Ethereum has experienced substantial fluctuations lately, resulting in a drop of about 12% in value during the last seven days. This dip has resulted in considerable financial setbacks for many investors.

As an analyst, I’ve noticed a shift in the sentiment surrounding Ethereum. Instead of cashing out, its holders are choosing to stockpile more assets, implying they have faith in Ethereum’s ability to bounce back, signifying renewed confidence in its potential recovery.

Ethereum Investors Move to Accumulate

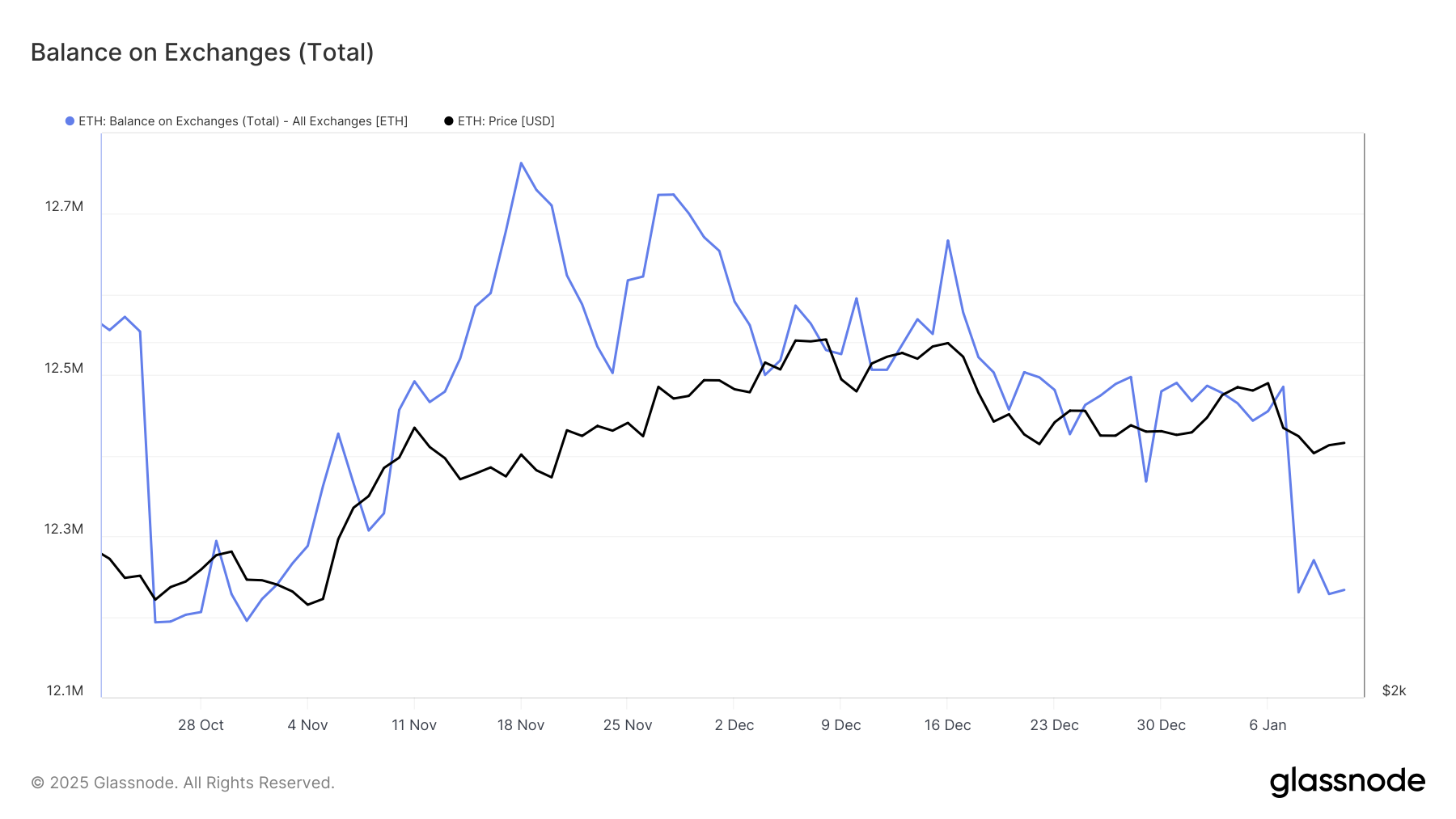

This week, there’s been a substantial drop in the amount of Ethereum held on exchanges, representing a decline of around 12.5 million ETH. This decrease suggests that investors have been buying about $815 million worth of Ethereum during the price dip. The swift transfer of Ethereum from exchange platforms to personal wallets indicates a sense of optimism among holders who are taking advantage of the lowered prices and planning for potential future gains.

