Solana’s current price fluctuations suggest its struggle to maintain the $200 mark as a reliable support base. The cryptocurrency has been consistently moving near this significant price threshold, mirroring the overall apprehension in the wider market.

Under changing market circumstances, there could be signs pointing towards a possible turnaround, leading potentially to an upward trend.

Solana Investors’ Profits Dip

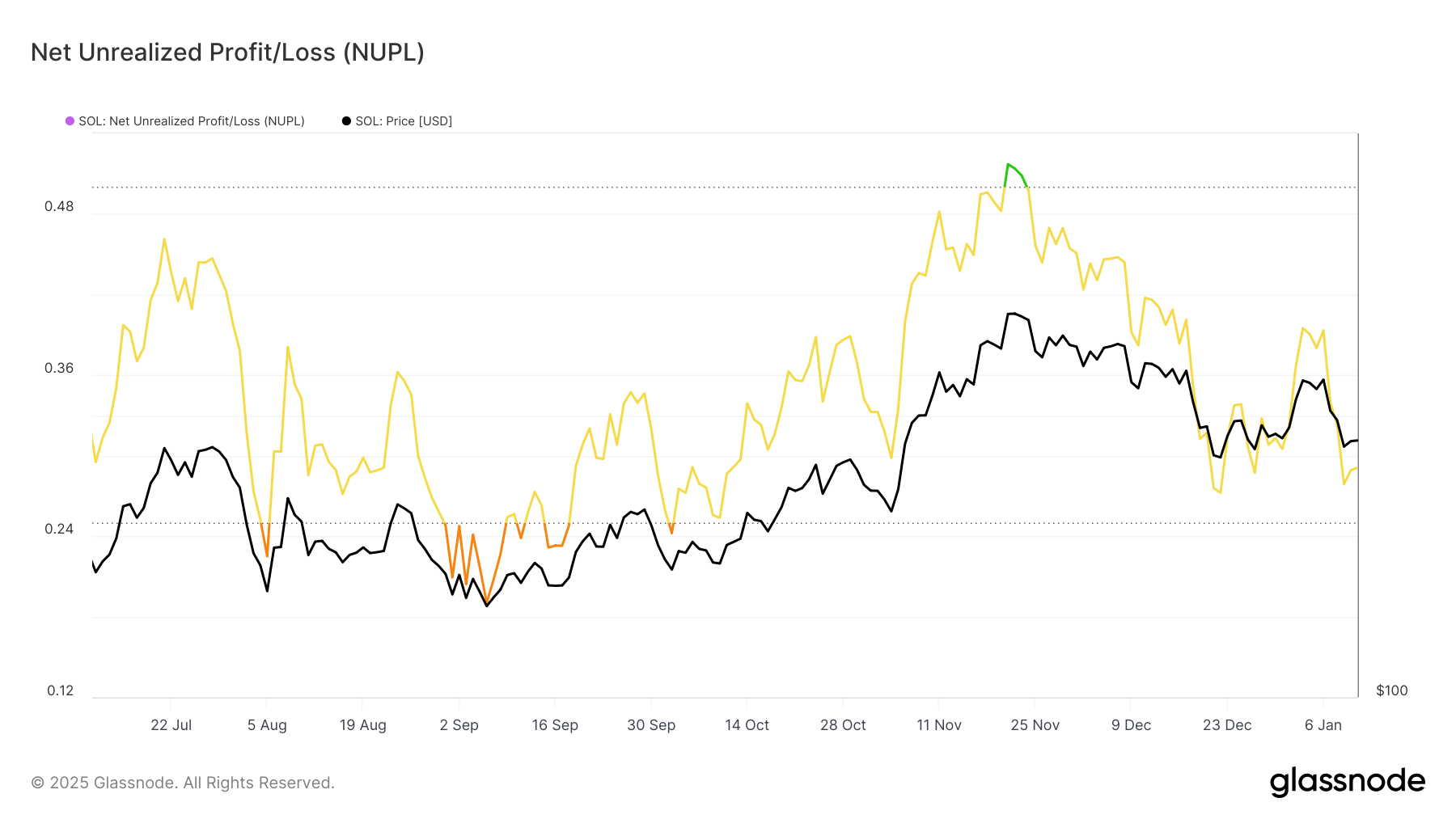

As Solana’s Net Unrealized Profit/Loss (NUPL) approaches the “Caution Zone,” it suggests investors are becoming more cautious. Historically, when we see a dip into this zone, prices have tended to rebound as the market finds its footing. This trend hints that Solana might follow suit if unrealized profits keep declining.

As I analyze the current market trends of Solana, it’s evident that investor sentiment plays a crucial role in predicting its future price movements. If the Network Value to Realized Price (NUPL) shifts into the Fear Zone, this could potentially spark renewed buying activity among investors. This increased buying activity, fueled by optimism, might serve as the catalyst required to propel Solana back into a bullish phase, marking its return to an upward trend.

