A suggested rephrasing for the given text:

The legislation, titled “A Bill concerning the authorization of the state treasury to purchase precious metals and digital assets,” has sparked interest among supporters who view digital money as a protective measure during periods of financial instability.

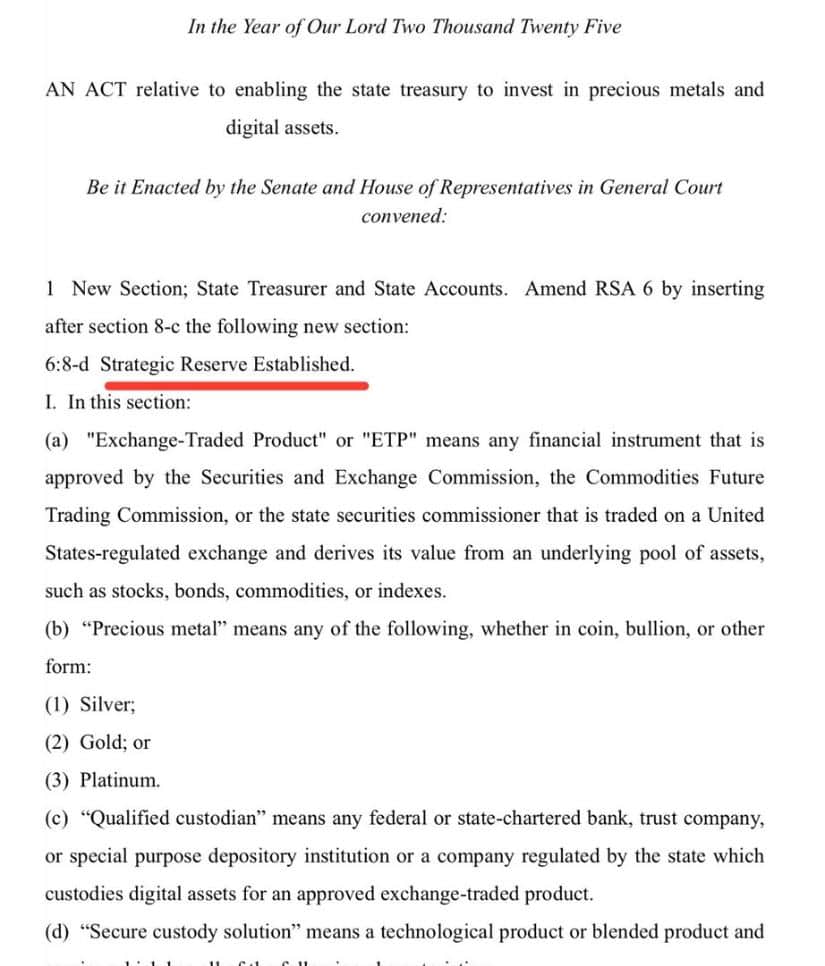

A well-known cryptocurrency supporter has made a bill available to the public, which if passed, will be added as “6:8-d Strategic Reserve Established” under RSA 6 state law. Proponents argue that it would enable the state treasurer to invest funds in cryptocurrency exchange-traded products, as long as they comply with regulations from bodies like the Securities and Exchange Commission, Commodities Futures Trading Commission, or the state’s securities commissioner. The bill also clarifies the term “precious metal” (including silver, gold, and platinum) and provides guidelines for secure storage of digital assets.

Dennis Porter, a renowned voice in the world of cryptocurrencies, shared on social media about the new development and posted what appears to be a draft of the legislation.

Techno-optimism

Representative Keith Ammon, a Republican from Hillsborough District 42, is the main supporter of this bill. He has previously championed blockchain technology and is often referred to by other lawmakers as a “tech-optimist.” If approved, this law would grant the state the ability to own certain digital assets alongside conventional reserves, mirroring a popular approach among policymakers who view cryptocurrency as a valuable strategic asset for long-term storage.

The action taken by New Hampshire is part of wider conversations happening at a national scale about Bitcoin‘s influence on the American financial market. Some authorities have recently proposed the idea of creating a federal “Bitcoin strategic reserve,” which is reminiscent of proposals that emerged from Washington in the past year. Those advocating for such a reserve believe that incorporating digital assets into government holdings could provide protection against debt issues and might yield substantial profits, particularly if cryptocurrency values keep increasing.

Leading individuals express enthusiasm about the potential impact of governments adopting Bitcoin. A recent expert comment stated that if governmental plans are implemented, “Bitcoin’s potential is virtually limitless due to its fixed supply.” Other analysts foresee prices exceeding $100,000 per bitcoin and anticipate market values reaching trillions of dollars, potentially surpassing or equaling those of precious metals.

Critics of the new law warn that, although digital assets such as Bitcoin have garnered widespread excitement among private investors and tech-savvy legislators, they are still prone to dramatic fluctuations and don’t possess the same lengthy history of success as more traditional commodities. These doubters contend that government-managed assets should first prove their stability and usefulness in critical situations, likening this new strategy to the renowned U.S. Strategic Petroleum Reserve.

In essence, the New Hampshire bill outlines a comprehensive framework. It identifies a “qualified custodian” as any financial or depository institution overseen by federal or state banking authorities, tasked with securely holding the obtained digital assets. Furthermore, it requires a “secure storage solution,” ensuring that cryptographic private keys are kept within a specialized system designed to prevent theft or unintended loss.

Advocates argue that this proposal would safeguard New Hampshire’s economic wellbeing by tapping into the increasing popularity of Bitcoin across various sectors. They cite the significant surge in Bitcoin’s worth over the last year, and predictions from reputable ETF custodians like Bitwise that Bitcoin’s price could reach $200,000 by 2025. If passed during the upcoming meeting, this law could make New Hampshire a trailblazer among states embracing innovative investment options.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-01-11 17:04