Regulatory Environment and Leadership Changes Under Trump

In the present regulatory climate, cryptocurrencies have faced tough challenges, as the Securities and Exchange Commission (SEC), particularly under Chair Gary Gensler’s leadership, has implemented rigorous regulations.

During Gensler’s term, there has been a strong focus on enforcing actions against numerous cryptocurrency entities, including Ripple. Nevertheless, following Trump’s election win, there is a sense that a more welcoming stance might emerge towards digital assets.

President Trump’s choice of Paul Atkins, who is well-known for his pro-cryptocurrency stance, as the new SEC Chair may indicate a possible relaxation in regulatory restrictions. It is expected that Atkins will advocate for clearer rules and a more favorable climate for crypto businesses, which could potentially bring significant advantages to Ripple.

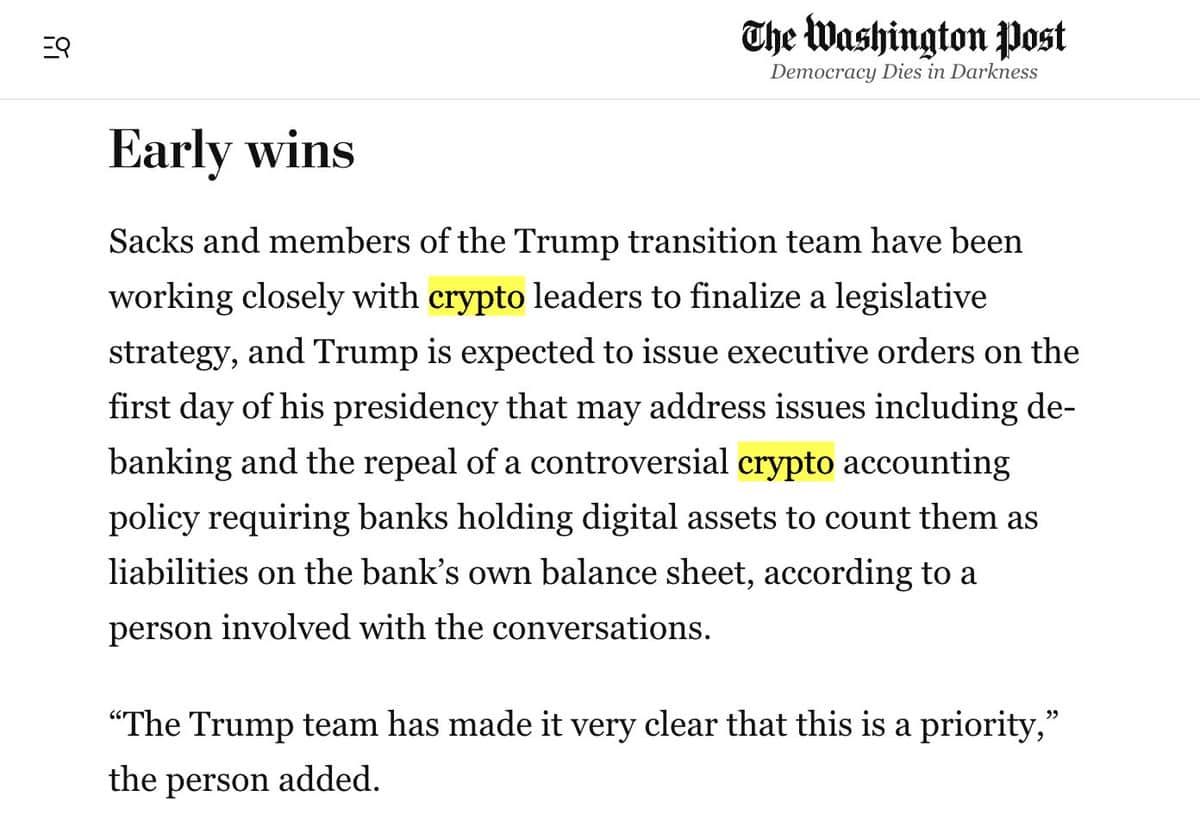

Here’s an exciting piece of news for all XRP and cryptocurrency enthusiasts and investors. Donald Trump has pledged to introduce favorable crypto policies through Executive Orders on his inauguration day.

These could include:

- Executive orders lifting or loosening crypto-focused regulations could come as soon as Day One.

- Eliminating the Biden-era crypto accounting rule, which forced banks to treat digital assets on their balance sheets as liabilities.

- Revoking Biden’s AI Executive Order: Many tech leaders say it stifled innovation.

- Supporting Crypto Freedoms: Expect a push to reduce the compliance burden that stifled many startups.

- Streamlining Federal Oversight: The new administration will push for a single, clear framework for crypto.

- Regulatory Clarity: The biggest reason crypto has been on a roller-coaster is unpredictability around regulations and enforcement.

- The approval of an XRP ETF. Bitwise has already applied for a spot XRP ETF. Approval is likely in early 2025.

