In the past 24 hours, VIRTUAL has suffered the greatest loss among significant altcoins, plummeting by 15%. This decline builds on a seven-day fall of 43%. As a result, its market capitalization currently hovers around $1.5 billion. Interestingly, most major AI coins have faced severe corrections over the past week, which might explain this steep drop in value for VIRTUAL.

Essential measures such as RSI and BBTrend suggest that the market is overly sold, suggesting a possible recovery, but the downward trend still holds significant momentum. At present, VIRTUAL hovers close to crucial support at $2.23. Its upcoming action may decide whether it will bounce back or face a potential 48% decline, reaching $1.20, which could represent a significant correction.

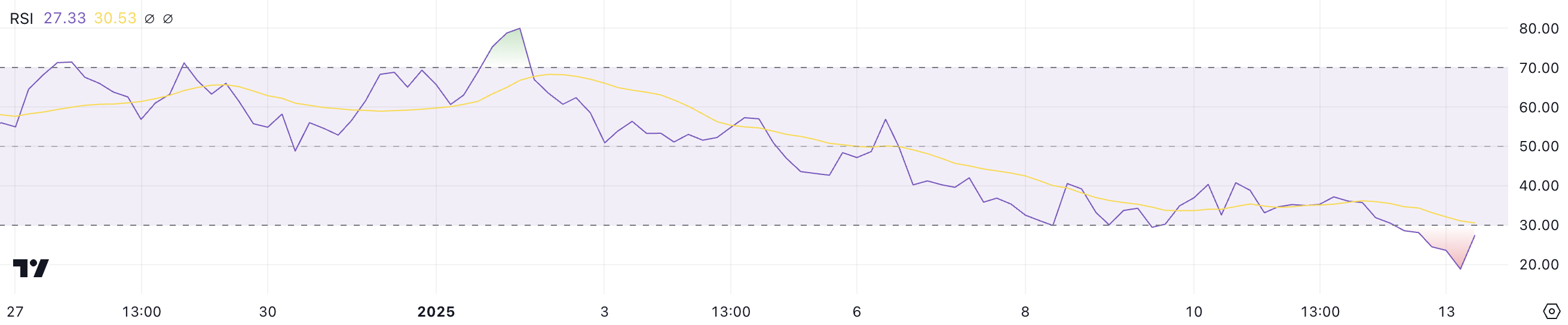

VIRTUAL RSI Hit Its Lowest Levels In 5 Months

Right now, the Virtual RSI stands at 27.3, slightly recovering following its dip to 18.7 a short while ago. These figures represent the lowest RSI values for Virtual since August 2024, indicating extremely oversold conditions. The RSI (Relative Strength Index) is a popular tool that helps determine if an asset is overbought or oversold, with values ranging from 0 to 100.

Generally speaking, when the Relative Strength Index (RSI) is less than 30, it usually means the market is oversold and could bounce back. On the other hand, if the RSI exceeds 70, it often signals an overbought market, implying a potential pullback may occur.

Based on VIRTUAL’s Relative Strength Index (RSI) being at 27.3, it signals that the asset is still in an oversold state. This situation may suggest a possible short-term price increase might be approaching, as oversold conditions frequently draw buyers who seek bargain entry points.

If the downward trend continues for VIRTUAL, it might struggle to maintain its position among the leading artificial intelligence coins, potentially dropping further in rank.

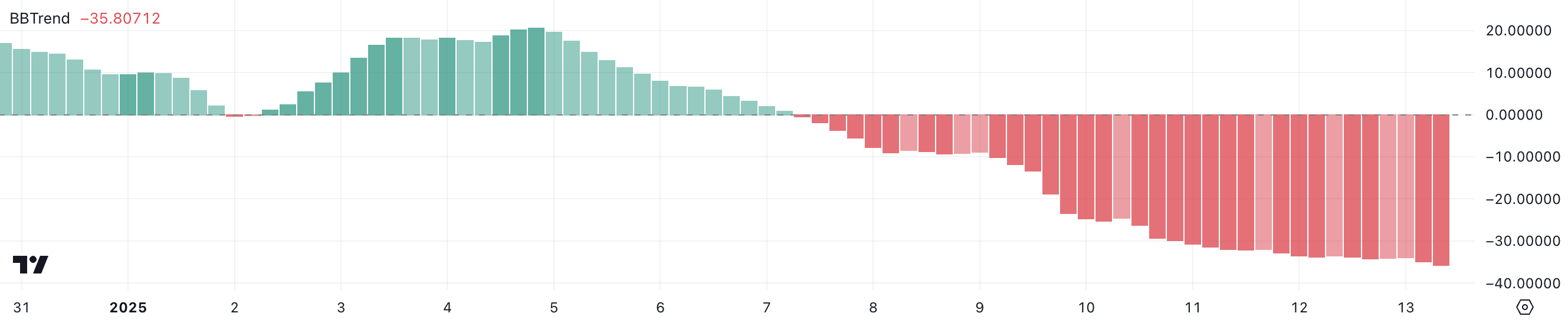

VIRTUAL BBTrend Is Breaking Negative Records

The VIRTUAL’s Bollinger Band Trend (BBTrend) stands at -35.8 right now, which is its lowest point since August 8, 2024. For the past six days, it has stayed in the negative territory, indicating persistent bearish influence. The BBTrend is a measurement derived from Bollinger Bands, a tool employed to assess market trends and momentum.

In simpler terms, high positive figures usually mean a market is on the rise, showing a trend towards increasing prices (bullish), while low negative numbers often signal a falling market, indicating a trend towards decreasing prices (bearish).

Using VIRTUAL’s BBTrend at -35.8 suggests a powerful downward trend and significant selling force. At such low readings, it usually means the asset has been heavily sold off, suggesting that market equilibrium or an upturn may occur if there is increased buying interest.

If the BBTrend persists in being negative and keeps falling, this might indicate a possible decrease for VIRTUAL, particularly when the overall market situation remains challenging.

VIRTUAL Price Prediction: A Further 48% Decline?

In simpler terms, the short-term trend line created by VIRTUAL’s Exponential Moving Averages (EMA) has recently dropped beneath the long-term trend line. This is a bearish technical indicator known as a “death cross,” suggesting potential downward price movements.

This indicates a possible strengthening of downward trend, as the estimated price for VIRTUAL stands at a crucial support point of $2.23. If this support weakens, the price might drop significantly to around $1.20, representing a potential adjustment of 48% from its current value. This downturn could lead to VIRTUAL falling below the $1 billion market cap threshold, which would separate it from other AI-based cryptocurrencies such as RENDER and TAO.

If the opinion about crypto AI agents in the market becomes more positive and VIRTUAL’s price starts to climb (an uptrend), there’s a chance that the price could bounce back and attempt to break through the resistance at $2.81.

Overcoming the current obstacle could enable the VIRTUAL price to pick up speed again and rebound towards $3.27, suggesting that it’s recovering after its recent downward trend.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-01-14 01:58