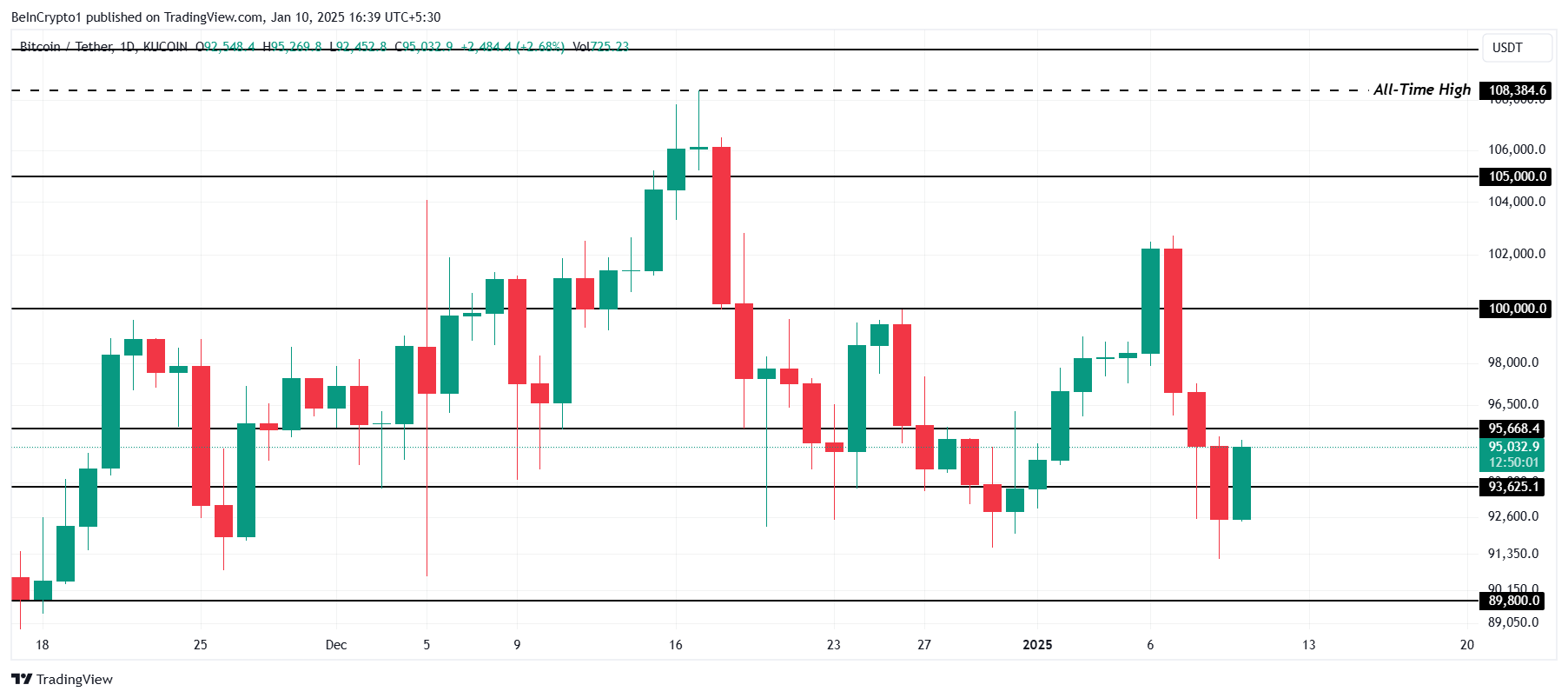

The price movement of Bitcoin has been volatile, as it plunged from its peak of $108,384 to a recent trough of $91,350 after reaching its all-time high.

The major decrease is primarily due to a prominent group of investors pulling back, leading to less immediate demand and putting downward pressure on the market.

