In the year 2024, Senator Cynthia Lummis proposed legislation that instructs the U.S. Treasury to buy up to a million Bitcoins over a five-year period. This daring decision, backed by President-elect Donald Trump, is perceived as a significant shift in the world of cryptocurrencies.

A Transformative Initiative

According to digital asset research firm CoinShares, the potential influence of the Bitcoin Act on Bitcoin’s acceptance might be just as broad as any effect seen thus far, even surpassing the significant impact when ETFs enter the market in 2024. In a recent blog post, CoinShares emphasized that this Act could elevate Bitcoin to a more recognized asset class, with the backing of the world’s most prominent government.

The proposed Bitcoin Act could significantly boost Bitcoin’s reputation among institutional investors, as it might help alleviate the concerns and negative perceptions they currently face.

The suggested law aligns with the growing tendency among nations who view Bitcoin as a crucial reserve asset. Nations such as El Salvador, Brazil, and Russia have started integrating Bitcoin into their financial structures, acknowledging its possible role as a protective measure against financial instability.

Potential Market Ripple Effects

As a crypto investor, I find myself intrigued by the predictions of analysts regarding the potential impact of a strategic Bitcoin reserve in the U.S. Such a move might trigger a wave of unexpected demand, propelling Bitcoin’s value to uncharted peaks. The CEO of Blockstream, Adam Back, even posits that if this legislation is enacted and other nations adopt similar strategies, Bitcoin could soar beyond $1 million per coin—an astounding prospect indeed!

As a crypto investor, I can’t help but envision the ripple effects if such a move were to take place – a surge in nation-states adopting Bitcoin, drastically reshaping the global financial terrain.

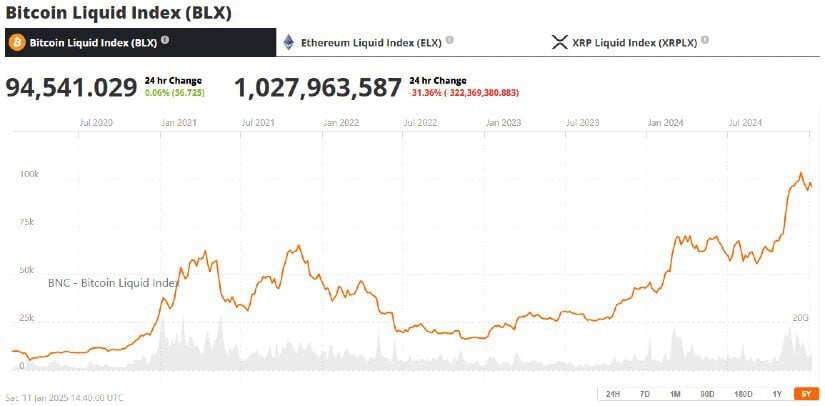

The Act aligns well with the increasing institutional fascination towards Bitcoin, as demonstrated by the escalating investments in Bitcoin ETFs. According to Bloomberg Intelligence, Bitcoin ETFs surpassed a net asset value of $100 billion by the end of 2024, and an additional $48 billion in investments is expected in 2025.

Challenges and Alternative Pathways

Although it holds great promise, the Bitcoin Act encounters considerable political obstacles. To get this bill passed in Congress, there needs to be strong bipartisan backing, but whether that will happen is unclear. Yet, a draft of an executive order has leaked, which suggests a quicker possible approach.

As a crypto investor, I’d rephrase that as: “The potential executive order suggests the U.S. Treasury would integrate Bitcoin into the Exchange Stabilization Fund (ESF). This move could instantaneously allocate $21 billion to acquire additional Bitcoins. Unlike an Act, an executive order can be enacted by the President at their discretion without requiring a Congressional vote.

This move, though not as significant as the Bitcoin Act, would nonetheless represent a historic change, solidifying Bitcoin’s position as a potential global reserve asset.

A Global Shift Toward Bitcoin Reserves

Countries outside the U.S. are also looking at Bitcoin as a potential strategic resource. For instance, European Parliament member Sarah Knafo suggests the European Union should establish a Bitcoin reserve, much like lawmakers in Brazil and Russia who have put forth similar suggestions.

