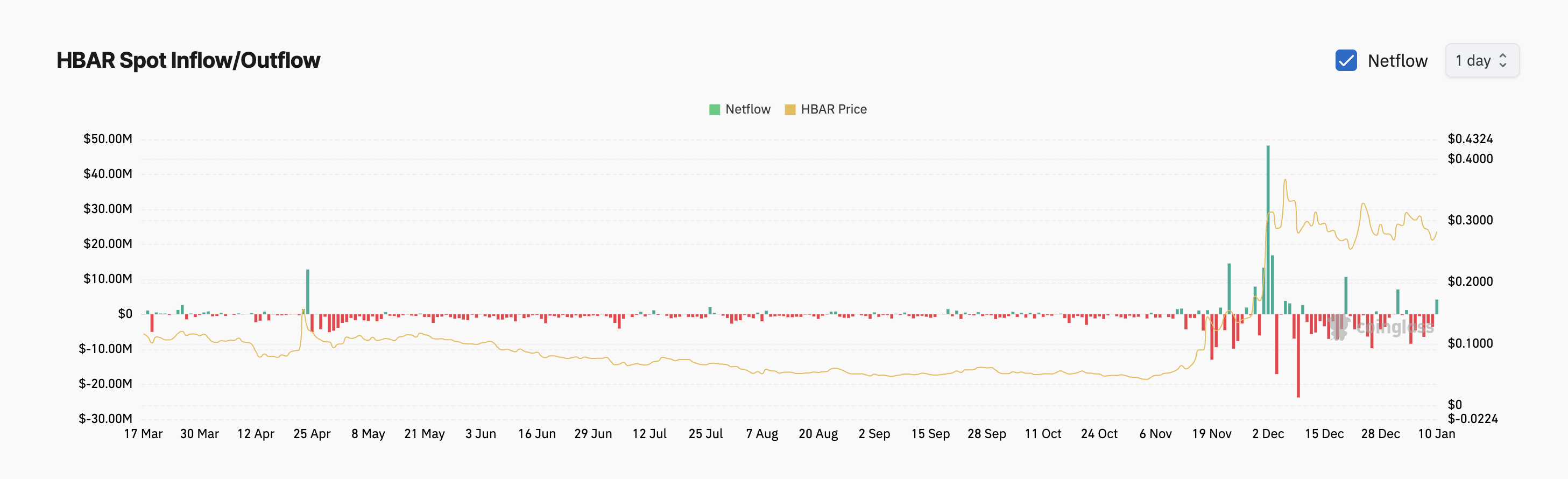

The cryptocurrency HBAR, which operates on the Hedera Hashgraph decentralized ledger system, has seen its initial inflows of approximately $4 million in the last week. This has ignited discussions among investors that this could signal a potential breakout for the altcoin beyond the limited trading range it has maintained since early December.

Nevertheless, there’s ongoing downward pressure on HBAR, which could potentially keep its price within a limited range or even cause it to decrease further.

Hedera Records Spot Inflows, But There Is a Catch

Based on Coinglass reports, HBAR experienced inflows worth $4 million on Friday. These inflows follow a six-day period during which a total of $26 million was withdrawn from the asset.

When an asset receives immediate purchases (in the spot market), it signifies a boost in its acquisition, suggesting a surge in demand for the asset. This is because buyers are prepared to buy it at the present market rate.

