As a crypto investor, I’ve seen a 13% decline in the price of my Cardano (ADA) holdings over the past week, which means that fewer of my ADA coins are currently in profit. Interestingly, on-chain data indicates that about 3.55 billion ADA coins have shifted from being held by profitable investors within this seven-day span.

With bullish sentiments weakening, it’s probable that Cardano (ADA) will persist in its downward trend, potentially leading to an increase in the possibility of more losses, thereby raising the risk of decreased holdings in profit.

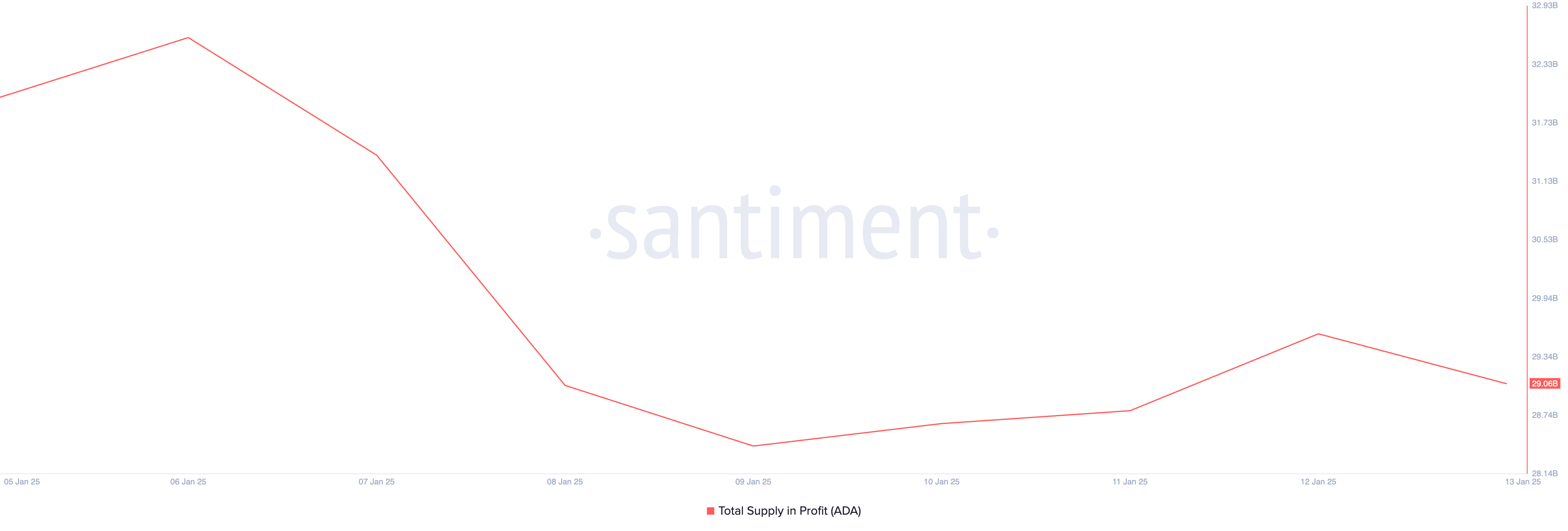

Cardano‘s Supply in Profit Dwindles

Based on Santiment’s data, the amount of Cardano (ADA) in profit has decreased by approximately 3.55 billion units over the past week. At present, about 29.06 billion ADA coins, representing around 68% of the total supply, are being held at a profit. This suggests that a large number of investors currently hold ADA at a loss, signaling increased selling activity and a potential downturn in market sentiment.

The heightened demand to sell ADA is likely because its value has consistently decreased throughout the specified timeframe. Currently, ADA is being traded at approximately $0.93, which represents a 13% drop in its worth over the last week.

