Last week saw a relatively small influx of around $48 million into cryptocurrencies. This inflow mirrors the fluctuating market reactions to changing economic markers worldwide and the latest adjustments in U.S. monetary policies.

The marked shift observed from the initial week of 2025 suggests that the short-lived post-US election market surge might be over, as economic factors are now back in control of asset values.

Hawkish Fed Affects Crypto Inflows

As an analyst, I observed a notable shift in digital asset investment trends during the recent week ending January 11. Initially, we witnessed nearly $1 billion inflow into these assets during the first half of the week. However, the unexpectedly robust macroeconomic data and the subsequent release of the US Federal Reserve’s minutes sparked a reversal in the second half of the week, resulting in outflows amounting to approximately $940 million.

The report indicates that the initial period of goodwill following the US election has come to an end, and once more, economic data on a large scale (macroeconomic data) is influencing the value of assets.

Last week’s FOMC meeting minutes indicate that the Federal Reserve is becoming increasingly anxious about potential inflationary impacts. This apprehension stems particularly from the anticipated fiscal policies of the incoming president, Donald Trump.

The briefing suggested that there might not be an immediate reduction in interest rates, reinforcing the Federal Reserve’s aggressive stance towards monetary policy. According to BeInCrypto’s report, this approach has contributed to a decline in various risky investments, such as cryptocurrencies.

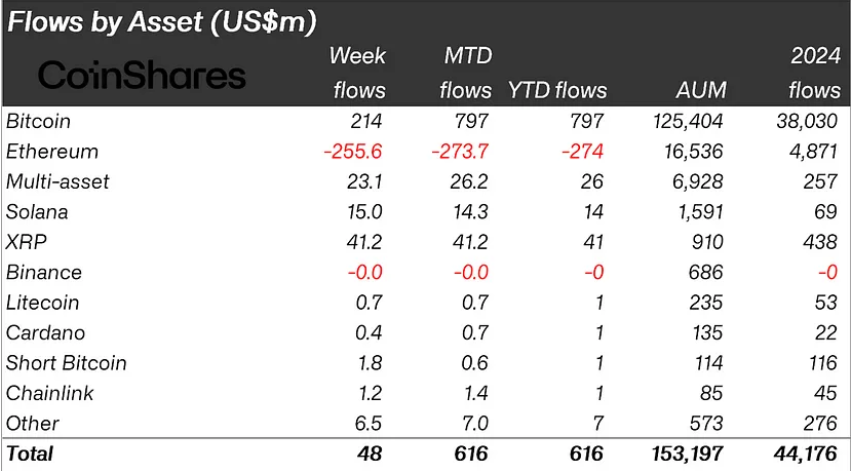

Bitcoin, the top digital currency, showed a common pattern recently. It had influxes of approximately $214 million early in the week, but later saw substantial outflows, echoing broader market trends. However, it’s important to note that Bitcoin still leads all digital assets in performance this year, having received a total of about $797 million.

2025 began with great promise for cryptocurrencies, as a staggering $585 million flowed in during the first week of the year. However, this positive trend has been halted due to recent economic developments that have cooled excitement.

As macro trends regain their importance in shaping market dynamics, upcoming key US economic data releases later this week may sway Bitcoin and crypto market sentiments significantly. More specifically, the Consumer Price Index (CPI) and Producer Price Index (PPI) will play crucial roles in predicting the economy’s direction, which could, consequently, impact investor confidence regarding cryptocurrencies.

Keeping a close eye on Consumer Price Index (CPI), Producer Price Index (PPI) reports, and jobless claims, investors are seeking any indications of decreasing inflation or cooling labor market trends. Such insights could hint at the Federal Reserve’s upcoming decisions, thereby offering a more defined perspective on the digital asset markets.

Although there’s a temporary obstacle right now, the future prospects of cryptocurrencies appear bright as we approach President Trump’s inauguration next week.

Based on information from BeInCrypto, Bitcoin currently stands above the significant $90,000 mark, trading at approximately $91,565 at this moment. However, the trend seems to favor a drop as demand weakens, leading some analysts to predict another potential decline for Bitcoin, with a possible bottom around the $70,000 area.

As a researcher examining Wyckoff’s Distribution strategy applied to Bitcoin, my findings indicate potential price levels that could materialize. These include the significant milestone of approximately $80,000, with an even higher possibility around $70,000.

Read More

2025-01-13 19:54