In the realm of digital currencies, KuCoin Token has taken the lead as the top performer, experiencing a 3% increase in value over the last day. This price rise has generated significant earnings for some investors who have held the token in the short term.

On the other hand, the type of investors who usually seek rapid profit from market fluctuations may pose a risk to the long-term success of KCS‘s recent growth. Here’s the reasoning behind this.

Short-Term Holders Put KuCoin Token at Risk

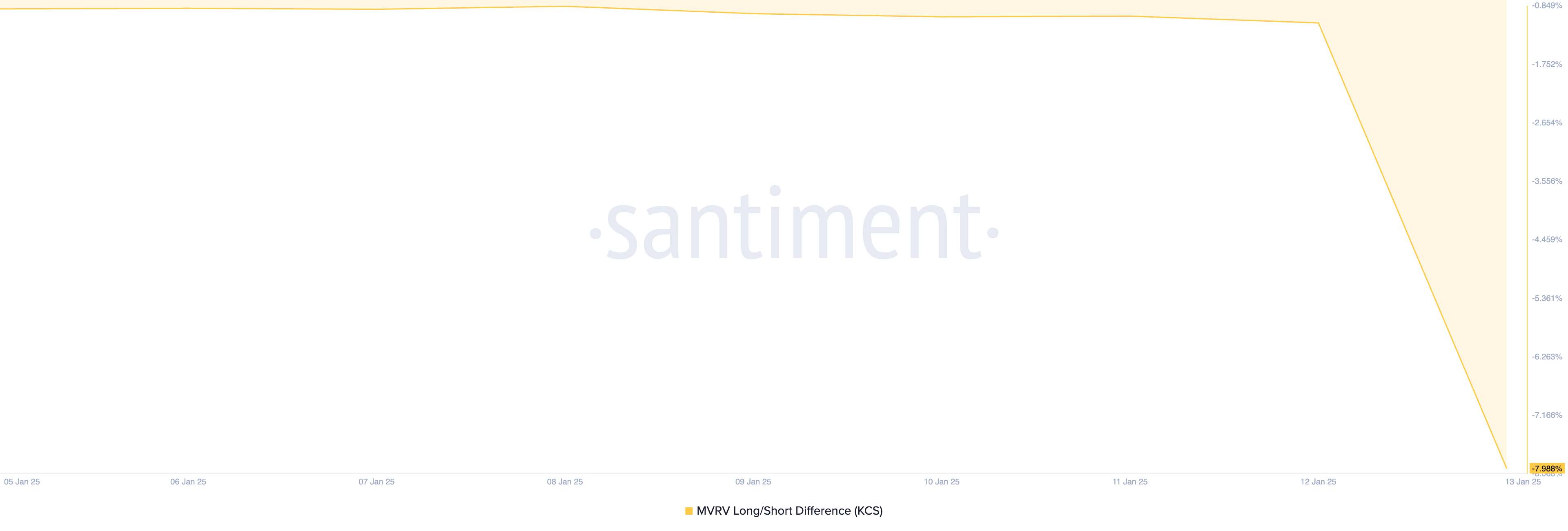

Over the last 24 hours, there’s been a significant surge (376%) in KCS trading activity, causing its price to climb by 3%. This spike has resulted in numerous KCS holders realizing a profit, as indicated by the MVRV Long/Short Difference readings. At present, this figure stands at a 30-day low of -7.98%, suggesting that many are currently making a profit rather than holding at a loss.

The MVRV Long/Short Difference of an asset evaluates the comparative profitability between those holding it long-term and short-term. If the metric has a positive value, this implies that long-term investors are doing better financially. This suggests a bullish outlook and possibly more price growth ahead.

Conversely, much like KCS, if there’s a negative difference, it implies that Short-Term Investors (STIs) are earning more, indicating a bearish outlook and the possibility of a price decrease. These investors, who usually don’t hold assets for long periods, tend to cash out their tokens during short-term price fluctuations to reap profits.