- Bitcoin Strategic Reserve: The specifics remain uncertain, but clarity could emerge as early as day one of Trump’s administration. Advocates praise this as a bold step toward positioning the U.S. as a frontrunner in the rapidly evolving digital economy. By establishing a national reserve of Bitcoin, the administration intends to utilize the digital asset as a safeguard against fiat currency instability and looming global economic shifts. Such a move would likely drive Bitcoin’s price upward, prompting analysts to revise their 2025 price predictions even higher.

- All of the above factors provide extremely bullish tailwinds for the crypto market, XRP included.

Market Performance and Investor Sentiment

After Donald Trump’s win in the 2016 election, the value of XRP, a popular cryptocurrency, has significantly increased. In fact, it has climbed by more than 370%. This impressive rise is largely due to growing investor confidence in a regulatory climate that may be more favorable. Additionally, there’s optimism that the new administration will ease legal constraints on Ripple, specifically addressing the Securities and Exchange Commission’s (SEC) past claims that XRP was an unregistered security.

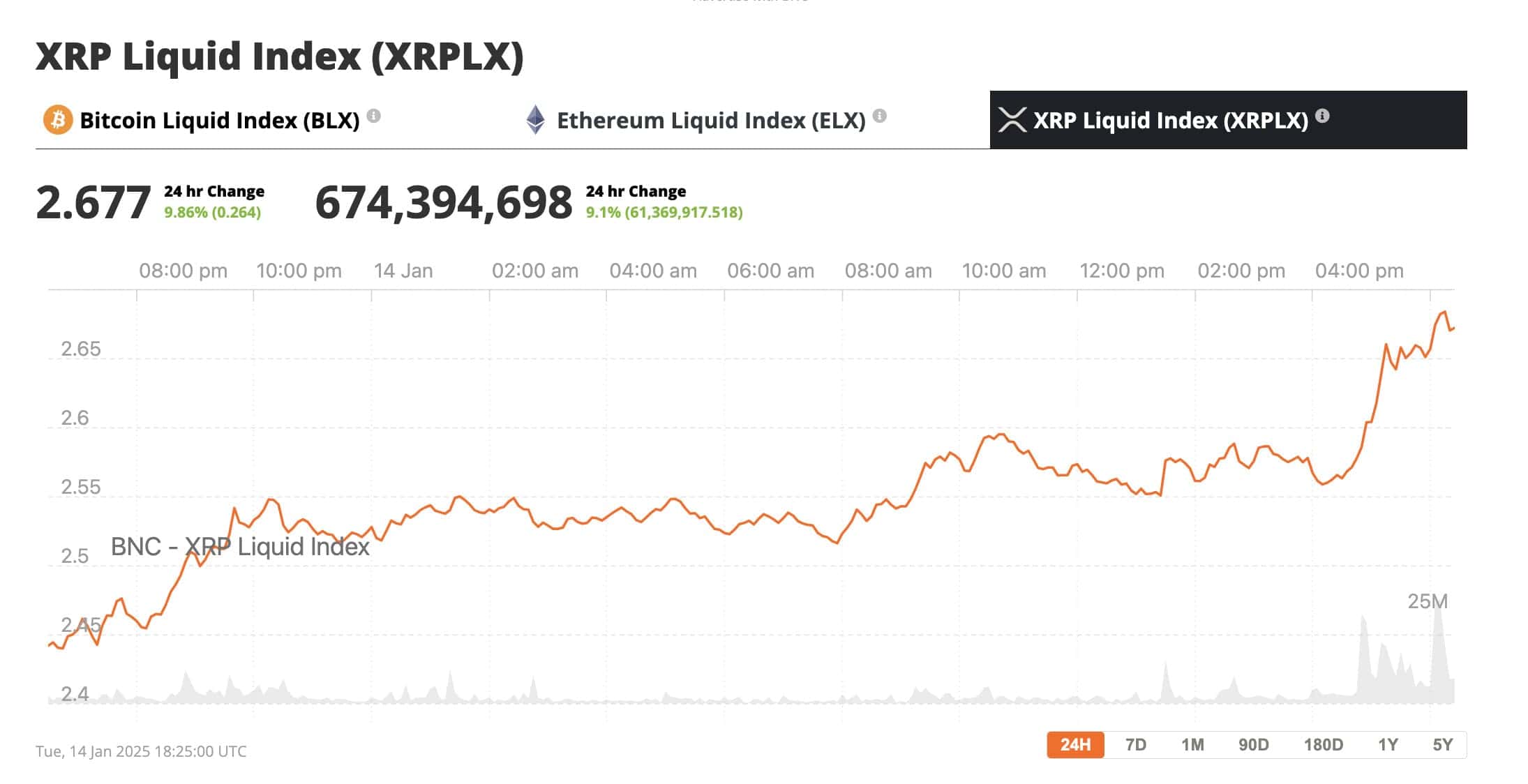

In the past 24 hours, XRP has surged by 9.8%, a sign that the market is recovering in expectation of President Trump’s inauguration.