Investor behavior suggests a tactical plan, where they are taking advantage of today’s lower prices with the expectation of profits later on. Such actions reflect optimistic expectations towards Ethereum, as the limited supply on trading platforms may push its price upwards in the near future.

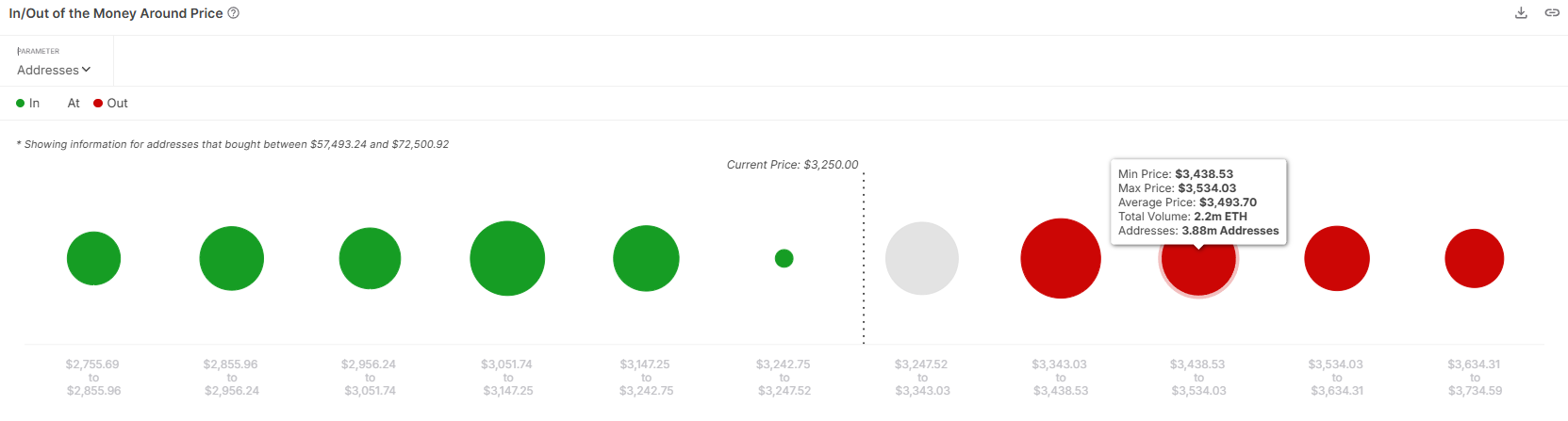

Based on the larger market trends, there seems to be a strong possibility that Ethereum may bounce back. As per the IOMAP (In/Out of Money Around Price) analysis, the bullish energy built up through recent acquisitions could propel Ethereum towards its upcoming resistance at $3,524.

Approximately 12.5 million Ether were bought between the existing price level and the resistance point. If the price increases, the supply, valued at around $40 billion at the moment of writing, will yield a profit.

Should Ethereum manage to surpass the $3,524 barrier, it would lend a stronger argument to its bullish outlook. It’s possible that some investors might choose to cash in at this price point, but the increased confidence could offset the selling pressure and potentially set the stage for a prolonged upward trend.