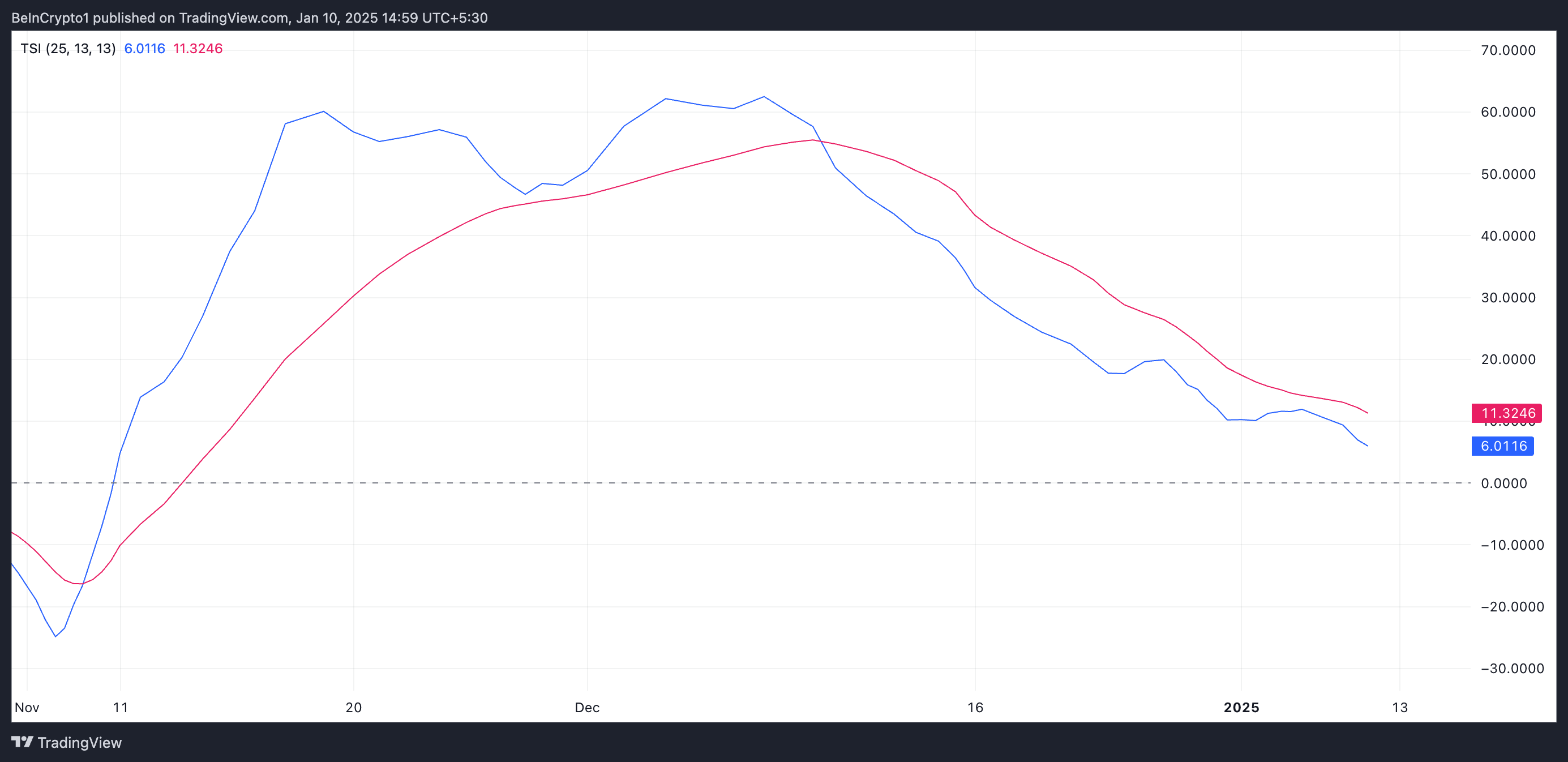

Although HBAR’s current inflow is promising, technical analysis indicates that there’s still significant bearish influence at play. For instance, the readings from its True Strength Index (TSI) indicator show the TSI line (blue) below the signal line (red) as we speak, suggesting an increasing bearish trend.

The TSI (Trade Strength Index) tool aids in recognizing the intensity and direction of market trends by softening out price fluctuations. If the TSI line hovers beneath the signal line, this implies a downward trending momentum. This implies that the selling force is overpowering the purchasing interest.

More specifically, traders tend to view this intersection as a sign to sell or as a caution that the current uptrend may be losing strength, potentially indicating a possible decline in the future.

