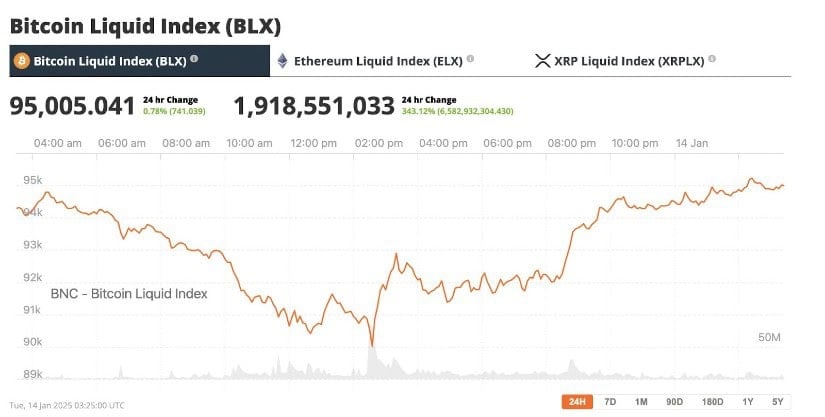

In anticipation of Donald Trump’s inauguration in the United States, there’s been an increase in discussions about Bitcoin possibly breaking through the $100,000 barrier. Notable blockchain analysis companies like CryptoQuant, Glassnode, and Santiment have reported that exchange reserves are at their lowest levels in almost seven years, which could indicate a potential shortage of supply in the market.

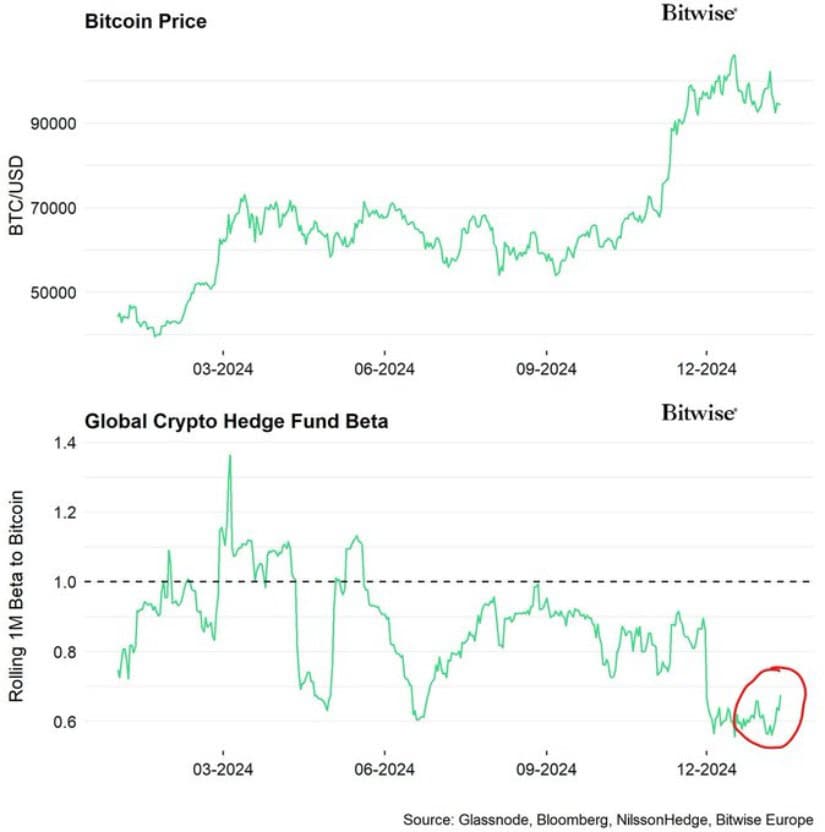

Bitwise researchers, headed by analyst André Dragosch, assert that hedge funds are purchasing assets at reduced costs, potentially exacerbating liquidity constraints. Simultaneously, Ryan Lee, the chief analyst at Bitget Research, points out that low trading volumes could continue to hinder a prolonged surge in prices.

