A Presidential Pitch at Bedminster

A report from The Washington Post states that the foundations for a fresh friendship were laid during a dinner at Donald Trump’s private golf club in Bedminster, New Jersey, last summer. This was actually their first encounter, as Marc Andreessen, who is renowned for inventing the modern web browser and co-founder of the influential venture capital firm Andreessen Horowitz, had never met Trump prior to this occasion.

Trump’s stance is clear: He aims to have American technology surpass China, eliminate regulatory hurdles, and boost rapid-growth sectors, such as cryptocurrency. Given Biden’s administration’s efforts to restrict crypto and other emerging technologies, Andreessen perceived a significant chance to shift focus towards promoting innovation.

Silicon Valley’s Renewed Courtship of Washington

During Biden’s presidency, some members within the venture capital sector believed they were excluded from Washington policy discussions. However, now, Andreessen Horowitz and other prominent investors perceive an opportunity to push forward a fresh “Little Tech” strategy, particularly in the realm of cryptocurrency.

Newfound Ally in the White House

- Andreessen’s role: He’s been quietly helping Trump’s transition team assemble the new administration, lending his tech-startup-style recruiting prowess to find top talent for everything from defense to intelligence to crypto oversight.

- Other tech heavyweights visiting Mar-a-Lago: People like Elon Musk, Jeff Bezos, Mark Zuckerberg, David Sacks, and Sundar Pichai have made pilgrimages to Trump’s Florida estate, signaling a renewed push for friendly relations with the White House.

- Behind the scenes:

- Andreessen’s influence runs far deeper than just tech or economic policy hires. The Post says insiders suggest he’s been tapped for input on key picks at the Defense Department and intelligence agencies.

- Trump’s willingness to collaborate has resonated with a segment of Silicon Valley leaders who had grown disillusioned with the Biden administration’s “burdensome” regulations.

- David Sacks has been appointed “AI and Crypto Czar.” Sacks, a former PayPal executive and close associate of Elon Musk, is set to steer U.S. policy in the Silicon Valley sectors of artificial intelligence and cryptocurrency.

A “Boot Off the Throat”

During an interview on the Joe Rogan Experience (episode #2234) in December 2024, Andreessen expressed his viewpoint that Trump’s presidency represented a liberating moment for the startup sector, offering a more welcoming atmosphere for artificial intelligence, cryptocurrency, and other cutting-edge technologies. This is particularly significant for fledgling companies with limited resources to maneuver through complex regulations.

Additionally, Andreessen and Rogan touched upon various significant issues, underscoring Andreessen’s tech-oriented viewpoint and the ongoing societal swing towards conservative perspectives.

Debanking and Financial Exclusion

Andreessen expressed worries about the phenomenon of “debanking,” which involves individuals and businesses, especially those associated with right-wing perspectives or cryptocurrency sectors, being deprived of banking services. He argued that this practice, possibly shaped by government policies, threatens financial accessibility and liberty.

Critique of ‘The Deal’ and Philanthropy

The individual in question spoke about the weakening of what he referred to as “The Agreement,” a longstanding belief among tech entrepreneurs that they could invent, earn profits, and eventually give back philanthropically without encountering negative societal reactions. Andreessen pointed out a change in cultural perspective, particularly on the left, where philanthropy is now met with suspicion. Critics argue that wealth redistribution should be handled by the government rather than individuals.

Political Realignment and Support for Donald Trump

Andreessen noted a major shift in political attitudes, expressing optimism towards America’s future. He pointed out that the latest election outcomes have sparked hope within his circle, signifying a break from past post-election feelings. Andreessen’s financial contributions to pro-Trump super PACs reflect his faith in the prospect of positive transformations under the new government.

Advancements in AI and Future Warfare

The discussion additionally covered the swift progress in artificial intelligence (AI) and its potential impact on future conflicts. Andreessen underscored that AI might reshape military tactics significantly, as AI-managed systems may surpass human capabilities. He stressed the importance of ethical deliberations and legal guidelines to supervise AI innovation and implementation.

Cultural Shifts and Wokeism

Andreassen spoke out against the emergence of “Wokeism,” pointing out its absence of principles like redemption and forgiveness, which are found in conventional religions. He suggested that this cultural transformation has resulted in heightened division and the squelching of innovative thoughts since Wokeism inherently leans towards totalitarian rule. Andreassen underscored the significance of creating a space open to fresh ideas to prevent societal immobility and decay.