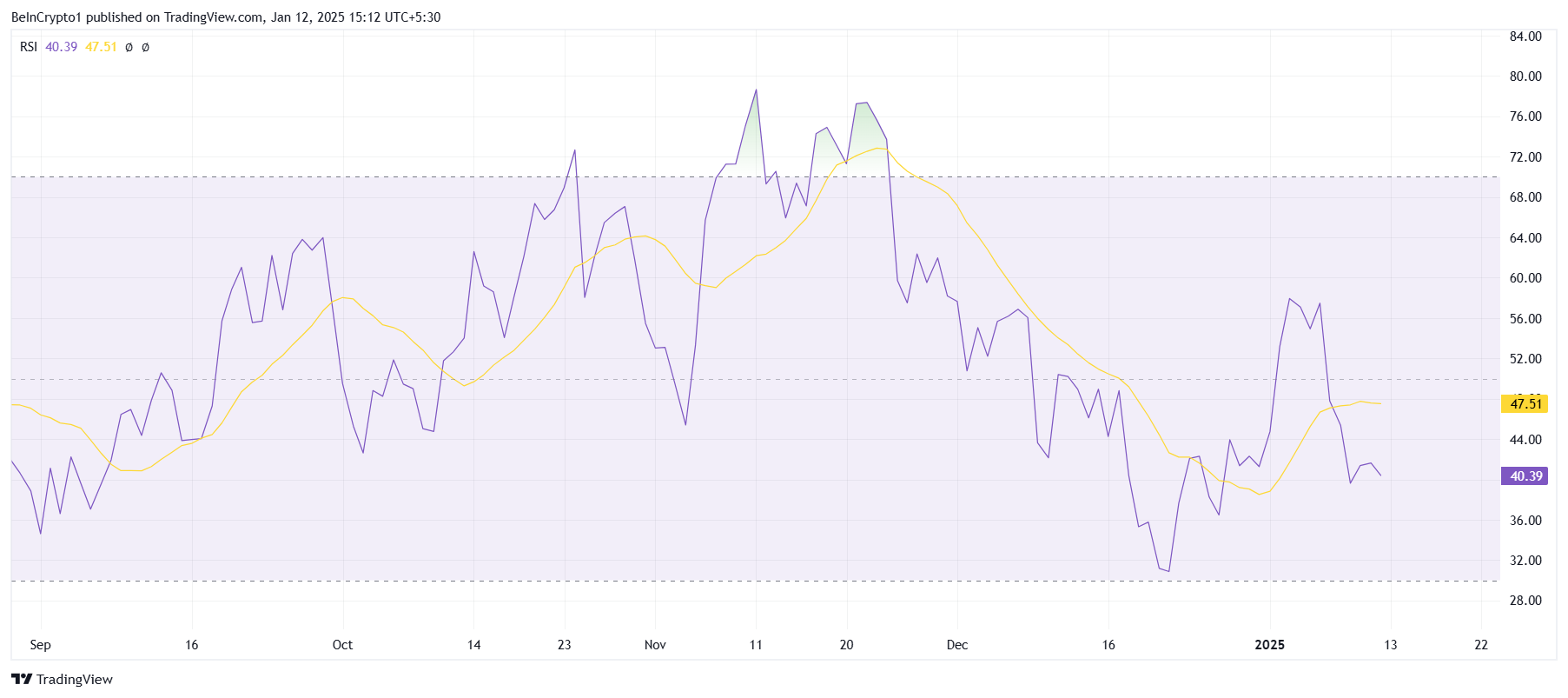

Solana’s overall momentum appears to be bouncing back. The Relative Strength Index (RSI), which dipped close to oversold levels last month, has recently shown a rebound. Although the RSI hasn’t yet solidified the 50.0 line as a support, its upward trend indicates a growing bullish energy that might gain strength in the forthcoming days.

As the RSI (Relative Strength Index) continues to get better, it mirrors market signals, suggesting a possible change in trend. If Solana keeps building momentum, it might boost investors’ trust and pave the way for a prolonged rebound beyond crucial price thresholds.

SOL Price Prediction: Reclaiming Support

In the beginning of January, Solana’s price momentarily surpassed the $201 resistance, only to subsequently drop by 15%, returning to the support level at around $183. This downward trend indicates the market’s persistent volatility, but it also sets the stage for potential recovery if crucial factors improve.

If the mentioned factors persistently grow stronger, Solana may once again establish $200 as a supportive floor. With continued momentum, its price could potentially rise to $221, which would not only offset recent declines but also indicate the start of a more robust upward trajectory.

If Solana can’t surpass the $201 resistance level, there could be an extended period of price fluctuation around $183. Should it lose this support, a potential drop to $169 may follow, which might dampen optimism and slow down any attempts at recovery. This situation would underscore the difficulties Solana encounters in establishing a clear upward trend.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-01-12 21:08