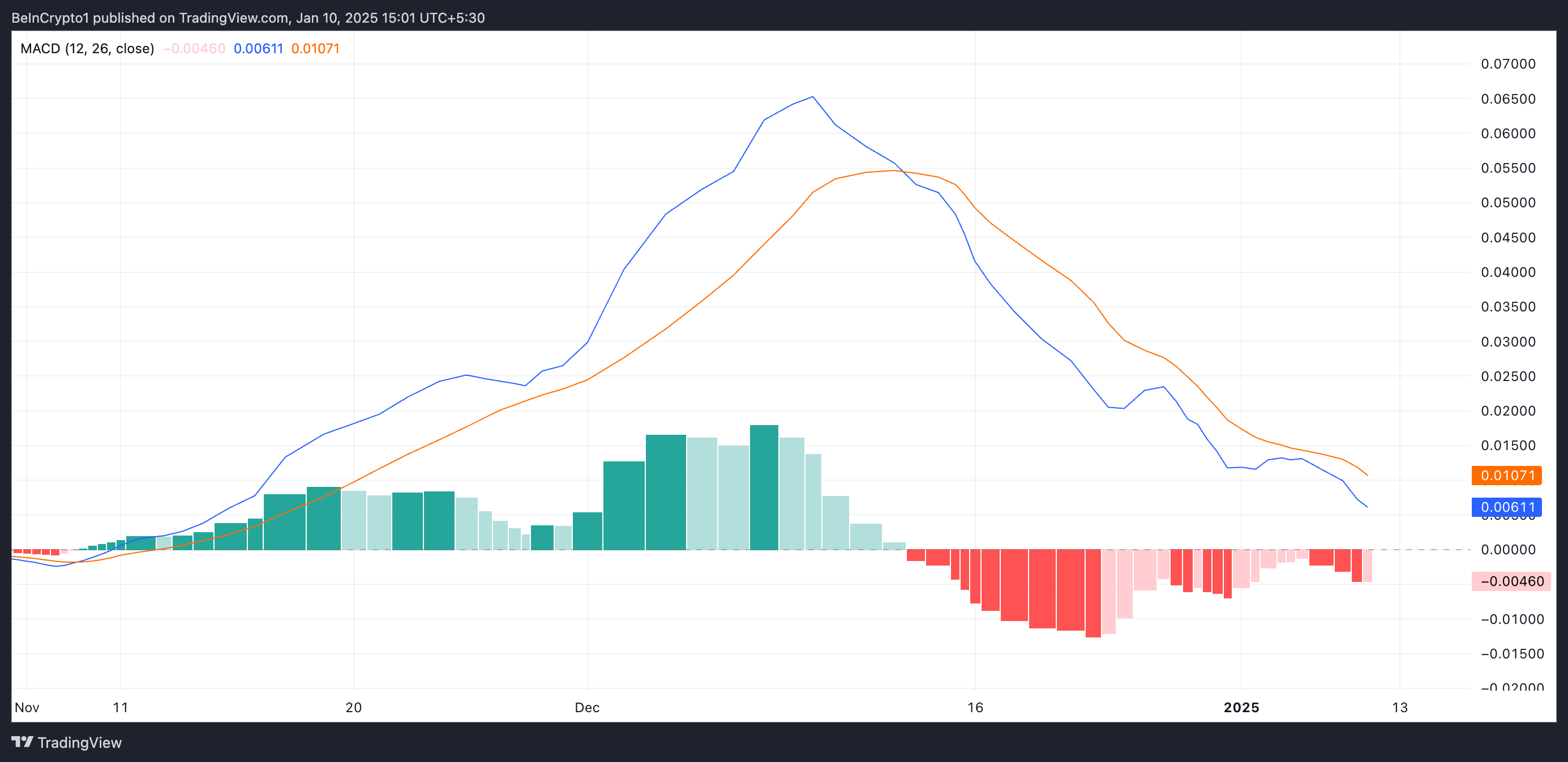

The Moving Average Convergence Divergence (MACD) chart for HBAR is reinforcing a pessimistic viewpoint right now. Specifically, as we speak, the MACD line (represented by blue) is positioned beneath the signal line (which is orange).

When you configure this indicator in such a manner, it suggests a downtrend or bearish trend. In other words, the selling actions surpass the buying actions within the market, leading to substantial drops in its price.

HBAR Price Prediction: Time to Break Out of This Range?

Starting from December 4th, HBAR’s value has been fluctuating within a specific price range. It has encountered resistance at approximately $0.33 and found backing at around $0.24. At the moment, the cryptocurrency is trading slightly above this support level, hovering at around $0.28.

As the price continues to drop, there’s a chance it might reach the support level for testing. If this level can’t prevent the fall, the price could descend even more to around $0.16.

If the demand for the altcoin remains strong and more tokens are bought on its spot market, there’s a possibility that HBAR’s price may increase, potentially reaching $0.33.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2025-01-10 21:54