Trump’s Top Tech & Crypto Hires

- David Sacks—co-founder of Craft Ventures—has been tapped as Trump’s AI and crypto czar. Expect him to be front and center of any conversation about rolling back Biden-era “obstacles” on cryptocurrency and streamlining regulation.

- Jacob Helberg—a former Palantir adviser—has been selected for a senior post at the State Department, underlining how tech-savvy voices will shape foreign and economic policy.

- Jared Isaacman, who’s famously traveled to space via SpaceX, is Trump’s pick for NASA Administrator. It’s a nod to the synergy between Musk’s aerospace ambitions and the new administration’s “America First” approach to space.

Crypto Investors, Rejoice

Here’s some exciting news for all cryptocurrency enthusiasts and investors! Andreessen Horowitz, an early supporter of Coinbase, continues to be a strong advocate for the potential future of cryptocurrencies. However, under the administration of President Biden, the crypto sector has faced increased scrutiny.

- “De-banking” concerns: Some crypto companies and even individual users found traditional banks reluctant to serve them, citing new compliance requirements.

- Harsher regulations around exchanges, stablecoins, and mining operations.

But in Trump’s new term, insiders say:

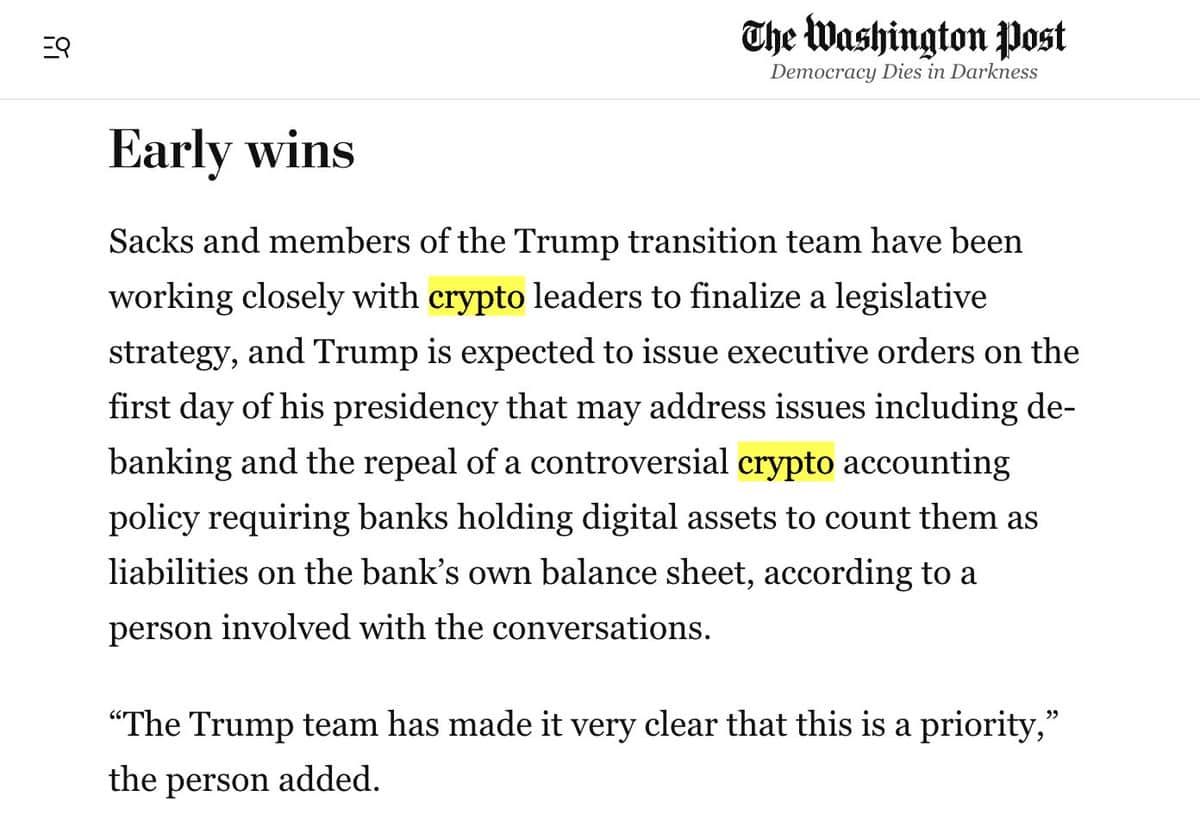

- Executive orders lifting or loosening crypto-focused regulations could come as soon as Day One.

