Bitcoin‘s price is trending lower and hovering near the significant support level of $90,000, as a prolonged market sell-off persists. Over the last seven days, its value has dropped by more than 8%, causing some investors to worry about possible additional decreases.

Due to a decrease in demand from buyers and less involvement from institutions, there’s a possibility that Bitcoin might dip below $90,000 in the short run, for the following reasons:

1. Declining buying pressure: This means that fewer people are interested in buying Bitcoin at its current price level, which can lead to a decrease in its value.

2. Drop in institutional participation: Institutional investors, such as banks and hedge funds, play a significant role in the crypto market by buying large amounts of Bitcoin. When their participation decreases, it can negatively impact Bitcoin’s price.

Bitcoin Struggles as Institutional Confidence Wanes

In the one-day BTC/USD chart, Bitcoin (BTC) currently sits below the red line of its Super Trend indicator. This tool helps identify the direction and intensity of an asset’s price movement. When the line is green, it indicates an upward trend, while a red line signals a downward trend.

If an asset’s price dips below its Super Trend line, it often suggests a downtrend with reduced buying interest. This trend change is often perceived by traders as either a prompt to sell or a warning of potential risks ahead.

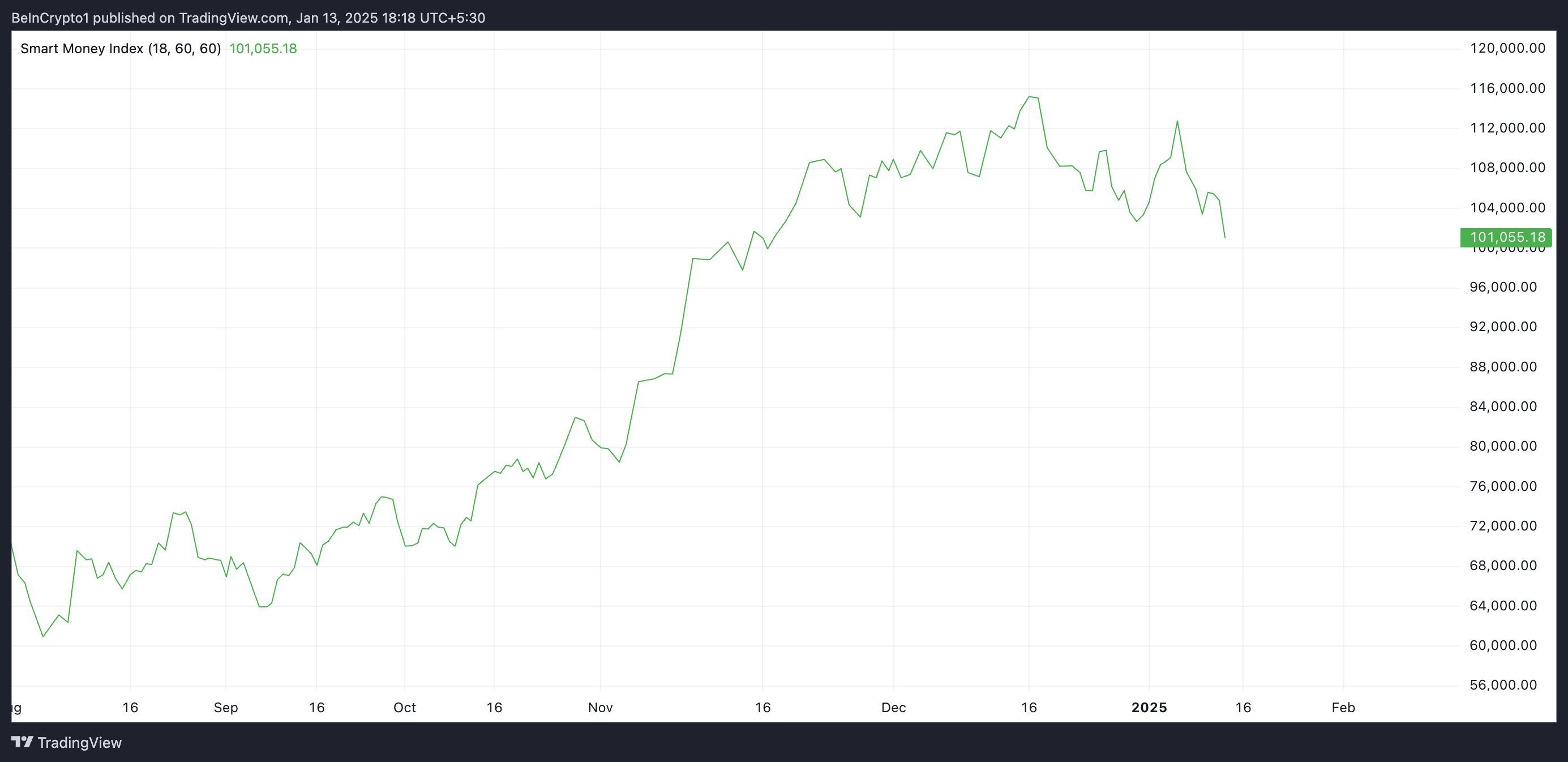

Furthermore, the Smart Money Index (SMI) for Bitcoin has consistently dropped since January 6. At present, the index stands at approximately 101,055, representing a decrease of around 10% since that date.

A Statistical Measurement of Investor Sentiment (SMI) monitors the actions of seasoned or institutional investors by examining market trends during the initial and closing hours of trading. When this index goes up, it implies higher buying activity from these investors, indicating a growing level of trust in the asset, demonstrating their increased confidence.

Alternatively, a drop in SMI indicates increased selling actions and decreased confidence among these investors, which may signal a possible short-term decrease in Bitcoin’s price.

In a more current update on platform X, seasoned cryptocurrency trader Peter Brandt endorses a pessimistic perspective. Based on his analysis, the daily price trend of Bitcoin appears to be suggesting the possible development of a head and shoulders (H&S) peak pattern.

As a crypto investor, I’ve come across a Head and Shoulders (H&S) pattern, which is quite intriguing. It comprises three significant highs: the middle one, dubbed the “head,” is the highest, with two slightly lower highs on either side, known as the “shoulders.” The line that connects the lowest points of these shoulders is referred to as the “neckline.

According to Brandt’s analysis, when it comes to Bitcoin (BTC), there are three possible outcomes for the Head and Shoulders (H&S) pattern:

1. The H&S pattern may finish as expected, leading the price trend towards its predicted target.

2. Alternatively, the pattern might not fulfill itself, creating a bear trap instead, which could potentially attract more buyers, causing a price increase.

3. Lastly, the H&S pattern could evolve into a larger and more intricate pattern, requiring further analysis to predict its potential impact on BTC’s price movement.

BTC Price Prediction: Bearish Pattern Emerges

A decrease in interest for Bitcoin might signal a continuation of its downward trend and a possible drop in its value. If so, the cryptocurrency may dip below the $90,000 mark, potentially trading near $85,224.

On the other hand, a shift in market trends could propel BTC’s price to $102,538.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- The Last Of Us 2 Teaser: Pedro Pascal And Bella Ramsay Promise An Emotional-Tense Ride In The First Glimpse Of The Post-Apocalyptic Drama

2025-01-13 16:13