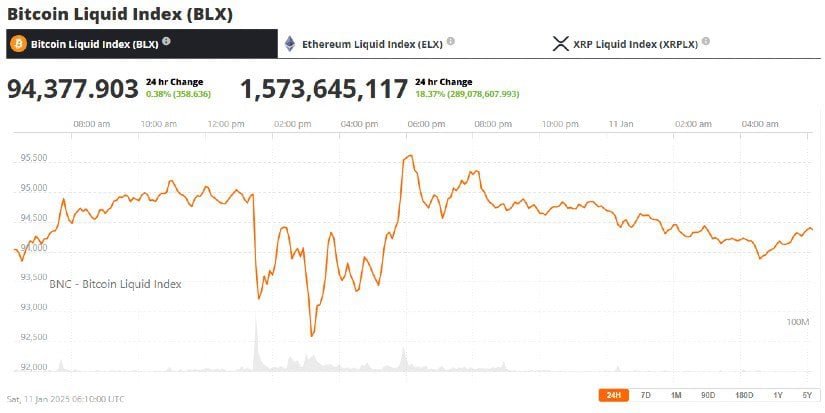

On January 10th, the value of the cryptocurrency fell beneath $93,000 following a robust U.S. employment report that boosted the U.S. dollar, leading to a decrease in investor optimism.

In his statement to Cointelegraph, Pandl explained that Bitcoin is being held back due to a strong U.S. dollar. This strength is attributed to aggressive monetary policies by the Federal Reserve and ongoing tariff concerns. Furthermore, he mentioned that robust job data has dampened expectations for immediate interest rate cuts, which in turn gives additional support to the dollar and momentarily puts pressure on Bitcoin’s value.

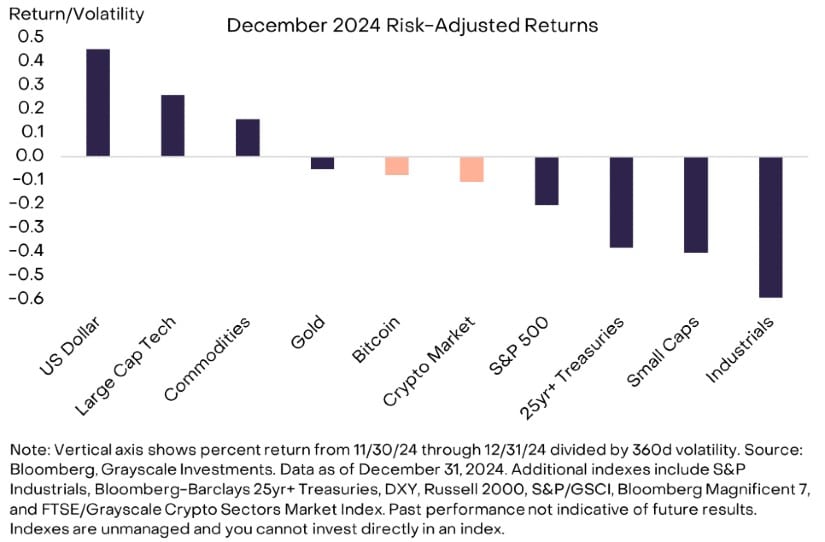

On the same day, there was a 0.5% rise in the U.S. Dollar Index (DXY) during early trading sessions, suggesting an increased faith in the US currency. Meanwhile, recent data from CME FedWatch indicates that traders currently predict a minimal chance of approximately 3% for an interest rate reduction in January.

Potential Catalyst: Presidential Inauguration

Regardless of the major obstacles, Pandl maintains a hopeful outlook regarding Bitcoin’s future. He emphasized that the forthcoming U.S. presidential inauguration on January 20 could serve as a trigger for favorable market shifts.

As the inauguration approaches, I believe this temporary economic downturn might not last long. Regardless, I remain optimistic about the long-term value of cryptocurrencies, maintaining a fundamentally bullish perspective.

The ceremony signifies Donald Trump’s second term at the White House following his win in the November 2024 presidential election. Trump has promised to emphasize the U.S. cryptocurrency industry, selecting regulators who are sympathetic towards crypto and placing the U.S. at the forefront of digital asset advancements on a global scale.

Institutional Inflows and Regulatory Momentum

Beyond Grayscale’s optimism, other market analysts are equally bullish about Bitcoin’s future in 2025. Steno Research predicts that Bitcoin will reach new record highs, given its “exceptionally advantageous” regulatory climate. Additionally, institutional adoption is expected to experience a substantial increase under the current administration.

For the very first time in November 2024, U.S.-based Bitcoin ETFs surpassed $100 billion in total assets, as reported by Bloomberg Intelligence. Analysts predict an additional $48 billion in investments could flow into these funds in 2025, potentially causing a sudden increase in demand that pushes the value of Bitcoin even higher.

Similarly, Sygnum Bank, a digital asset management firm based in Switzerland, anticipates a significant increase in institutional interest and believes that this trend will continue to boost Bitcoin’s value for the rest of the year.

Grayscale’s Projections for 2025

Grayscale has recently revised its list of promising cryptocurrency tokens for 2025, taking into account potential regulatory changes following the US election results. One token worth keeping an eye on is Ripple‘s XRP, which has shown strong performance as the leading crypto asset in the past 90 days. The company anticipates that this could bolster the investment case for cryptocurrencies as a whole.

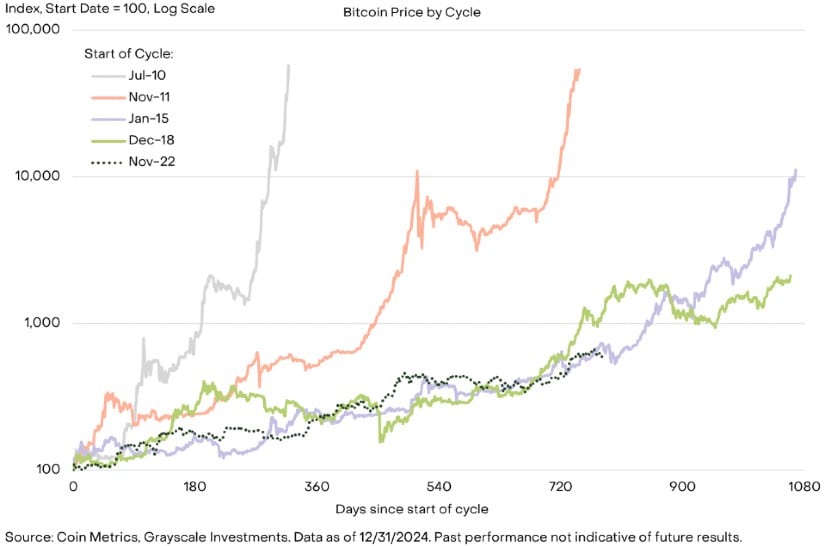

As a researcher studying Bitcoin, I’ve noticed that it’s natural for short-term price swings to occur. However, what sets Bitcoin apart is its remarkable resilience during periods of macroeconomic turbulence. This resilience comes from its ability to adapt and benefit from long-term economic trends.

Looking ahead, Bitcoin’s long-term potential remains robust, bolstered by favorable regulatory advancements and growing institutional interest. Despite some short-term challenges to the broader economy, powerful macroeconomic factors are expected to continue. With the upcoming U.S. presidential inauguration and potential progress in space technology, 2025 may present a particularly favorable year for Bitcoin.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-12 14:40