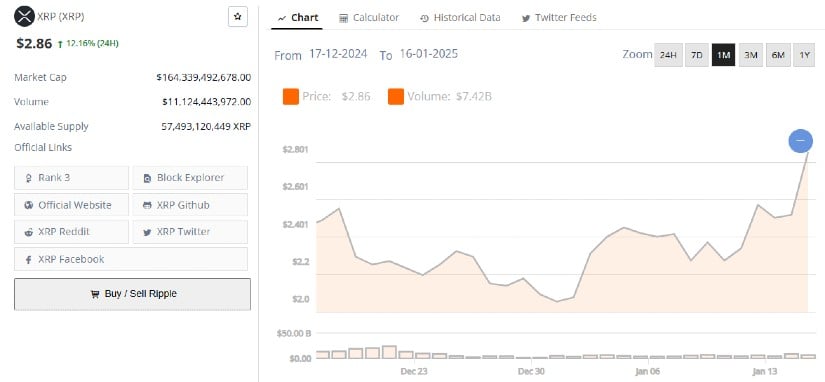

On January 11, Ripple’s XRP has burst free from a symmetrical triangle pattern, marking the start of a robust upward trajectory. With its 20-day Exponential Moving Average at $2.34 climbing and a healthy Relative Strength Index (RSI), there is potential for XRP to continue rising. If it manages to stay above the breakout point, the XRP/USDT pair could potentially aim for $2.73 and subsequently $2.91. However, these higher levels might trigger significant selling activity.

Following a certain pattern, an increase beyond $2.91 could lead to $4.84. Dropping below the 20-day Exponential Moving Average (EMA) may weaken the positive outlook and potentially cause it to decrease to around $2.20.

Recently, the value of XRP soared to a seven-year peak of nearly $2.90, thanks to positive developments in banking, ETFs, and bullish projections from industry experts. These analysts are forecasting that XRP could climb further, potentially reaching between $4 and $8 in the near future. Moreover, they predict that its market capitalization may surpass half a trillion dollars. The optimistic outlook for Ripple’s XPR suggests that the upward trend is likely to persist as individual investors increasingly invest in XRP.

Furthermore reinforcing the optimistic outlook, the number of XRP holders with significant amounts (1 million to 10 million XRP) has hit an unprecedented peak at 2,054 – up slightly from 2,004 in only a few days. This surge in whale activity suggests strong conviction and strategic hoarding by large-scale investors, which is a positive indicator.

Peter Brandt, a seasoned trader, has recently updated his pessimistic outlook on XRP and now anticipates its market capitalization to increase significantly with a projected price of $9.50 per unit. This shift in perspective from Brandt and the high level of whale activity suggests a strong conviction among investors regarding XRP’s potential future success.

Nevertheless, it’s crucial for investors to keep an eye out for potential reversals. Should XRP lose the $2.35 mark during a bearish trend, it may slide to retest $2.20 and potentially even dip to $1.99, indicating a more significant correction.

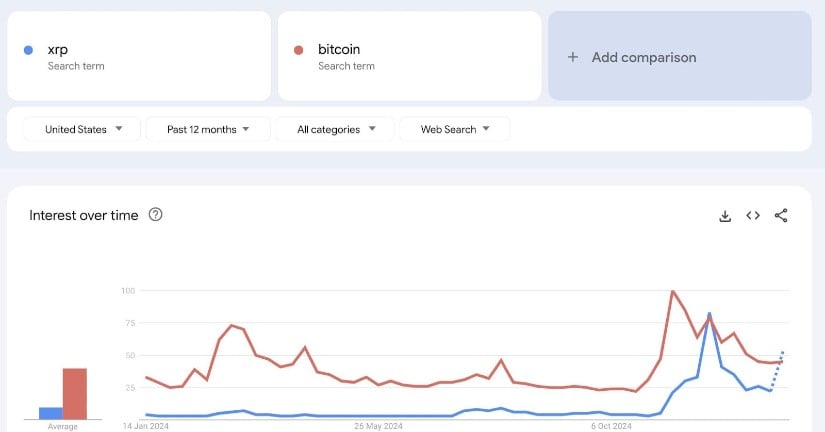

To put it simply, the latest data from Google Trends indicates a surge in public curiosity about “XRP” exceeding that of “Bitcoin,” demonstrating the growing fascination surrounding XRP.

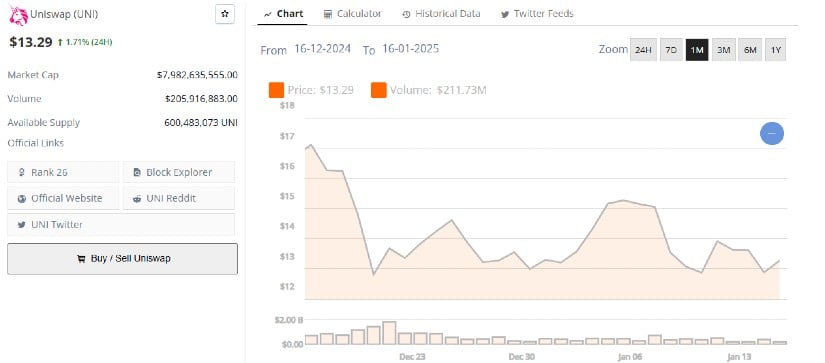

Uniswap (UNI): Market Expert Predicts UNI To $42.49

Uniswap continues to reign supreme within the Decentralized Finance (DeFi) sector, and recent advancements suggest promising prospects for even greater growth. Notably, there’s been a surge in whale activity, with a staggering 694% spike in large transactions over the past 24 hours. This upward trend could be an indicator of significant price movements to come for UNI.

As a researcher, I’m observing the current UNI price standing at $12. This level appears to be a strong support point. Analysts anticipate that if UNI maintains this position, it may challenge the resistance at $17. A break above this could pave the way for further gains and potentially new record highs.

The integration of Uniswap’s trading API with Ledger Live allows users to conduct trades directly from the Ledger platform. This enhancement provides greater convenience and security for trading on Uniswap. This development not only boosts the practicality of UNI, but also its potential as an investment.

The market data indicates that the proportion of long positions to short ones stands at 57%, implying there are more individuals betting on price increases rather than decreases. Additionally, the number of active Uniswap addresses has risen by 23%, suggesting an increase in user activity and investor confidence. In essence, this points towards a bullish market sentiment.

Regardless of the current fluctuations, UNI appears resilient, implying it has a robust base for potential future expansion. As per industry analyst Javon Marks, UNI has recently surpassed a prolonged downward trendline. He anticipates UNI to increase by approximately 200% and reach around $42.49 due to its technical and market indications.

Conclusion

These resources not only hold worth, but they also present chances to broaden your portfolio and capitalize on the upcoming surge in the cryptocurrency sector. A potential rise of Bitcoin to $100,000 serves as a powerful boost for the entire crypto market. Traditionally, altcoins have mirrored Bitcoin’s growth during bull markets and yielded greater returns. However, selecting the optimal altcoins involves technical analysis, assessing market trends, and comprehending the unique value each asset offers.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-17 15:41