Strategic Developments and Future Outlook

Ripple is actively working to solidify its role in the rapidly changing world of cryptocurrencies. The company has recently secured final approval from the New York Department of Financial Services (NYDFS) for its stablecoin, known as RLUSD, which is linked to the U.S. Dollar. This approval could significantly boost Ripple’s digital payment platform, potentially drawing in a larger user community and increasing the practical applications of XRP.

Beyond this, Ripple’s top executives have been conversing with the incoming government. Specifically, Brad Garlinghouse, Ripple’s CEO, and Stuart Alderoty, its Chief Legal Officer, recently held a discussion with President-elect Trump. This meeting suggests a possible shared vision and cooperative stance between them, aiming to jointly mold the destiny of digital assets within the United States.

As a researcher delving into the dynamics of the digital currency market, I find myself highlighting an intriguing development: Brad Garlinghouse, CEO of Ripple, has unveiled a strategic transformation within our organization. He ascribes this change to what he terms the “Trump effect.” Notably, 75% of our current job vacancies are now situated in the United States, a stark contrast to the past four years where we predominantly recruited internationally. This shift is a direct response to President-elect Donald Trump’s anticipated crypto-friendly policies, which Garlinghouse anticipates will stimulate innovation and employment growth within the U.S.

Garlinghouse pointed out that Ripple secured more domestic deals in the final six weeks of 2024 than in the preceding six months, suggesting a shift towards the US market. This is a significant change from a few years back when the company was contemplating moving its headquarters overseas due to regulatory pressures. At its peak of international growth, Ripple revealed that 95% of its clients were based abroad, showcasing its past concerns over US regulatory unpredictability.

The optimism arises from the belief that the new administration will foster a more welcoming climate for blockchain and cryptocurrency ventures. Garlinghouse has criticized the U.S. Securities and Exchange Commission (SEC), particularly under former Chair Gary Gensler, for essentially blocking Ripple’s domestic prospects for years. He expects this situation to improve following the November 2024 election results.

This tactical shift aligns with Ripple’s larger objective to invest back into its domestic market, focusing on positions within engineering and product development. Experts in the industry observe this action as a reflection of increased optimism among blockchain and cryptocurrency ventures operating within the United States.

Ripple’s Big Bet on Tokenization

Austin King, a longtime cryptocurrency businessman who sold his firm to Ripple back in 2019 and subsequently spent two years with them, recently disclosed his perspectives on Ripple’s grand schemes for the XRP Ledger (XRPL).

Through high-profile acquisitions such as Metaco and Standard Custody, and the introduction of Ripple USD (RLUSD), a stablecoin regulated by the New York Department of Financial Services, Ripple is strongly emphasizing asset tokenization and interoperability as its primary growth strategies for 2025 and beyond.

Last year, Ripple spent more than $250 million on acquisitions to strengthen its collection of custody solutions. The acquisitions of Metaco and Standard Custody are intended to improve Ripple’s infrastructure for managing tokenized assets and banking services. As per King, RLUSD signifies a significant step in Ripple’s strategy for tokenization, opening up new possibilities for the XRPL.

Working together, Ripple’s emphasis on asset tokenization through the XRP Ledger (XRPL) will generate income from both tokenization and transaction charges. This approach is similar to how Ripple has effectively employed the XRPL in its On-Demand Liquidity (ODL) services for international remittances.

Expanding Beyond XRPL: A 100x Opportunity

King posits that Ripple’s aspirations transcend XRPL and may facilitate bank-level tokenization across various blockchain networks in the future. His ongoing project, Omni Network, is designed to realize this vision.

According to King, his initial company was purchased by Ripple and specialized in interoperability. Now, with Omni, he’s aiming to facilitate the growth of tokenized banking assets across multiple blockchains on the XRP Ledger. He considers this as a 100x opportunity during this cycle.

Ripple’s efforts towards omni-chain tokenization could revolutionize how digital assets are utilized within banking and finance sectors. By driving the tokenization movement and investing heavily in their robust infrastructure, Ripple emerges as a pioneer in the upcoming phase of digital asset development. As demonstrated by King’s past achievements, Ripple’s approach to blockchain technology is rooted in innovation, compatibility, and scaling solutions for businesses.

Conclusion

Under a more cryptocurrency-inclined presidency during Trump’s term, favorable regulatory decisions, and active collaboration with policy makers, sets the stage for significant expansion for Ripple and XRP in 2025.

As the latest Consumer Price Index (CPI) report is released today, and with David Sacks’ and President Trump’s crypto initiative gaining momentum, it seems that the bullish sentiment is poised to regain control within the financial markets.

Keeping a close eye on these advancements is crucial for businesses and investors, as they could significantly impact the wider acceptance and seamless operation of digital assets within the financial sector. It’s anticipated that XRP will excel among altcoins in this market cycle, potentially reaching a new peak this year.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2025-01-15 00:37