Approximately $612 billion is anticipated to flow into the American economy during the initial three months of the year, boosting hope for an increase in Bitcoin value amidst ongoing doubts.

As a crypto investor, I find Arthur Hayes’ predictions particularly insightful. In a recent blog post, he suggests that an abundance of dollar liquidity could compensate for potential delays in Trump’s pro-crypto and pro-business legislations. Essentially, Hayes believes that strong fiscal policies can have a significant impact on Bitcoin’s market trends, providing a positive outlook even if the proposed legislation falls short.

A Rollercoaster Start to the Year

As a crypto investor, I’ve noticed that Bitcoin took a significant hit recently, dropping around 6% and trading below $100,000—a notable psychological resistance level—on January 8. This dip seems to be a result of the holiday-induced slowdown in institutional trading activity. However, analysts are optimistic about increased institutional liquidity at the beginning of the year, which could boost Bitcoin’s performance and help it regain and maintain six-figure valuations before Trump’s inauguration on January 20.

As per Binance Research, the return of institutional investors could potentially rekindle Bitcoin’s price surge. The research suggests that if favorable cryptocurrency regulations are implemented, like the establishment of a Bitcoin Strategic Reserve, Bitcoin could once again reach $100K. However, it is important to note that for such high levels to be sustained, the market must continue experiencing supportive conditions.

As a crypto investor, I’ve been hopeful about the potential pro-crypto policies from Trump’s administration. However, I’m cautious due to the possibility of delays in establishing a regulatory framework, which could negatively impact investor confidence in the near future. Hayes, an analyst, predicts that we might see a market correction by March, largely due to these unmet regulatory expectations. Despite this short-term uncertainty, he remains optimistic about Bitcoin’s long-term prospects. His reasoning is based on the anticipated $20 trillion increase in global money supply over the next few years, which could potentially funnel $2 trillion into Bitcoin investments by late 2025.

Diverging Market Opinions

Opinions in the market are split between bullish and bearish views. On one hand, Hayes anticipates an upward trend due to monetary expansion, but not all share his enthusiasm. Some technical analysts have spotted a potentially bearish head-and-shoulders pattern on Bitcoin’s weekly chart, which could lead to a decline in price towards $80,000.

Some supporters of Bitcoin’s future value believe that it is becoming more and more incorporated into global financial structures. As stated by the American Bitcoin mining company, MARA, the establishment of a strategic U.S. Bitcoin reserve could spark a worldwide competition to amass Bitcoin, further boosting its price.

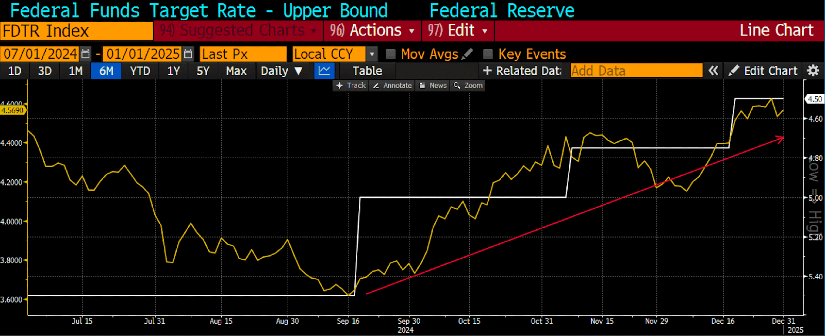

Crypto Markets Brace for 2025 Fed Moves

Changes in the Federal Reserve’s monetary policies are playing a key role in shaping Bitcoin’s market trends. With traditional finance and cryptocurrencies growing more connected each day, it seems likely that future actions taken by entities such as the Federal Reserve will keep affecting the price fluctuations of Bitcoin.

Even though there’s a lot of ups and downs right now, the crypto community remains hopeful. Analysts believe that by Q1 2025, we might see significant events, such as additional liquidity injections which could trigger another Bitcoin price surge. However, maintaining this momentum requires clear regulations, increased institutional involvement, and favorable overall market circumstances.

2025 could be a pivotal year for Bitcoin, as economic policies, institutional involvement, and technological advancements are likely to shape its course. Whether these factors lead to a market surge or encounter obstacles due to regulatory hurdles, Bitcoin is expected to continue spearheading financial innovation throughout the upcoming years.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-01-11 14:06