Bitcoin Investors Are Pulling Back

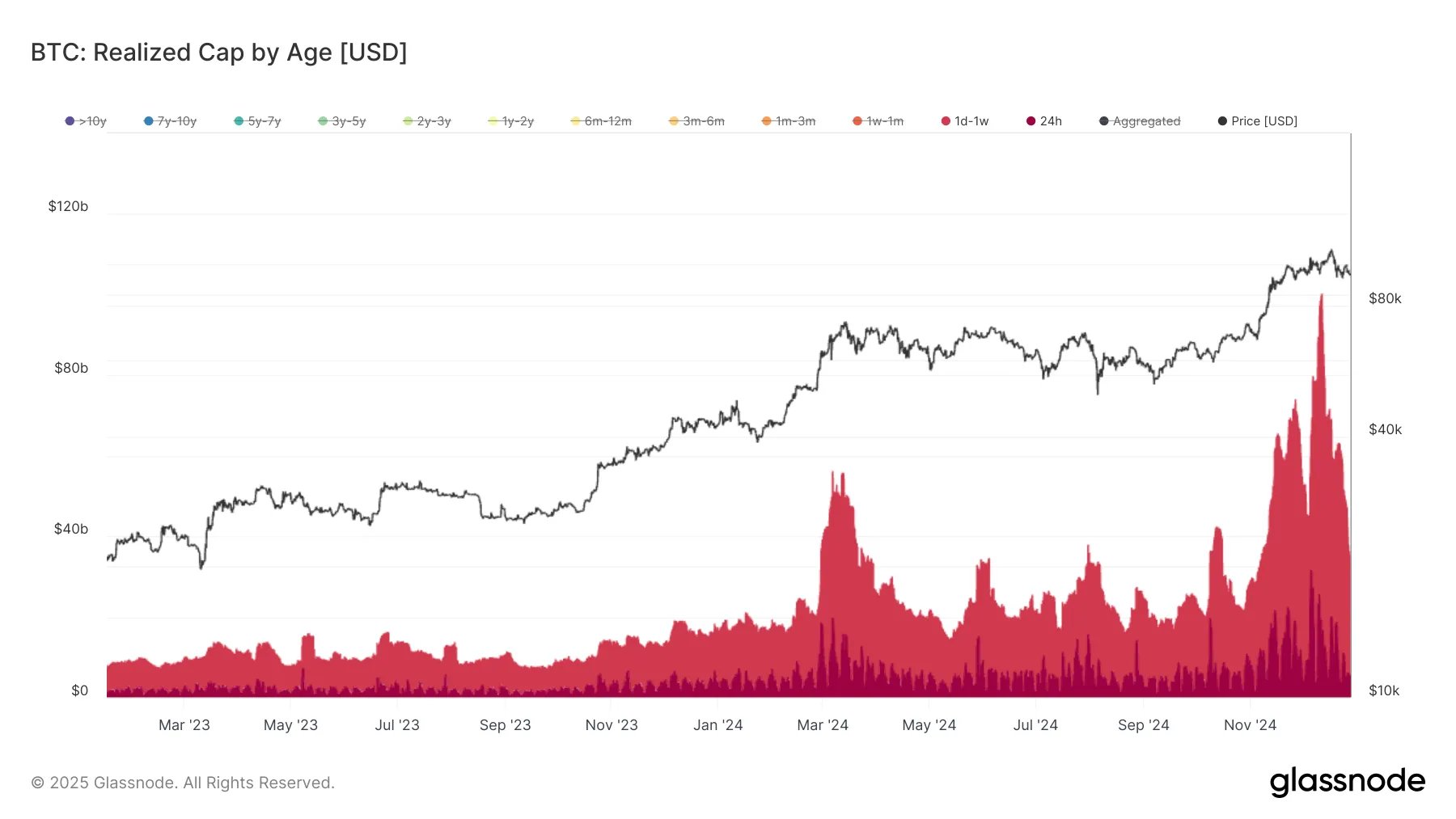

The “Realized Cap by Age” indicator suggests a troubling pattern in Bitcoin’s popularity. In the last seven days, the amount of money poured into the market for short-term purposes has dropped drastically by 66% within the past month. At present, this swiftly moving capital amounts to around $32 billion, indicating a significant decrease in short-term investments being funneled into the market.

This decrease is crucial because it underscores the waning trust among short-term investors, who typically propel Bitcoin’s progress. The absence of fresh investment from these players indicates increasing doubt and adds to Bitcoin’s challenge in holding its ground above significant thresholds.