The amount of Bitcoin stored on exchanges is currently approximately 2.35 million Bitcoins, a level not seen since 2018. As per Dragosch’s remarks on platform X, there’s an increase in hedge fund involvement with Bitcoin, as they are increasingly buying rather than selling the cryptocurrency. This suggests that institutional investors are preparing for a potential surge in Bitcoin’s value. This optimism is based on the possibility of Bitcoin exceeding the $100,000 mark, a psychologically important threshold.

While some indicators suggest a potential rally might be coming soon, other signs seem to hint at a delay. For instance, Santiment’s research indicates a decrease in total crypto trading volumes, which suggests that retail investors are still hesitant. This reduced activity could temporarily impede Bitcoin’s price increase according to experts like Lee from Bitget. In essence, even though the overall sentiment seems positive, technical analysis reveals low daily trading volume, implying there isn’t enough momentum at present to surpass current resistance levels.

Aditya Bhave, an analyst from Bank of America, suggests that worries about inflation might dampen the positive outlook for markets like Bitcoin. The minutes from the Federal Open Market Committee (FOMC) show concern about increasing prices, and if the Federal Reserve becomes less eager to lower interest rates, investments such as Bitcoin could be affected. Similarly, Michael Strobaek, the global investment chief at Lombard Odier, cautions that economic issues, including possible tariffs and a stronger U.S. dollar, might outweigh the positive factors for Bitcoin’s supply growth.

Despite some skepticism, there’s a strong belief among market participants that Bitcoin holds potential. For instance, Whale Alert, a service monitoring large cryptocurrency transactions, has observed substantial transfers of Bitcoin from exchanges to private wallets, suggesting that major investors are stockpiling the digital currency. Eloísa Cadenas, the chief innovation officer at Monetae, views these outflows as an indication of renewed investor trust. She speculates that if the current buying trend persists, Bitcoin might surge past the $100,000 mark soon, which could trigger further growth.

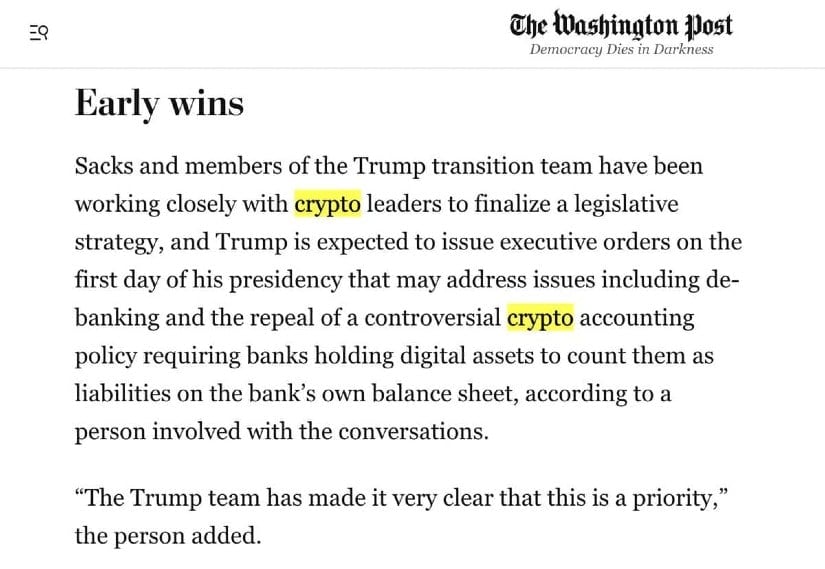

Essentially, reaching six-digit figures with Bitcoin relies on multiple factors: accumulation by institutions, low exchange reserves, and the potential for a lenient monetary policy. For now, though, the market seems optimistic about Trump, so we’ll be closely watching Bitcoin in search of the “Trump Boost”.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2025-01-14 13:36