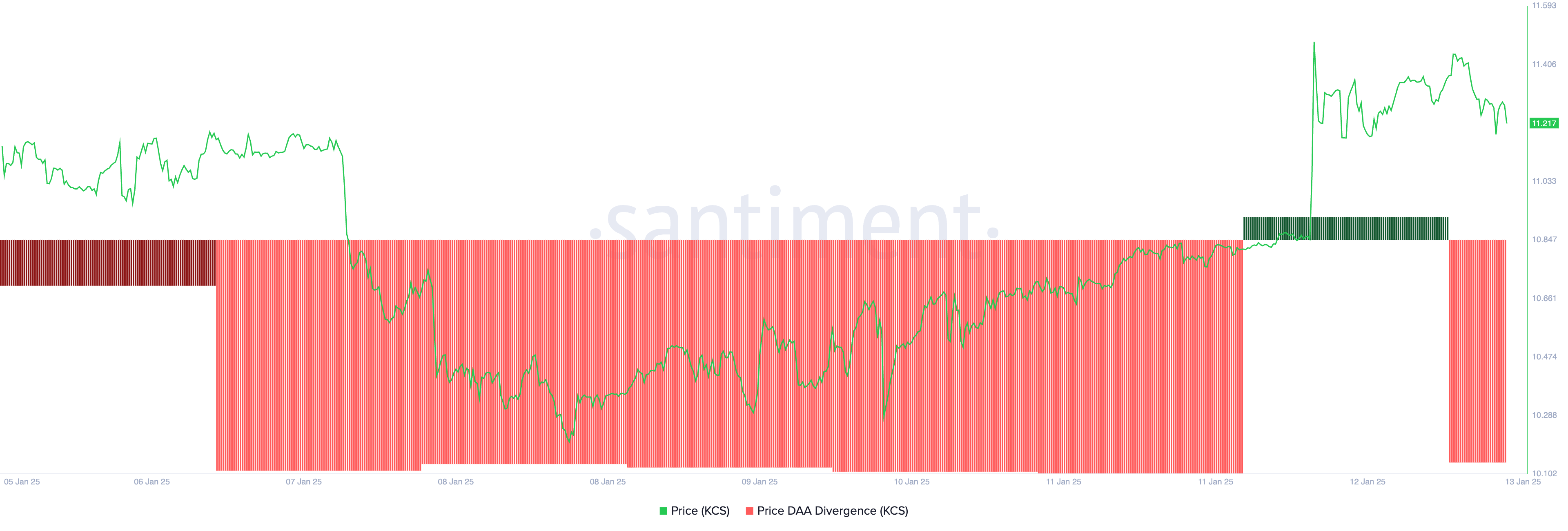

Even though the cost of KCS increased, its Daily Active Addresses Divergence signal is indicating a possible sell today instead.

As a crypto investor, I’ve noticed an interesting pattern: The price seems to be surging, but the network activity doesn’t appear to back up this rally. This could indicate underlying vulnerabilities. If this trend continues with speculators cashing out, I believe a reversal in KCS price is just around the corner.

KCS Price Prediction: Bearish Divergence Points to Potential Reversal

Looking at the daily chart for KCS/USD, there appears to be a developing bearish pattern known as divergence between the altcoin’s price movement and its Chaikin Money Flow (CMF). Currently, the CMF is trending downwards towards 0.01, suggesting it might drop below the zero line in the near future, which could signal potential downward price action for KCS.

The Capital Movement Factor (CMF) of an asset indicates the movement of money entering and exiting its market. If it decreases during a price surge like this, it creates a bearish divergence. This divergence hints that there’s growing selling pressure, which might question the durability of the current upward trend.

Should KCS’ Capital Market Fluctuation Index (CMF) drop below zero, indicating a rise in selling pressure, the price is likely to shift direction and decrease towards approximately $10.15.

If the purchasing power grows stronger, the current bearish view might not hold true. Under such circumstances, the price of KCS may break through the resistance at $11.42, potentially rising towards $13.82.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-13 15:21