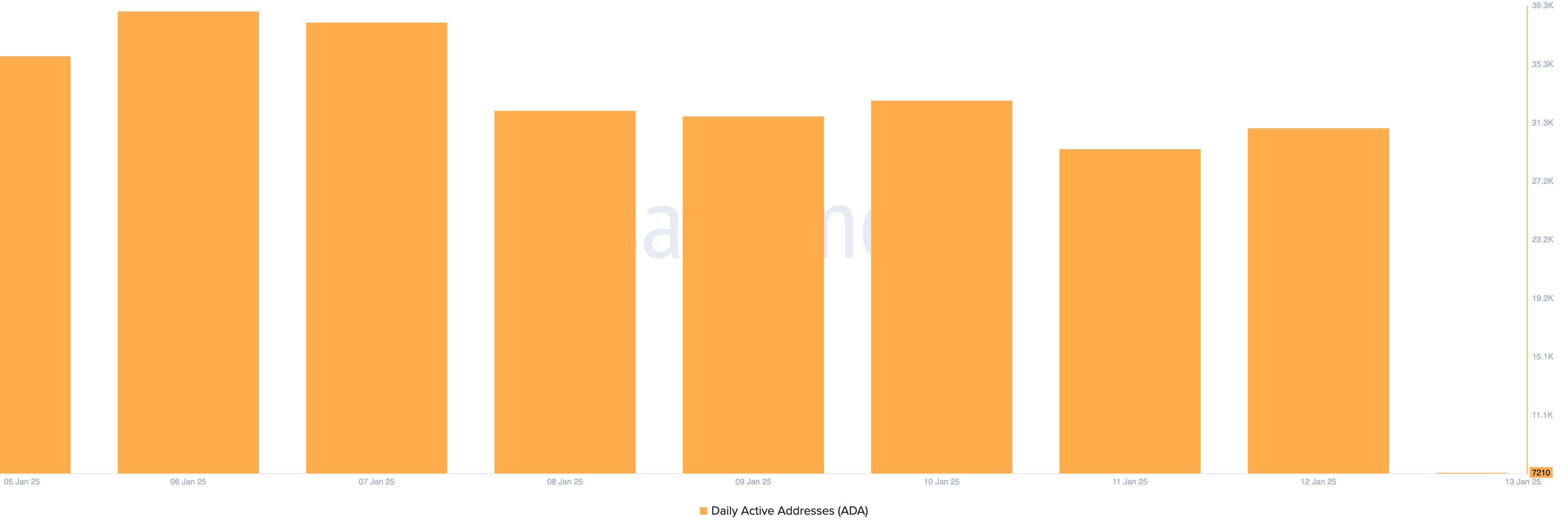

Besides the general market dip observed during that time, it appears that the decrease in ADA’s price is partially influenced by reduced activity on the Cardano network. According to Santiment’s data, there has been a significant drop of approximately 81% in the daily count of unique addresses executing at least one transaction with ADA over the last week.

The decrease in the number of daily addresses on the Cardano network may indicate less user interaction and reduced usage, leading to decreased interest in ADA and contributing to its downward pricing trend.

ADA Price Prediction: Will It Fall to $0.85 or Rally to $1.12?

The ADA’s Daily RSI (Relative Strength Index), a measure of the altcoin’s demand, currently indicates a decrease in interest as it sits below the median line at 46.83 during the current update.

The RSI (Relative Strength Index) tool assesses the extent to which an asset’s market is overbought or oversold. This index varies between 0 and 100. A reading above 70 signifies the asset might be overbought, meaning a drop could occur soon. Conversely, a reading below 30 indicates the asset may be oversold, implying it could potentially experience an upturn.

46.83, currently showing a descending pattern, indicates that the Relative Strength Index (RSI) for ADA is predominantly influenced by selling forces. This could potentially lead to additional price drops if purchasing activity does not intensify.

Should purchasing interest continue to dwindle, the value of the coin could drop down to $0.85. Conversely, if there’s a shift in market attitude and intense buying of ADA occurs, its worth might surge towards $1.12.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-13 13:49