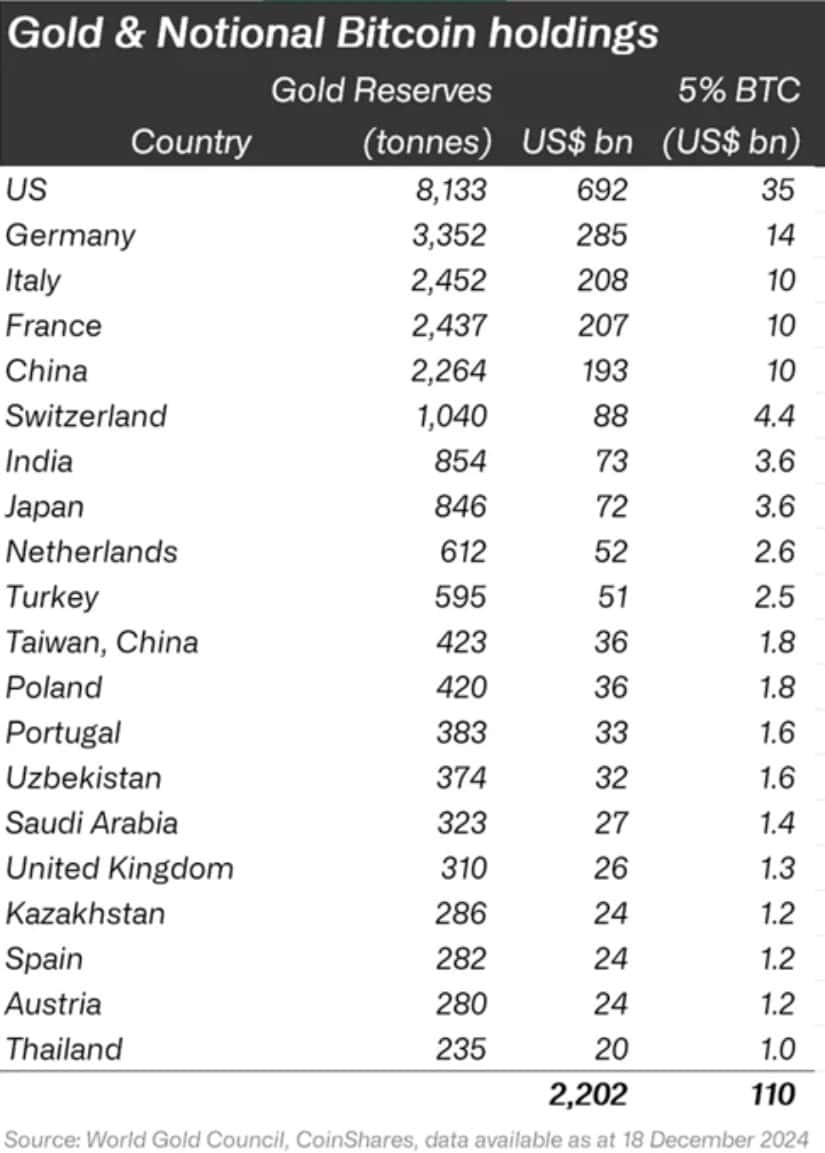

According to CoinShares’ analysis, shifting towards a mixed reserve that incorporates Bitcoin could potentially tackle worldwide economic issues like decreasing trust in the U.S. dollar. Data from the International Monetary Fund (IMF) indicates that the U.S. dollar’s share of global reserves has declined from 71% in 2000 to 59% in 2022.

The Bigger Picture

Passing the Bitcoin Act could significantly reshape Bitcoin’s role in the international economic landscape, potentially leading to increased acceptance by institutions and governments. This impact might extend beyond U.S. borders, prompting a transformation in how countries view and handle digital currencies, thereby creating a new perspective on their approach towards such assets.

In simple terms, the unique combination of its indestructible quality and extreme rarity makes Bitcoin an excellent choice for inclusion in any long-term investment portfolio, according to Coinshares. This suggests that Bitcoin can be a profitable investment opportunity not just for large institutions, but also for individual retail investors.

Read More

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- DEXE PREDICTION. DEXE cryptocurrency

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Young and the Restless Spoilers: Will Michael Baldwin Stop Victor Newman’s Revenge Plot?

2025-01-12 18:42