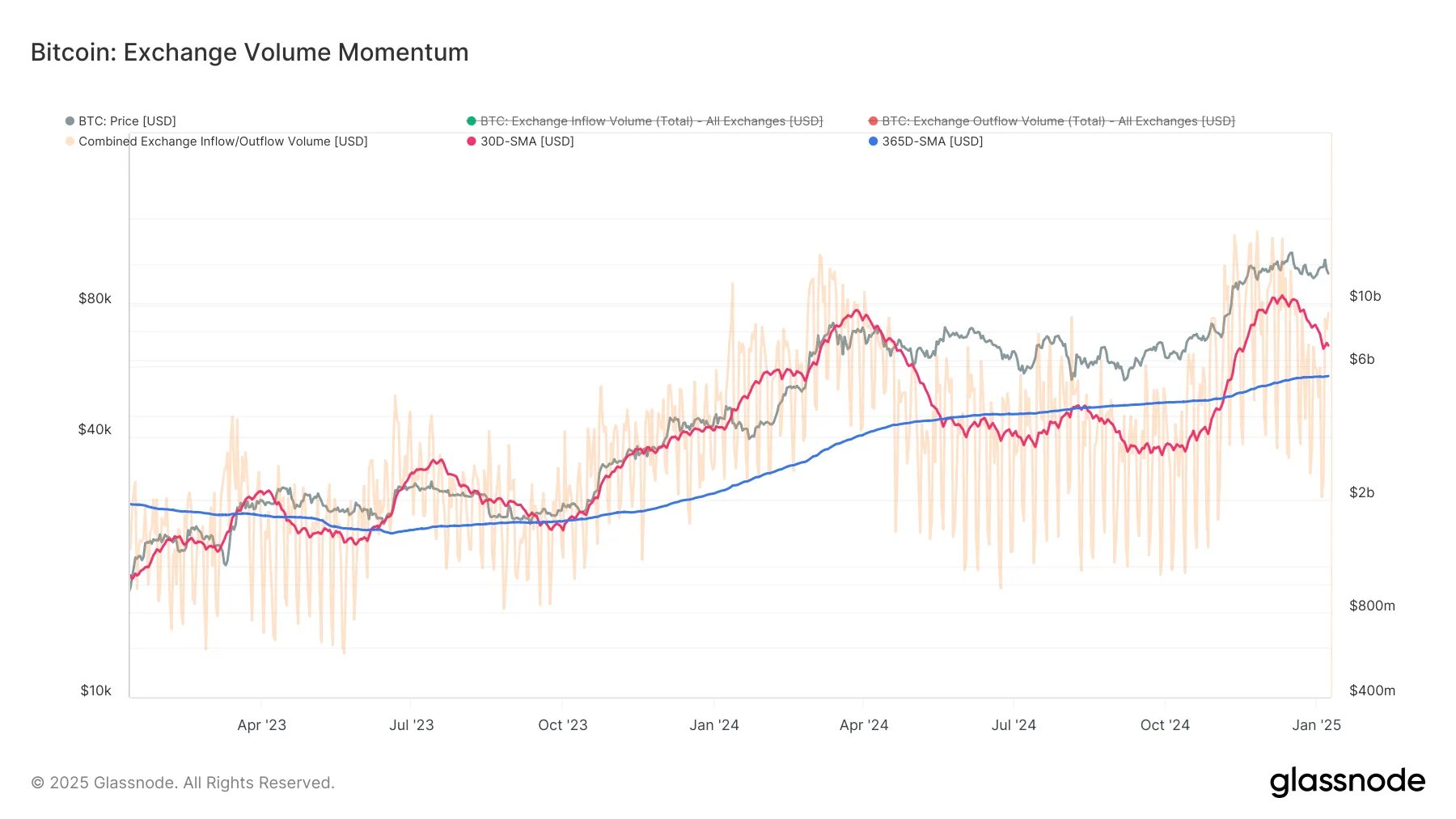

The strong overall trend of Bitcoin seems to align with a negative perspective, as trading volume trends are approaching a significant bearish cross-over point. In simpler terms, the 30-day average is about to dip below the 365-day average, suggesting prolonged weakness in investments flowing into Bitcoin.

As a researcher studying market trends, I’ve noticed a shift in behavior from short-term holders, who are known for their rapid buying and selling strategies. Currently, their activity seems to be decreasing, which aligns with the observed slowdown in overall demand. This reduced involvement raises worries about Bitcoin’s potential short-term recovery. If this cautious approach persists, it could potentially impede Bitcoin’s journey towards reclaiming higher price levels.

BTC Price Prediction: Charting A Path To $100,000

At the moment, Bitcoin is hovering around $95,000, having rebounded from $92,600 and establishing $93,625 as a significant support point. Nevertheless, this digital currency is encountering difficulties in maintaining its upward trajectory due to dwindling short-term interest and unfavorable long-term economic signs.

If these conditions continue, there’s a possibility that Bitcoin might break its current support at $93,625, causing a potential fall to around $89,800. This drop could intensify the ongoing downtrend, challenging the patience of long-term investors.

Instead, let’s focus on Bitcoin aiming to surpass the $95,668 barrier as its next objective. Once it does, this level could serve as a foundation for further growth, potentially allowing Bitcoin to regain the $100,000 mark. Hitting this significant figure would contradict the current pessimistic forecast and revive investor enthusiasm.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

2025-01-10 18:52