- There’s talk of eliminating the Biden-era crypto accounting rule, which forced banks to treat digital assets on their balance sheets as liabilities.

- The Trump team may look to slash red tape around AI, a boon for many of the data-driven crypto analytics startups out there.

“America First” on Crypto

At an exclusive lunch gathering at Mar-a-Lago towards the end of last year, David Sacks presented proposals for significant changes in regulations concerning AI and cryptocurrency. Should these plans be implemented by Trump, it’s likely that we will witness a more favorable environment for businesses and increased focus on innovation.

Planned Moves:

- Revoking Biden’s AI Executive Order: Many tech leaders say it stifled innovation through mandatory “fairness” protocols they call vague or “woke.”

- Supporting Crypto Freedoms: Expect a push to reduce the compliance burden that stifled many startups.

- Streamlining Federal Oversight: The new administration might push for a single, clear framework for crypto, which would be music to investors’ ears.

A New “Crypto Ball”

As a researcher examining the intersection of politics and technology, I am observing an intriguing development: some supporters are labeling President Trump as the “first crypto president,” indicating a shift in the political landscape that they believe is favorable to cryptocurrencies. Notably, tech industry heavyweights like Peter Thiel are arranging a “Crypto Ball” during the inaugural celebrations, suggesting a potential deepening of the alliance between the new administration and crypto leaders.

Potential Hurdles

As a crypto investor and supporter of conservative circles, I understand that not everyone is entirely on board. Some influential figures within the MAGA movement harbor concerns about Silicon Valley’s dominance, labeling it “techno-feudalism.” Stephen K. Bannon, a former key adviser to President Trump, has been vocal in his criticism of the “sociopathic overlords” in Silicon Valley, fearing they could amass excessive economic and cultural power.

Currently, Trump seems to be aligning himself with influential figures in artificial intelligence and cryptocurrency. Notably, over a dozen key roles within the White House and government departments are being filled by individuals associated with Andreessen Horowitz, Elon Musk, or Peter Thiel.

Why This Matters for Crypto Investors

-

- Regulatory Clarity: The biggest reason crypto has been on a roller-coaster is unpredictability around regulations and enforcement. A friendlier administration could bring the clarity that crypto and blockchain startups desperately need.

- Bitcoin Strategic Reserve: What this will look like is still unclear. But we should know as soon as day 1 of Trump’s administration. Advocates hail it as a forward-thinking move to position the U.S. as a leader in the emerging digital economy, while critics question its practicality and implications. By creating a national reserve of Bitcoin, Trump’s administration aims to leverage the digital asset as a hedge against fiat currency instability and potential global economic shifts. This strategy could provide the U.S. with a powerful tool to counterbalance rising financial threats from nations like China, which are heavily investing in their own digital currencies. Additionally, a Bitcoin reserve will symbolize a broader embrace of blockchain technologies, signaling to innovators and investors that the U.S. is serious about leading the next wave of financial innovation. It will also make the Bitcoin price go up. It means that 2025 price predictions for Bitcoin will have to be pushed higher again.

- Green Light for Financial Innovation: By easing rules and relaxing the threat of investigations, the new administration might spark another wave of venture capital investments into crypto projects.

- Competition with China: Trump is on record wanting the U.S. to stay ahead of China in emerging tech. Crypto, AI, and quantum computing all play major roles in that race. Investors could see strategic partnerships, tax incentives, or research grants funneled into the space.

AI Impression of a Bitcoin Strategic Reserve and geopolitics at play

Final Thoughts

The bond between Trump and Silicon Valley seems stronger and more practical than ever before. Important dinners at Bedminster and Mar-a-Lago are serving as platforms for creating partnerships and attracting new talents – individuals who carry a penchant for swift innovation and a strong pro-cryptocurrency perspective. For investors eager to see the U.S. regain its status as the world leader in digital assets, this emerging alliance could be the spark needed. For those considering when to invest in Bitcoin or wondering which cryptocurrency to choose, now may just be the ideal moment.

As Trump prepares for his second term and influential figures advocating for cryptocurrency take on important roles, it’s not unthinkable that we could see a resurgence in Bitcoin, blockchain technology, and artificial intelligence. If this strategic plan comes to fruition, crypto enthusiasts might find the slogan “Get ready for launch” fitting for the next four years.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2025-01-14 00:47