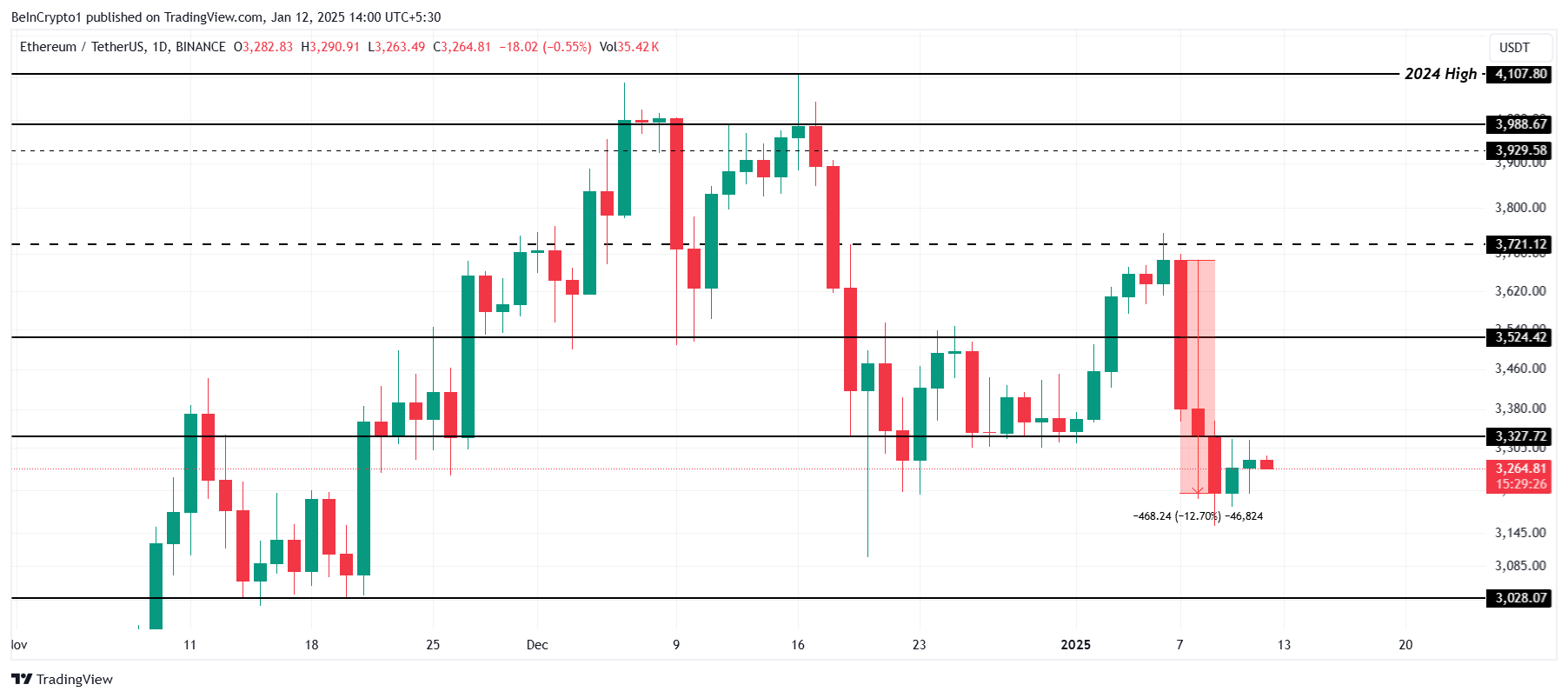

ETH Price Prediction: $3,327 Resistance is Critical

At present, Ethereum is being exchanged at approximately $3,264. Earlier this week, it experienced a drop of around 12%. However, it’s still below a significant barrier of $3,327, which needs to be surpassed for any potential positive price action. Overcoming this level could potentially reverse the current downward trend.

As an analyst, I see that establishing $3,327 as a support point is crucial for Ethereum to aim for its next notable resistance at $3,524. Maintaining a position above this level could rejuvenate the bullish trend necessary for recuperating the losses from the previous week.

If Ethereum doesn’t surpass $3,327, there’s a possibility it might dip instead. A fall to $3,028 could undo its recent progress and challenge the optimistic viewpoint, which in turn could weaken market confidence and postpone any potential rebound.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Persona 5: The Phantom X Navigator Tier List

2025-01-12 17:27