The company, recognized for its pioneering methods, might be the initial one in the S&P 500 index to adopt a transparent Bitcoin policy. This prediction is made by Matthew Sigel, the Head of Digital Asset Research at VanEck, who emphasized Block’s distinctive positioning and compliance with the index’s rigorous standards.

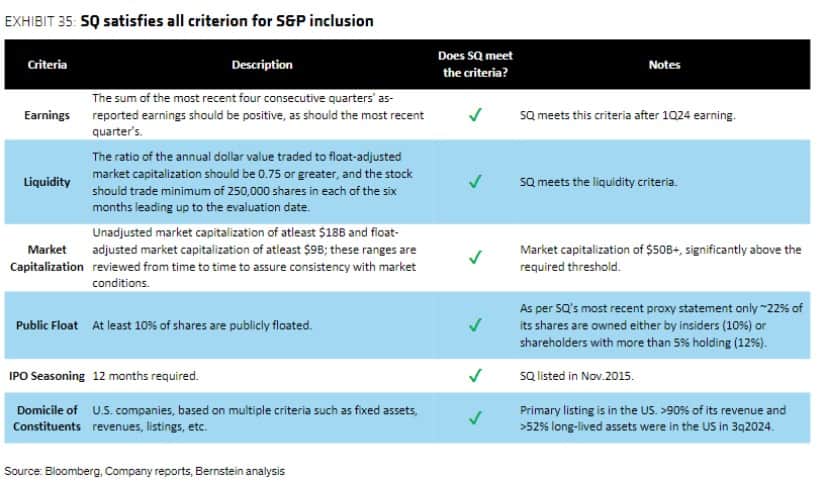

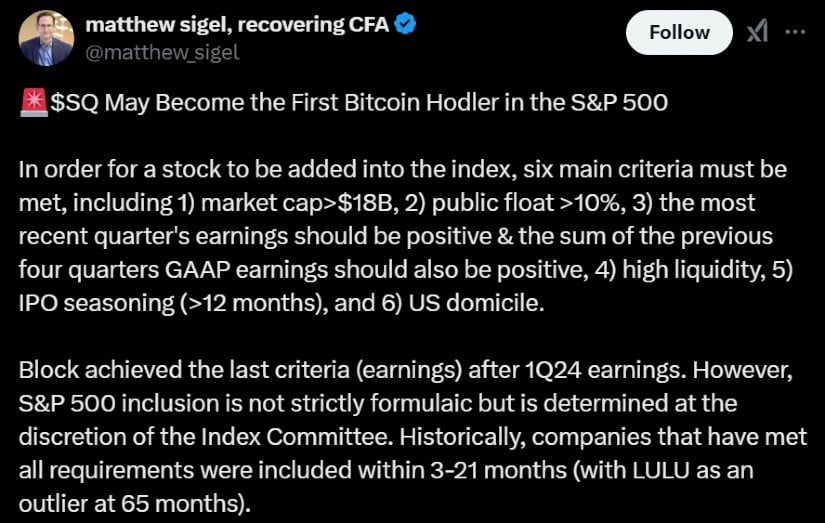

Meeting S&P 500 Criteria

The S&P 500 Index is a collection of the 500 biggest American corporations that are listed on public stock exchanges, chosen based on their total market value. To qualify for inclusion, these companies must meet specific requirements.

In Q1 2024, Block reached the specified milestones, qualifying it for potential inclusion. Nonetheless, whether or not it gets included relies on the S&P Index Committee’s decision, which takes into account factors such as industry balance. Precedent shows that once companies meet the criteria, they are usually added to the index within a range of 3 to 21 months.

A Distinct Bitcoin Strategy

What makes Block unique is its systematic and repetitive strategy towards investing in Bitcoin. In contrast to Tesla, which owns Bitcoin without a specific plan, Block consistently puts 10% of its monthly Bitcoin earnings towards purchasing more cryptocurrency. This regular accumulation provides consistent involvement while minimizing the risks associated with market timing.

At present, Block is keeping around 8,363 Bitcoins, which are roughly equivalent to a value of about 775 million US dollars. This places it among the top eight largest corporate holders of Bitcoin, as indicated by BitcoinTreasuries.NET.

Potential Impact of Inclusion

Getting included in the S&P 500 is not just about reaching a notable achievement; it’s a beacon that showcases financial resilience and market dominance, thereby increasing investor trust. Sharing the limelight with established corporations lends greater visibility and credibility to a company, particularly in evolving sectors such as cryptocurrency, where skepticism is common.

As an analyst, I observed that Sigel emphasized the significance of Block’s involvement in Bitcoin, suggesting it could be a turning point for mainstream acceptance. In his view, Block’s unique strategy with Bitcoin could pave the way for increased institutional adoption, setting it apart as a pioneer in this digital currency landscape.

Other Contenders: Tesla and Coinbase

In the world of cryptocurrencies, Tesla and Coinbase stand out as key players, yet they differ significantly in their strategic approaches. Although Tesla, a member of the S&P 500, does not actively hoard Bitcoin like some others, Coinbase, on the other hand, is deeply rooted in the crypto world but its heavy involvement in cryptocurrencies might make it complex when considering investment.

Block’s even financial structure and defined Bitcoin approach make it a more secure choice compared to the S&P 500, providing investors an indirect method of investing in cryptocurrencies with reduced risk levels.

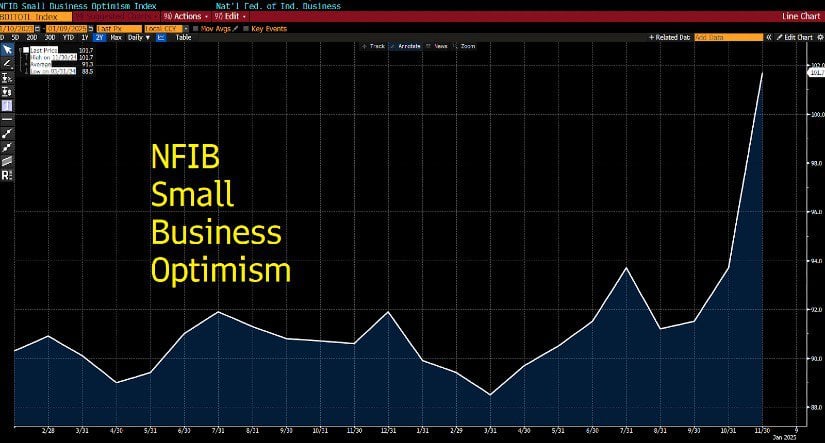

Crypto’s Rising Influence in Traditional Finance

As a crypto investor, I eagerly anticipate Block’s announcement of their Q4 2024 financial results on February 20. This critical moment could significantly boost their chances of getting included in the index. Despite the recent market turbulence that caused a 1% decrease in its stock price over the past five days, I firmly believe that Block continues to be a strong contender for inclusion due to its solid fundamentals.

The possibility that Block might be included underscores a wider movement towards merging cryptocurrency with conventional financial systems. In December 2024, MicroStrategy, another supporter of Bitcoin, got listed on the Nasdaq 100, indicating the growing recognition of crypto-related firms in prominent stock indices.

As an analyst, I find Block’s voyage to be a significant stepping stone in narrowing the divide between conventional finance and digital currencies, symbolizing a fresh wave of trust in Bitcoin’s future potential amidst lingering financial uncertainties.

Increased corporate attention toward Bitcoin, notably from companies like Block, strongly suggests Bitcoin’s success will persist through 2025. Adapt your strategies accordingly.

Read More

2025-01-12 17:36