A federal court has decided that over 94,000 Bitcoins, confiscated due to the well-known 2016 hack on cryptocurrency platform Bitfinex, should be returned to the exchange. This decision follows years of legal disputes and investigations, ultimately resulting in what the U.S. Department of Justice (DOJ) refers to as their largest asset forfeiture ever.

In 2016, hackers managed to redirect approximately $71 million worth of Bitcoin (equivalent to around 120,000 coins) from a Hong Kong-based exchange. Today, due to the significant increase in Bitcoin’s value, those coins are valued at nearly $12 billion. According to recent court documents filed on Tuesday, about $9 billion of the stolen cryptocurrency has been recovered.

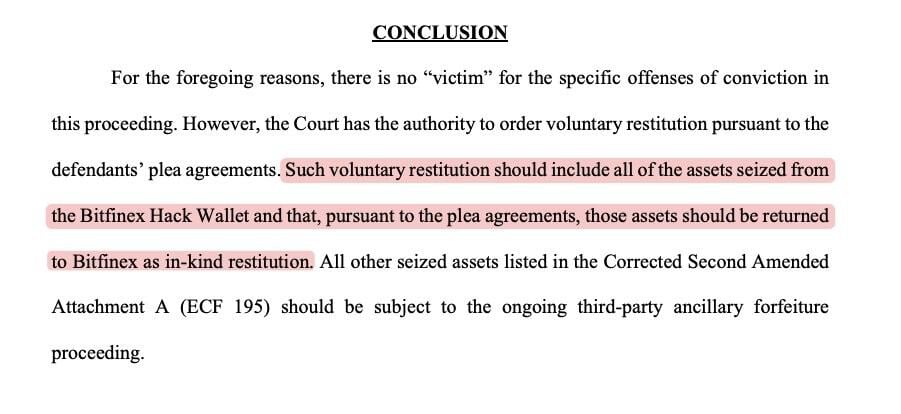

In the document they submitted, DOJ officials argued that Bitfinex, instead of its customers, should receive the confiscated assets. This stance was based on their interpretation that, under the applicable U.S. laws, there were no clearly defined “victims” for the crimes of money laundering and conspiracy, as the statute of limitations for the original hack had passed. The filing explained, “In this case, there is no ‘victim’ for the offenses of conviction,” and also mentioned the intricacy of the laundered transactions as a reason why not all stolen cryptocurrencies could be retrieved.

Laundering Scheme and Arrests

On Tuesday, the court decision brought fresh insights into the part played by Ilya “Dutch” Lichtenstein and his wife, well-known rapper Heather “Razzlekhan” Morgan. They admitted to money laundering related to the Bitfinex hack last year and are now serving their respective sentences. Lichtenstein, who confessed to masterminding the hack itself, is currently serving a 60-month term. Morgan, recognized by her stage name “Razzlekhan,” received an 18-month sentence for her role in laundering the stolen Bitcoin. The Department of Justice acknowledged that both individuals’ cooperation was instrumental in recovering a substantial amount of the funds.

Although Morgan starts her prison term this month, she has persistently followed her musical aspirations. Lately, she unveiled a song and video titled “Razzlekhan vs. The United States,” which she characterized as a “song for the outcasts.” Morgan claimed that the track is inspired by her case-related experiences: “The song is about defying the odds and supporting misfits like me,” she stated.

Impact on Bitfinex Customers

After the security incident in 2016, I distributed the losses evenly among all user accounts on Bitfinex, resulting in a 36% decrease in each balance. The platform issued BFX tokens, later followed by Recovery Right Tokens (RRT), as compensation. These tokens could be exchanged for cash or potentially transformed into shares of parent company iFinex. Bitfinex asserts that the majority of customers have been fully compensated, but some users challenge this assertion, particularly given Bitcoin’s price surge since then significantly surpassed the value of the tokens.

With the court mandating the return of 94,643 Bitcoins to Bitfinex, debates about who is eligible to claim a portion of these recovered assets have resurfaced. The Department of Justice has established a website where potential victims can submit their statements, and third parties have until January 28, 2025, to file objections or make claims. Legal experts anticipate that the restitution hearing, scheduled for February 25, 2025, could establish a precedent for how courts handle victim status in cases of cryptocurrency theft.

Future Proceedings

Apart from the main amount allocated for Bitfinex, authorities have also mentioned a legal process called “third-party ancillary forfeiture” to handle cryptocurrency that is either unrecovered or connected to money laundering operations. The government believes that any funds tied to money laundering should be addressed independently. This allows parties who feel they have a claim, like some Bitfinex customers, to present their case in court.

Bitfinex has once again affirmed its dedication to utilizing any retrieved funds to pay off the remaining RRT tokens, emphasizing that for legal purposes, it is the only victim of the 2016 hack. A representative from the company stated, “We’ve always held onto the belief that the stolen Bitcoins could be recovered.” They further added, “We are committed to tirelessly distributing the retrieved assets fairly.

The upcoming restoration hearing is considered significant. If the court rules entirely in favor of Bitfinex and allows it exclusive control over the recovered Bitcoins, this decision might severely limit options for account holders whose balances were reduced almost a decade back, as they may have little to no recourse left.

The El Salvador Connection

Paolo Ardoino, CEO of Tether and Bitfinex, has yet to respond to the proposal for the return of Bitcoin. However, he revealed this week to Reuters that Tether will be moving its headquarters to El Salvador. This would be the first time the company establishes a permanent office space. Currently, Tether employs over 100 staff members worldwide, most of whom work remotely. Ardoino and several top executives, including co-founders, plan to reside in El Salvador.

Ardoino stated that moving to El Salvador would mark our first establishment of a physical office. The forward-thinking policies and favorable regulatory landscape of the country align perfectly with our mission to promote cryptocurrency usage in developing regions.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-01-16 17:26