If approved by Congress, Scott Bessent, who was nominated by President-elect Donald Trump for the position of Treasury Secretary, may need to undergo a substantial financial overhaul.

This procedure involves selling off various assets that don’t align with the ethical guidelines applicable for holding public office.

Bitcoin ETF Stake Under Review for Treasury Nominee

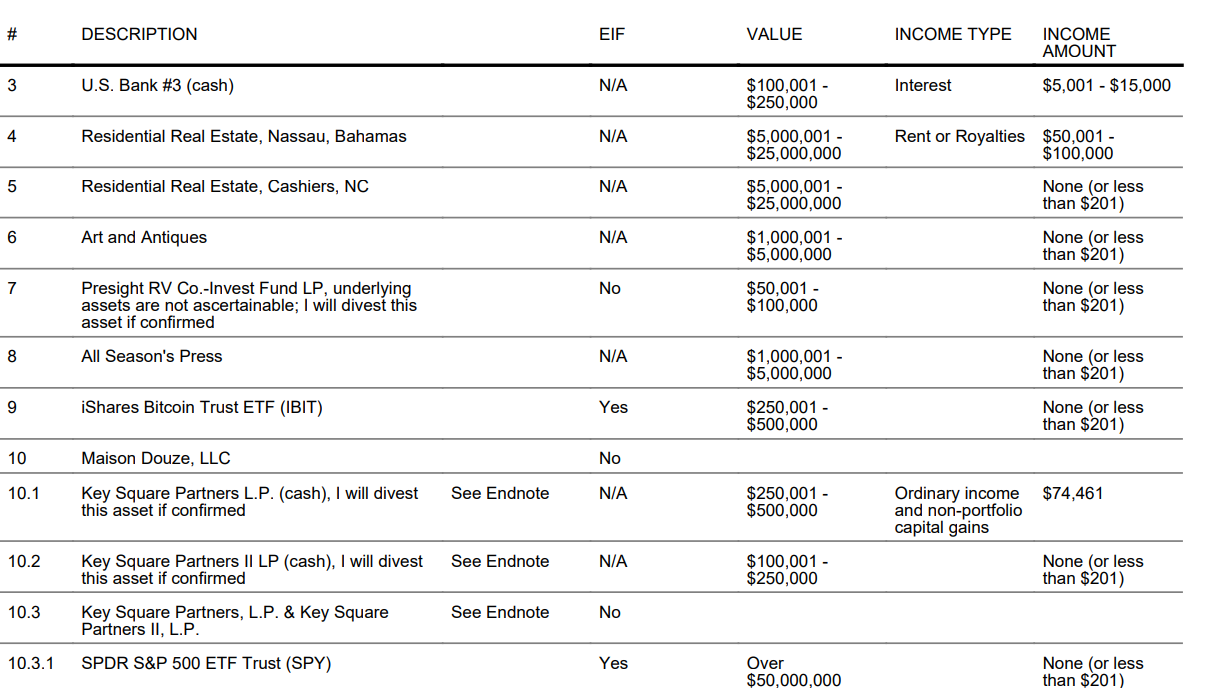

Bessent owns a sizable portion of BlackRock’s Bitcoin exchange-traded fund (ETF), IBIT, worth between a quarter of a million and half a million dollars. This ETF administers more than $50 billion in assets, making it the world’s largest spot Bitcoin fund in terms of asset value.

Bessent’s approach to investing mirrors his strong advocacy for cryptocurrencies. As a prospective Treasury Secretary, he has been an advocate for its use as a means of financial freedom and a suitable choice for youthful investors looking for options beyond conventional finance.

Beyond just his Bitcoin ETF holdings, Bessent’s financial disclosures show a broad and extensive portfolio with various investments. Among these are significant positions in well-known ETFs like the SPDR S&P 500 Trust (SPY), Invesco QQQ Trust (QQQ), and Invesco S&P 500 Equal Weight ETF (RSP). Furthermore, he has minor holdings in gold and silver trusts, indicating a wider interest in different types of investment assets.

According to the disclosure, his overall wealth is estimated to be around 521 million dollars. The report reveals substantial investments in areas like hedge funds, U.S. Treasury bonds, and foreign currency markets.

To prevent possible conflicts of interest should Congress approve Bessent’s appointment, it is necessary for him to dispose of some of these assets within 90 days. Additionally, he plans to step down from his position at Key Square Group, the hedge fund he established, and offload his company shares.

In the meantime, Matthew Sigel, who leads research at VanEck, has brought up doubts as to whether Bessent might likewise have to offload his Bitcoin ETF shares. Importantly, Bessent’s financial declarations pointed out the resources he would need to relinquish.

The confirmation process for him has been set for January 16, 2025. In his capacity as Treasury Secretary, he is expected to significantly contribute to the economic plans of the new government and help design initiatives for monetary and fiscal restructuring.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-12 23:05